Get the free 706N-GST-1 - revenue ne

Show details

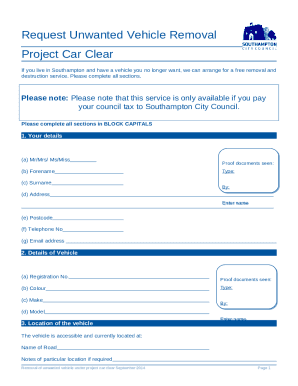

This form is used for filing the Nebraska generation-skipping transfer tax return for taxable transfers made on or after July 15, 1992 and before January 1, 2003.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 706n-gst-1 - revenue ne

Edit your 706n-gst-1 - revenue ne form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 706n-gst-1 - revenue ne form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 706n-gst-1 - revenue ne online

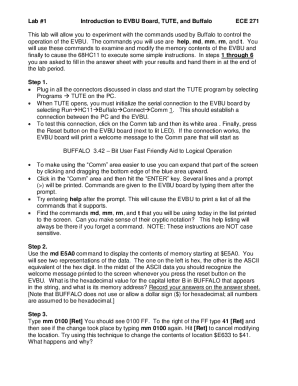

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 706n-gst-1 - revenue ne. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 706n-gst-1 - revenue ne

How to fill out 706N-GST-1

01

Obtain the 706N-GST-1 form from the appropriate tax authority website or office.

02

Read the instructions carefully before you start filling out the form.

03

Fill out the identification section with the required information, including your name and taxpayer identification number.

04

Report the date of the decedent's death in the designated section.

05

Complete the information regarding the estate and its assets, ensuring all values are accurate.

06

If applicable, include information about any deductions you are claiming.

07

Review the form for accuracy and completeness before signing.

08

Submit the form by the deadline, ensuring you keep copies for your records.

Who needs 706N-GST-1?

01

Executors or administrators of estates where the gross estate exceeds the exempt amount.

02

Individuals managing estates that require reporting for federal estate tax purposes.

03

Persons involved in the transfer of property that may be subject to the Generation-Skipping Transfer Tax.

Fill

form

: Try Risk Free

People Also Ask about

What is GST r1 in English?

Form GSTR-1 is a monthly Statement of Outward Supplies to be furnished by all normal and casual registered taxpayers making outward supplies of goods and services or both and contains details of outward supplies of goods and services.

When to use 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

What is the difference between 706 and 1041?

An estate and trust planning advisor can provide support, helping to ease the process and ensure compliance with federal tax laws. Form 706 ensures that estate taxes are adequately assessed for larger estates, while Form 1041 helps report the estate's income during the settlement process.

What is the best trust to minimize estate taxes?

A credit-shelter trust offers a way for you to pass on your estate and lower estate taxes. Under a credit-shelter trust, your surviving heirs would not receive your property (which would then be subject to an estate tax). Instead, your heirs would receive an interest in the trust itself.

What is the purpose of the Form 706?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

What is the estate tax return Form 706?

The executor of a decedent's estate uses Form 706 to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code. Form 706 is also used to compute the generation-skipping transfer (GST) tax imposed by Chapter 13 on direct skips.

What does 706 mean on a tax transcript?

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

What is a 1041 estate?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 706N-GST-1?

The 706N-GST-1 is a form used for reporting the generation-skipping transfer tax in the United States. It is specifically designed for the estates of decedents who have made generation-skipping transfers.

Who is required to file 706N-GST-1?

Individuals who have made generation-skipping transfers that exceed the exclusion limit, and executors of estates that involve such transfers, are required to file the 706N-GST-1.

How to fill out 706N-GST-1?

To fill out the 706N-GST-1, one must gather information about the decedent's estate, the transfers made, and any applicable deductions. Detailed instructions are provided in the IRS guidelines for completing the form.

What is the purpose of 706N-GST-1?

The purpose of the 706N-GST-1 is to report any generation-skipping transfers and calculate the corresponding tax liability to ensure compliance with federal tax laws.

What information must be reported on 706N-GST-1?

Information that must be reported on the 706N-GST-1 includes details about the decedent, the beneficiaries, the value of the transfers, and any deductions or exemptions applicable to the generation-skipping transfer.

Fill out your 706n-gst-1 - revenue ne online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

706n-Gst-1 - Revenue Ne is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.