Get the free PUBLIC UTILITY TAX RETURN - sctax

Show details

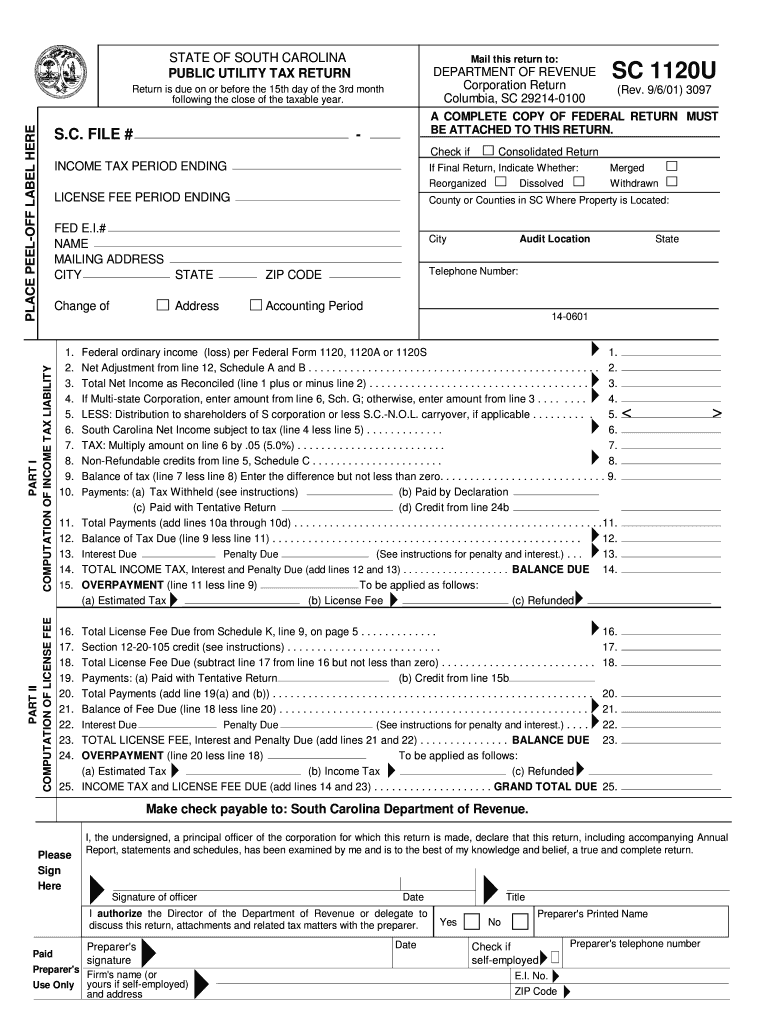

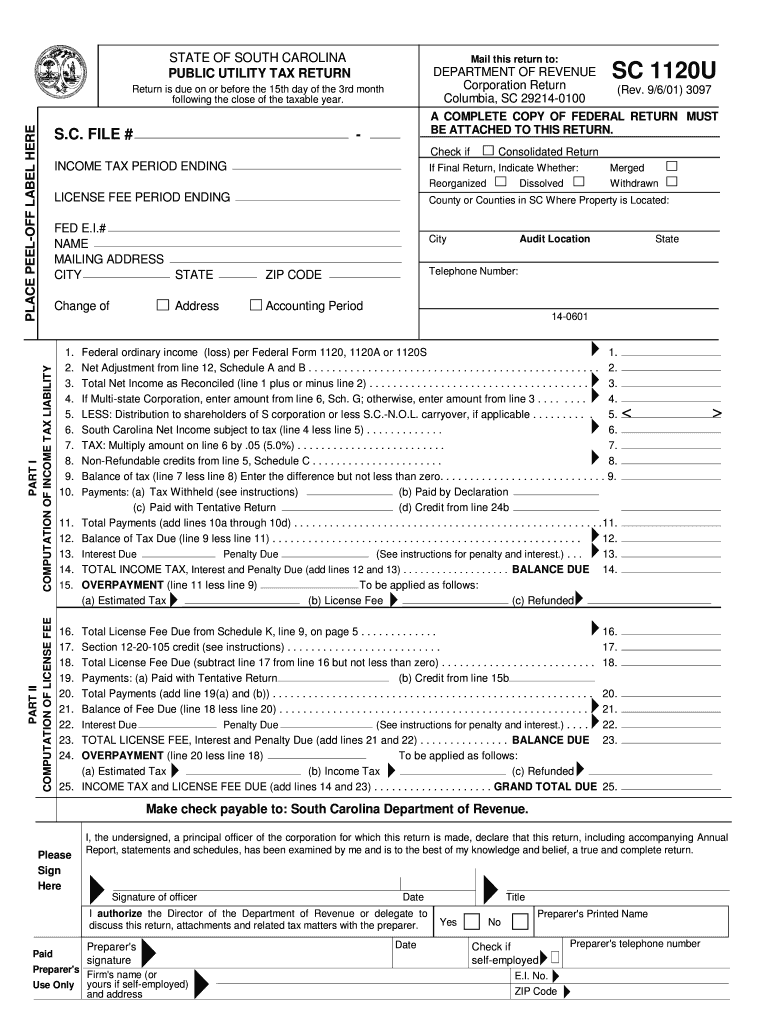

This document serves as the tax return for public utility companies in South Carolina, detailing the computation of income tax liability and license fees, and requiring additional information such

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign public utility tax return

Edit your public utility tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your public utility tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit public utility tax return online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit public utility tax return. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out public utility tax return

How to fill out PUBLIC UTILITY TAX RETURN

01

Obtain the PUBLIC UTILITY TAX RETURN form from your local tax authority's website or office.

02

Gather all necessary financial records related to your public utility business for the reporting period, such as revenue, expenses, and any applicable deductions.

03

Fill out the identification section of the form, including your business name, address, and tax identification number.

04

Report your gross receipts from utility services for the specified period in the appropriate section.

05

Calculate any applicable deductions and exemptions according to the guidelines provided on the form.

06

Complete the tax calculation section, applying the appropriate tax rate to your taxable amount.

07

Double-check all entries for accuracy and completeness to avoid errors.

08

Sign and date the form before submitting it to the tax authority, either by mail or electronically if allowed.

Who needs PUBLIC UTILITY TAX RETURN?

01

Public utility companies providing services such as electricity, gas, water, or telecommunications.

02

Businesses involved in the transmission and distribution of utility services.

03

Any other entities recognized under local laws as public utilities that generate taxable revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is the public utility tax in Delaware?

Electricity Distribution 4.25% of gross receipts from non-residential users. 2.0% of gross receipts from manufacturers, food processors and agribusinesses. Sales to automobile and certain other types of manufacturers are exempt. Returns and payment due on or before the 20th day after the end of each calendar month.

What is the utility tax in Delaware?

Electricity Distribution 4.25% of gross receipts from non-residential users. 2.0% of gross receipts from manufacturers, food processors and agribusinesses. Sales to automobile and certain other types of manufacturers are exempt. Returns and payment due on or before the 20th day after the end of each calendar month.

