Get the free IRA Legacy MAX - CBS Brokerage LLC

Show details

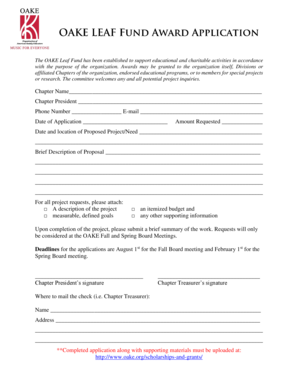

IRALegacyMAX Anadvancedsolutiontohelpreduceestatetaxesandincreasetheaccount valuethatispassedontoheirs.b At l xztv9655SchmidtLakeRd.,Ste300

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira legacy max

Edit your ira legacy max form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira legacy max form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira legacy max online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira legacy max. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira legacy max

How to fill out IRA legacy max:

01

Gather necessary documents: Before you start filling out the IRA legacy max form, gather all the required documents, including your personal identification, beneficiary information, and any relevant tax forms.

02

Understand the rules and regulations: Familiarize yourself with the rules and regulations associated with IRA legacy max. This includes understanding the contribution limits, tax implications, and any specific requirements for beneficiaries.

03

Determine your contribution amount: Decide on the contribution amount you want to make to your IRA legacy max. Consider factors such as your financial goals, risk tolerance, and available funds.

04

Complete the necessary forms: Fill out the IRA legacy max form accurately and legibly. Provide all the required information, including your personal details, beneficiary information, and the contribution amount. Read the instructions carefully to avoid any mistakes or omissions.

05

Review and double-check your form: Carefully review the filled-out form for any errors or missing information. Ensure that all the details are accurate, especially the beneficiary information, as it will determine how your IRA assets are distributed after your passing.

06

Submit the form: Once you are satisfied with the accuracy of your IRA legacy max form, submit it according to the instructions provided by your IRA provider. This might involve mailing the form or submitting it electronically through their online platform.

Who needs IRA legacy max:

01

Individuals with significant assets: IRA legacy max is suitable for individuals who have accumulated substantial assets and wish to efficiently pass them on to their beneficiaries. It allows for the potential growth of investments within the IRA while providing a strategy for estate planning.

02

Those concerned about estate taxes: Individuals who are concerned about their beneficiaries facing hefty estate taxes may find IRA legacy max beneficial. By utilizing the strategy, they can help mitigate potential tax burdens and protect their wealth for future generations.

03

Individuals with specific legacy goals: Those with specific goals or desires for passing their assets to their loved ones can benefit from IRA legacy max. It allows for customization and flexibility in distributing assets, ensuring that they align with the intentions of the account holder.

04

Investors who prioritize tax efficiency: IRA legacy max offers tax advantages, such as potential tax-free growth and the ability to designate beneficiaries. For investors seeking tax-efficient ways to pass on their wealth, this strategy can be advantageous.

Note: It's always recommended to consult with a financial advisor or tax professional who can provide personalized advice based on your unique financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira legacy max?

IRA Legacy Max is a strategy that allows individuals to transfer their remaining IRA assets to their heirs.

Who is required to file ira legacy max?

Individuals who have IRA accounts and wish to transfer their assets to their heirs are required to file an IRA Legacy Max.

How to fill out ira legacy max?

IRA Legacy Max can be filled out by consulting with a financial advisor or estate planner who can help determine the best strategy for transferring IRA assets to heirs.

What is the purpose of ira legacy max?

The purpose of IRA Legacy Max is to facilitate the transfer of IRA assets to heirs in a tax-efficient manner.

What information must be reported on ira legacy max?

Information such as the value of the IRA assets, the names of the heirs, and any specific instructions for the transfer must be reported on an IRA Legacy Max form.

How can I manage my ira legacy max directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your ira legacy max and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit ira legacy max from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your ira legacy max into a dynamic fillable form that you can manage and eSign from anywhere.

Can I edit ira legacy max on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as ira legacy max. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your ira legacy max online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Legacy Max is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.