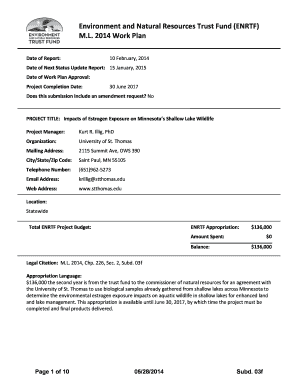

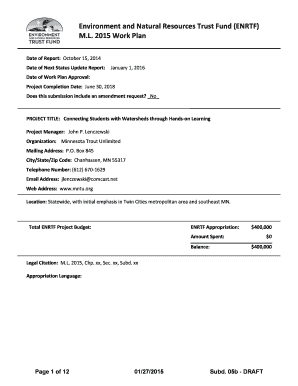

Get the free Folha n ido proe 4delina Cicoe e - 39 flentar RF 100406 200 bb - www2 camara sp gov

Show details

Fol ha n do pro 4delina CICE e %?.. (' RF. 100.406 200 CABINET DE TOREADOR LAR CIO BENTO plantar r PROJECT DE LEI N 01 PL ()I W 155120 13 Dispel sober a responsabilidade was empress plea lavage dos

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign folha n ido proe

Edit your folha n ido proe form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your folha n ido proe form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing folha n ido proe online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit folha n ido proe. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out folha n ido proe

How to fill out folha n ido proe:

01

Start by gathering all the necessary information such as your personal details, tax identification number, and any relevant financial documents.

02

Take a close look at the form and make sure you understand each section. If there are any confusing parts, consult the instructions or seek assistance from a professional.

03

Begin by filling out the basic information section, which may require you to provide your name, address, contact details, and other identifying information.

04

Move on to the financial section where you will need to disclose your income, assets, and liabilities. Make sure to include accurate and up-to-date information as this will be used for assessment and verification purposes.

05

If there are any specific sections or questions that you are not sure how to answer, consider reaching out to the relevant authorities or experts who can guide you through the process.

06

Once you have completed all the required sections, review the form thoroughly to ensure there are no errors or missing information.

07

Sign and date the form according to the specified instructions. In some cases, you may need to obtain additional signatures or have the form notarized.

08

Make copies of the filled-out form for your records. It's always a good idea to keep a copy of any important documents submitted to authorities or institutions.

09

Submit the completed form as per the instructions provided. This may involve mailing it, dropping it off in person, or submitting it online through a designated portal.

10

After submission, keep track of any confirmation or acknowledgment receipts. It's also a good practice to follow up if you don't receive any acknowledgment within a reasonable time frame.

Who needs folha n ido proe:

01

Individuals who are required to provide financial information for tax purposes.

02

People applying for certain government benefits or assistance programs that require income verification.

03

Businesses or self-employed individuals required to report their financial information for tax or regulatory compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send folha n ido proe to be eSigned by others?

folha n ido proe is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit folha n ido proe straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing folha n ido proe.

How do I edit folha n ido proe on an Android device?

You can make any changes to PDF files, such as folha n ido proe, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is folha n ido proe?

Folha de pagamento do 13º salário (13th salary payroll)

Who is required to file folha n ido proe?

Employers are required to file folha n ido proe for their employees.

How to fill out folha n ido proe?

Folha n ido proe can be filled out using the required forms provided by the local authorities.

What is the purpose of folha n ido proe?

The purpose of folha n ido proe is to report and pay the 13th salary to employees.

What information must be reported on folha n ido proe?

Information such as employee details, salary amounts, deductions, and bonuses must be reported on folha n ido proe.

Fill out your folha n ido proe online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Folha N Ido Proe is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.