SC DoR CL-1 2006 free printable template

Show details

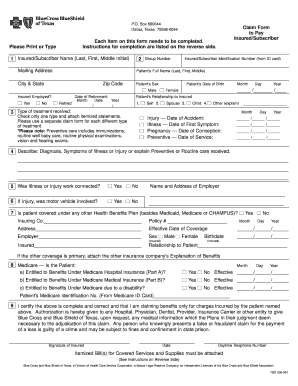

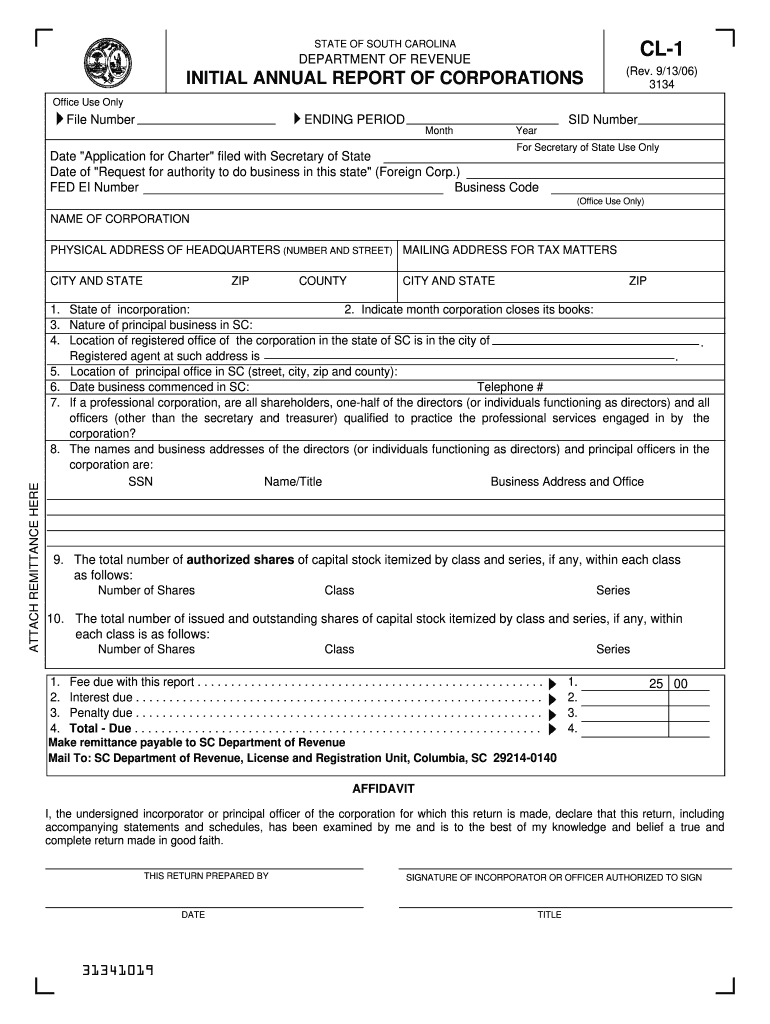

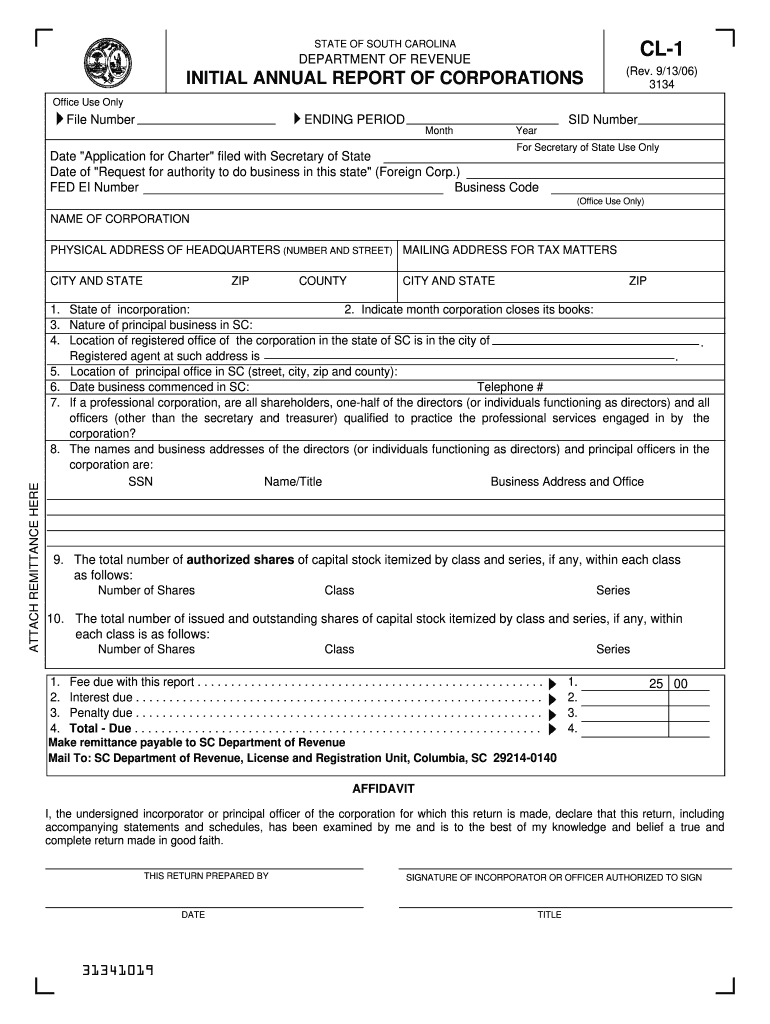

STATE OF SOUTH CAROLINA CL-1 DEPARTMENT OF REVENUE (Rev. 9/13/06) 3134 INITIAL ANNUAL REPORT OF CORPORATIONS Office Use Only File Number ENDING PERIOD SID Number Month Year For Secretary of State

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR CL-1

Edit your SC DoR CL-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR CL-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR CL-1 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC DoR CL-1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR CL-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR CL-1

How to fill out SC DoR CL-1

01

Gather all necessary documentation related to the incident or event.

