Get the free Large Cap Equity

Show details

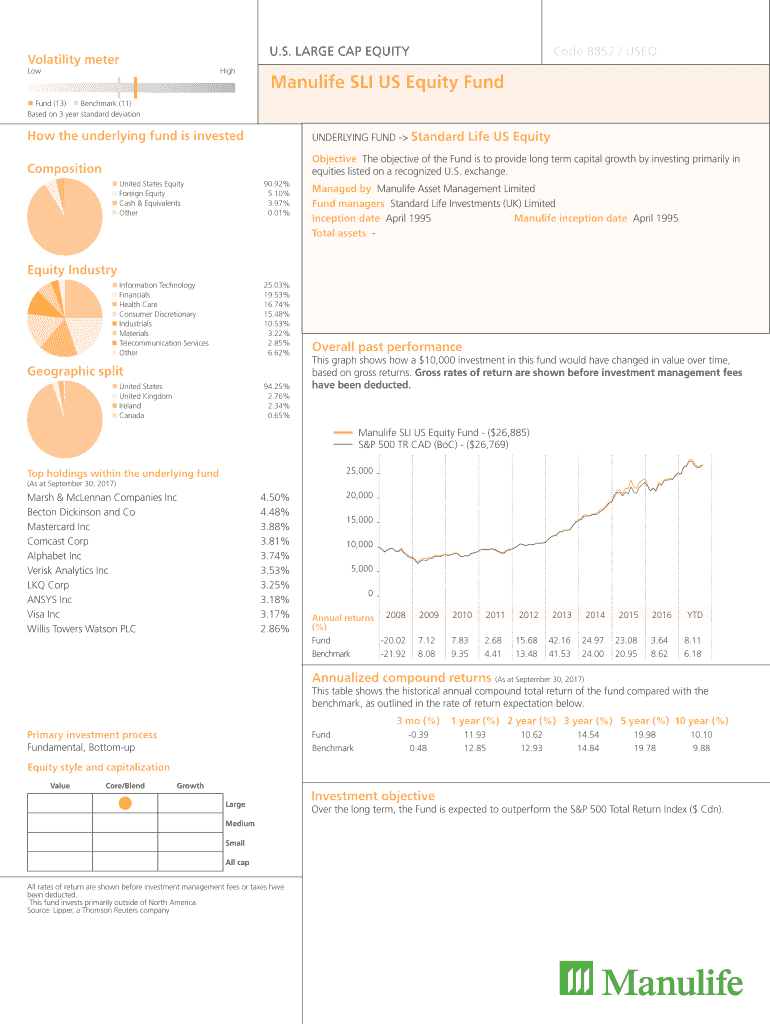

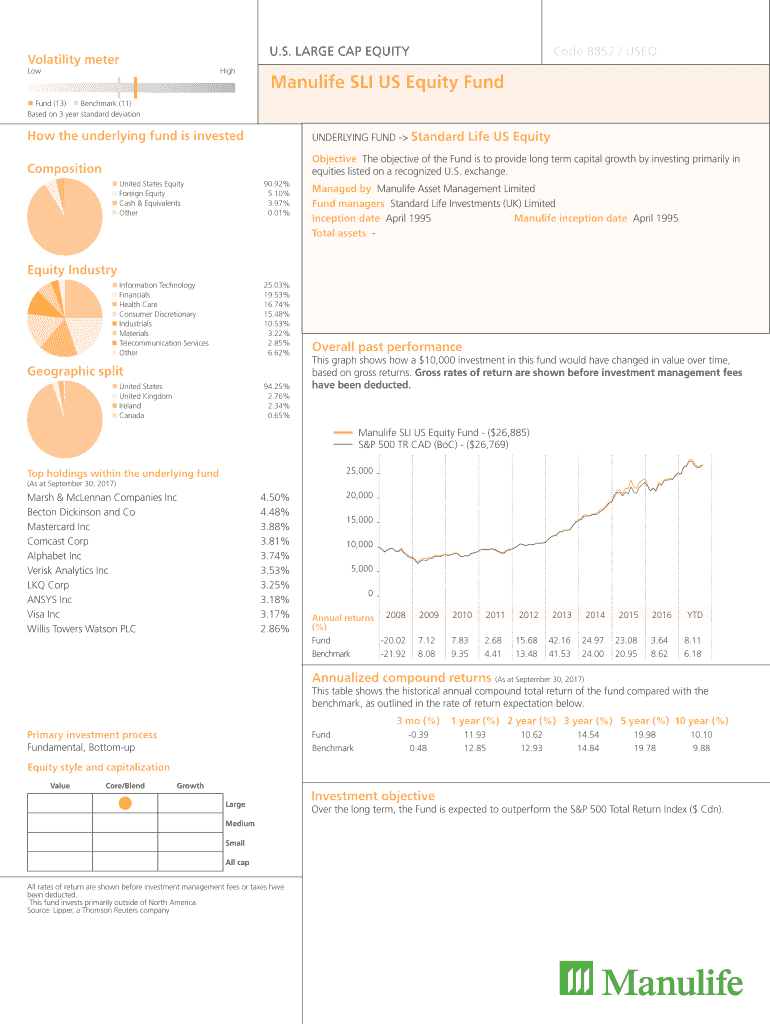

U.S. Large Cap EquityVolatility meter LowHighCode 8852 / USEQManulife SLI US Equity Fund (13) Benchmark (11) Based on 3 year standard deviation the underlying fund is investedUNDERLYING FUND StandardCompositionObjective

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign large cap equity

Edit your large cap equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your large cap equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing large cap equity online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit large cap equity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out large cap equity

How to Fill Out Large Cap Equity:

01

Research and Understand: Begin by thoroughly researching and understanding the concept of large cap equity. Understand its definition, characteristics, and investment strategies associated with it. This will help you make informed decisions throughout the process.

02

Assess Your Investment Goals: Evaluate your investment goals and risk tolerance. Determine if investing in large cap equity aligns with your financial objectives and if you are comfortable with the potential volatility and fluctuations typically associated with this type of investment.

03

Identify Suitable Large Cap Equity Funds: Explore different large cap equity funds available in the market. Consider factors such as fund performance, fees, portfolio composition, and investment philosophy to find funds that suit your preferences and align with your investment goals.

04

Conduct Due Diligence: Once you have shortlisted potential large cap equity funds, dig deeper into their historical performance, track record, and investment strategies. Review their prospectuses, fund manager's expertise, and any relevant disclosures to ensure that you are well-informed before making investment decisions.

05

Determine Investment Amount: Assess your financial situation and determine the amount you are willing to invest in large cap equity. Consider your overall portfolio diversification and how large cap equity will fit into your investment allocation strategy.

06

Monitor and Review: Regularly monitor the performance of your chosen large cap equity funds. Stay updated with market trends, economic conditions, and any significant news affecting the performance of the fund and the large cap equity sector as a whole.

Who needs Large Cap Equity?

01

