Get the free APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES

Show details

This document serves as a ledger for tracking appropriations and encumbrances related to salaries and wages, detailing amounts appropriated, payments, and balances for the fiscal year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign appropriation ledger and encumbrance

Edit your appropriation ledger and encumbrance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your appropriation ledger and encumbrance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing appropriation ledger and encumbrance online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit appropriation ledger and encumbrance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

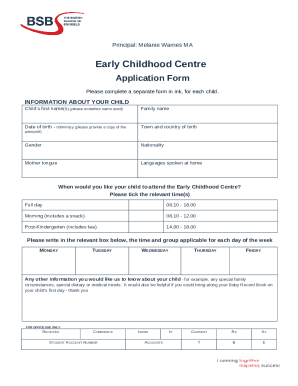

How to fill out appropriation ledger and encumbrance

How to fill out APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES

01

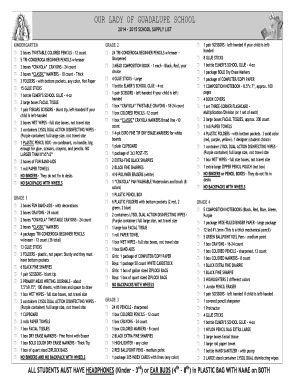

Gather all necessary payroll information including employee names, positions, salaries, and wage rates.

02

Access the appropriate form for the Appropriation Ledger and Encumbrance Record for Salaries and Wages.

03

Enter the fiscal year in the designated section of the form.

04

List each employee's name in the 'Employee Name' column.

05

Fill in the respective position titles of the employees in the 'Position' column.

06

Input the approved salary or wage amount for each employee in the 'Salary/Wage' column.

07

Calculate and enter the total appropriated amount for salaries and wages in the respective section.

08

Sign and date the ledger to confirm accuracy and completeness.

Who needs APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES?

01

Financial officers responsible for budgeting and fund allocation in organizations.

02

Human resources departments managing employee payroll.

03

Auditors reviewing financial records and compliance.

04

Government agencies monitoring appropriations and expenditures.

Fill

form

: Try Risk Free

People Also Ask about

What is the encumbrance entry?

Encumbrance entries are useful as a basic planning tool and to forecast financial outflow. The PO encumbrances strategy guarantees that financial statements represent the budgetary allocations to resources at the time of planning rather than when the company actually records the expenditure.

What is the journal entry to record encumbrances?

The journal entry for recording an encumbrance involves debiting the Encumbrances account, which represents the commitment, and crediting the Budgetary Fund Balance – Reserved for Encumbrances account, which reflects the portion of the budget that has been set aside for the future expenditure.

How to record salaries and wages payable?

Steps for Recording a Payroll Journal Entry Collect your upcoming payroll data. Record gross wages as an expense (debit column). Record money owed in taxes, net pay and any other payroll deductions as liabilities (credit column). Check the initial entry to make sure the credit column equals the debit column.

What is encumbrance in payroll?

An encumbrance is an estimate of the salary and benefit expense which will occur for the future. Salary and benefit expense encumbrances are generated semi-monthly. Negative encumbrances (liquidations) reverse the prior semi-monthly period encumbrance by changing (reversing) the sign.

Is encumbrance a debit or credit account?

Is encumbrance a debit or credit? Encumbrance is considered a debit balance account. When you need to allot money for a future payment, such as when a purchase order is approved, the encumbrance account is debited. In the future, when you pay that sum off, the encumbrance account is credited.

What is the journal entry for encumbrances?

When an organization creates a new purchase order or adds a new line item to an existing purchase order, the new items are encumbered to the journal. An entry is made in the journal with a debit to the encumbrance account and transferred to the general ledger.

What is appropriation and encumbrance in accounting?

Appropriation or Encumbrance? APPROPRIATION • Maximum amount you can expend for a certain purpose. ENCUMBRANCE • Setting aside a portion of available appropriation for a certain future obligation.

How do you record encumbrance in accounting?

Accounting for encumbrances involves recording the estimated cost of goods/services in the encumbrances account when the purchase order is issued, reversing it and recording the expenditure when the goods/services are received, and closing the budgetary accounts at year-end.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES?

The Appropriation Ledger and Encumbrance Record for Salaries and Wages is a financial record used by organizations to track allocated funds for employee salaries and wages, ensuring that expenses do not exceed the approved budget.

Who is required to file APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES?

Entities that manage payroll and budget allocations, such as government agencies, educational institutions, and non-profit organizations, are typically required to file the Appropriation Ledger and Encumbrance Record for Salaries and Wages.

How to fill out APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES?

To fill out the Appropriation Ledger and Encumbrance Record, one must enter the total budget amounts allocated for salaries and wages, record encumbrances (committed funds), update actual expenditures, and ensure that the totals balance according to the established accounting procedures.

What is the purpose of APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES?

The purpose of the Appropriation Ledger and Encumbrance Record for Salaries and Wages is to maintain accurate financial oversight by tracking the budget, monitoring encumbered funds, and ensuring compliance with fiscal policies.

What information must be reported on APPROPRIATION LEDGER AND ENCUMBRANCE RECORD FOR SALARIES AND WAGES?

Information that must be reported includes budgeted amounts, encumbered amounts, actual salary expenditures, remaining balances, and any adjustments made to the initial budget throughout the fiscal period.

Fill out your appropriation ledger and encumbrance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Appropriation Ledger And Encumbrance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.