02

Start filling out the personal information section at the top of the form.

03

Clearly state the date and location of the incident.

04

Provide a detailed description of the event, including facts and observations.

05

List any witnesses or involved parties along with their contact details.

06

Include relevant evidence or attachments if applicable.

07

Review the form for accuracy and completeness.

08

Sign and date the form before submission.

Who needs SC DoR CL-1?

01

Individuals or organizations involved in incidents requiring reporting.

02

Insurance companies for claims related to incidents.

03

Legal representatives handling cases that necessitate documentation.

04

Government agencies needing records of occurrences.

Fill

form

: Try Risk Free

People Also Ask about

What is a CL-1 fee in SC?

Instructions. What you need to know: You must submit a CL-1 and a $25 minimum License Fee to the SCSOS if you are a: • domestic corporation filing your initial Articles of Incorporation, or • foreign corporation filing an Application for Certificate of Authority to Transact Business in South Carolina.

What is a CL-1 form in South Carolina?

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.

Is there a South Carolina state tax form?

These 2021 forms and more are available: South Carolina Form 1040 – Personal Income Tax Return for Residents. South Carolina Schedule NR – Nonresident Schedule. South Carolina Form 1040/Schedule NR – Additions and Subtractions.

Why would SC Department of Revenue send me a letter?

Common reasons the SCDOR may send you a notice: You have a balance due. You are due a larger or smaller refund. We have a question about your return or need additional information or documents.

Why am I getting a letter from the South Carolina Department of Revenue?

Common reasons the SCDOR may send you a notice: You have a balance due. You are due a larger or smaller refund. We have a question about your return or need additional information or documents.

What does the South Carolina Department of Revenue do?

The Department of Revenue is a department of the South Carolina state government responsible for the administration of 32 different state taxes in South Carolina. The Department is responsible for licensing and taxing all manufacturers, wholesalers and retailers of alcoholic liquors.

What is South Carolina Department of Revenue State Income Tax?

Individual Income Tax rates range from 0% to a top rate of 7% on taxable income for tax years 2021 and prior and from 0% to a top rate of 6.5% on taxable income for tax year 2022. Tax brackets are adjusted annually for inflation.

At what age do you stop paying state taxes in South Carolina?

South Carolina taxpayers ages 65 and older do not need to file a state income tax return in most cases. If your gross income is less than the federal gross income filing requirement, you shouldn't be required to file a SC state return. In addition, Social Security benefits are not taxed by the state of South Carolina.

Do I have to file a CL-1 in South Carolina?

You must submit a CL-1 and a $25 minimum License Fee to the SCSOS if you are a: • domestic corporation filing your initial Articles of Incorporation, or • foreign corporation filing an Application for Certificate of Authority to Transact Business in South Carolina.

Is there an annual fee for LLC in South Carolina?

So for most people who own an LLC in South Carolina, there are no state-required annual South Carolina LLC fees. If you hired a Registered Agent service, you'll have an annual subscription fee to pay each year. This is usually about $125 per year. Some LLCs may need a business license in South Carolina.

Do you have to renew your LLC every year in South Carolina?

South Carolina does not require LLCs to file an annual report.

Does SC require annual reports?

The state of South Carolina requires all corporations to file a South Carolina Corporation Income Tax Return – which includes an annual report.

What is the annual fee for an LLC in South Carolina?

So for most people who own an LLC in South Carolina, there are no state-required annual South Carolina LLC fees. If you hired a Registered Agent service, you'll have an annual subscription fee to pay each year. This is usually about $125 per year. Some LLCs may need a business license in South Carolina.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SC DoR CL-1 directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your SC DoR CL-1 along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit SC DoR CL-1 on an iOS device?

Create, edit, and share SC DoR CL-1 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete SC DoR CL-1 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your SC DoR CL-1, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is SC DoR CL-1?

SC DoR CL-1 is a specific form used for filing certain disclosures related to the State of South Carolina's Department of Revenue.

Who is required to file SC DoR CL-1?

Individuals or businesses that have specific tax obligations or disclosures as required by the South Carolina Department of Revenue must file SC DoR CL-1.

How to fill out SC DoR CL-1?

To fill out SC DoR CL-1, one must provide accurate information regarding their tax situation, including personal or business details, income, and applicable deductions.

What is the purpose of SC DoR CL-1?

The purpose of SC DoR CL-1 is to ensure compliance with South Carolina tax laws by collecting necessary tax-related information from individuals and businesses.

What information must be reported on SC DoR CL-1?

The SC DoR CL-1 requires reporting of personal identification, income details, tax obligations, and any deductions or credits applicable to the filer.

Fill out your SC DoR CL-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR CL-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.