Long-Term Investors: Large cap equity is suitable for long-term investors who have a higher risk tolerance and are seeking the potential for higher returns over extended investment horizons. These investors understand that fluctuations in the market can occur, and they are patient enough to weather short-term volatilities.

02

Investors Seeking Stability: Large cap equity funds often invest in well-established companies with strong market positions. These companies tend to be more resilient during economic downturns, providing stability to investors during turbulent times.

03

Passive Investors: Large cap equity can be a suitable choice for passive investors who prefer to have a diversified portfolio without actively managing their investments. Investing in large cap funds allows these individuals to gain exposure to a broad range of well-established companies without the need for constant monitoring and rebalancing.

Remember, before making any investment decisions, it is crucial to consult with a financial advisor who can provide personalized advice based on your unique financial circumstances and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the large cap equity electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the large cap equity form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign large cap equity and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How can I fill out large cap equity on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your large cap equity. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is large cap equity?

Large cap equity refers to stocks of companies with a market capitalization value of $10 billion or more.

Who is required to file large cap equity?

Institutional investors such as mutual funds, pension funds, and hedge funds are required to file large cap equity holdings with regulatory authorities.

How to fill out large cap equity?

Large cap equity holdings are typically reported on a Form 13F, which requires information on the name of the security, number of shares held, and the market value of the holdings.

What is the purpose of large cap equity?

The purpose of reporting large cap equity holdings is to provide transparency and insight into the investment activities of institutional investors.

What information must be reported on large cap equity?

Information such as the name of the security, number of shares held, and the market value of the holdings must be reported on large cap equity filings.

Fill out your large cap equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Large Cap Equity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.