OK 538-S 1996 free printable template

Show details

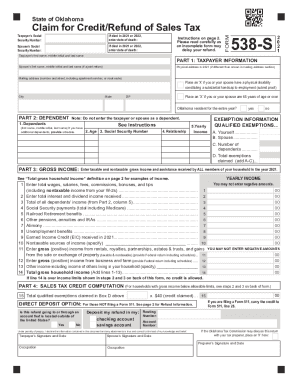

IT 0101296 000 OKLAHOMA CLAIM FOR CREDIT OR REFUND OF SALES TAX FORM 538-S INSTRUCTIONS ON REVERSE SIDE -- PLEASE READ CAREFULLY AN INCOMPLETE FORM MAY DELAY YOUR REFUND ITI0012-08-96-IT 1996 YEAR

pdfFiller is not affiliated with any government organization

Instructions and Help about OK 538-S

How to edit OK 538-S

How to fill out OK 538-S

Instructions and Help about OK 538-S

How to edit OK 538-S

To edit the OK 538-S Tax Form, utilize a PDF editing tool such as pdfFiller. Begin by uploading the form into the platform, where you can add or remove text as required. Ensure that all information is accurate and complies with the IRS standards before finalizing the document.

How to fill out OK 538-S

Filling out the OK 538-S Tax Form necessitates careful attention to detail. Gather necessary information, such as personal identification and financial data relevant to the tax year. Complete each section accurately, ensuring you follow the form's instructions. Once finished, review the form for completeness and correctness.

About OK 538-S 1996 previous version

What is OK 538-S?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About OK 538-S 1996 previous version

What is OK 538-S?

OK 538-S is a tax form previously used for reporting certain financial information related to tax obligations in the state of Oklahoma. This form was utilized for a specific period, allowing taxpayers to report tax information accurately to the state's tax authority.

What is the purpose of this form?

The purpose of the OK 538-S Tax Form is to report specific types of income and tax-related information to ensure compliance with state tax laws. It helps the Oklahoma Tax Commission monitor tax liabilities and ensure that taxpayers are reporting their income correctly.

Who needs the form?

This form is required for certain individuals and entities that receive specific payments or have certain transactions that meet the reporting criteria set forth by the Oklahoma Tax Commission. Taxpayers who engage in business activities or receive reportable income often need to complete the form.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out the OK 538-S form if they do not meet the income threshold or reporting requirements established by the Oklahoma Tax Commission. Common exemptions include individuals whose income falls below a specific level or those not engaged in reportable activities during the tax year.

Components of the form

The OK 538-S Tax Form consists of several key components, including sections for taxpayer information, nature of payments received, and summary of taxable income. Each section must be carefully completed to provide a clear picture of the taxpayer's financial obligations.

What are the penalties for not issuing the form?

Failing to issue the OK 538-S form can result in penalties imposed by the Oklahoma Tax Commission. These penalties may include fines or additional tax liabilities that could escalate if the omission is not corrected in a timely manner. It is crucial for taxpayers to understand these consequences to ensure compliance.

What information do you need when you file the form?

When filing the OK 538-S Tax Form, it is essential to gather specific information, including taxpayer identification number, details of all payments received, and any supporting documentation to substantiate the income reported. Accurate record-keeping is critical in this process.

Is the form accompanied by other forms?

In some cases, the OK 538-S may need to be filed alongside other related forms to provide a complete tax picture. Taxpayers should review state requirements to confirm whether additional documentation is necessary during the filing process.

Where do I send the form?

The completed OK 538-S Tax Form should be submitted to the Oklahoma Tax Commission at the designated address provided in the form's instructions. Ensure that the form is sent to the correct location to avoid processing delays.

See what our users say