What is a local utility tax?

A UUT may be imposed by a city or county on the consumption of utility services. The tax is levied by the city or county on the consumer of the utility services, collected by the utility as a part of its regular billing procedure, and then remitted to the city or county.

What is a local utility tax?

A UUT may be imposed by a city or county on the consumption of utility services. The tax is levied by the city or county on the consumer of the utility services, collected by the utility as a part of its regular billing procedure, and then remitted to the city or county.

Why is Delaware a no tax state?

0:17 2:31 Which is a significant incentive for businesses to incorporate in the state. Instead of a sales taxMoreWhich is a significant incentive for businesses to incorporate in the state. Instead of a sales tax Delaware imposes a gross receipts tax on the seller of goods.

What taxes do you pay in the state of Delaware?

Delaware has an 8.70 percent corporate income tax rate and a state gross receipts tax. Delaware does not have a state sales tax rate. Delaware has a 0.48 percent effective property tax rate on owner-occupied housing value. Delaware does not have an estate tax or inheritance tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PUBLIC UTILITY TAX RETURN?

A Public Utility Tax Return is a tax form filed by businesses operating in sectors such as telecommunications, electricity, and gas to report their earnings from public utility services.

Who is required to file PUBLIC UTILITY TAX RETURN?

Entities that provide public utility services, such as telecommunications companies, electric companies, and gas suppliers, are required to file a Public Utility Tax Return.

How to fill out PUBLIC UTILITY TAX RETURN?

To fill out a Public Utility Tax Return, businesses need to gather their revenue data, follow the form's instructions for reporting income and expenses, and submit the completed form to the appropriate tax authority.

What is the purpose of PUBLIC UTILITY TAX RETURN?

The purpose of the Public Utility Tax Return is to assess and collect taxes on the revenues generated by public utility companies, ensuring they contribute to public funding.

What information must be reported on PUBLIC UTILITY TAX RETURN?

Information that must be reported on a Public Utility Tax Return includes gross revenue from utility services, deductions for specific expenses, and any applicable credits.

Fill out your public utility tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Public Utility Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.