Get the free of Letter of Credit Law & Practice

Show details

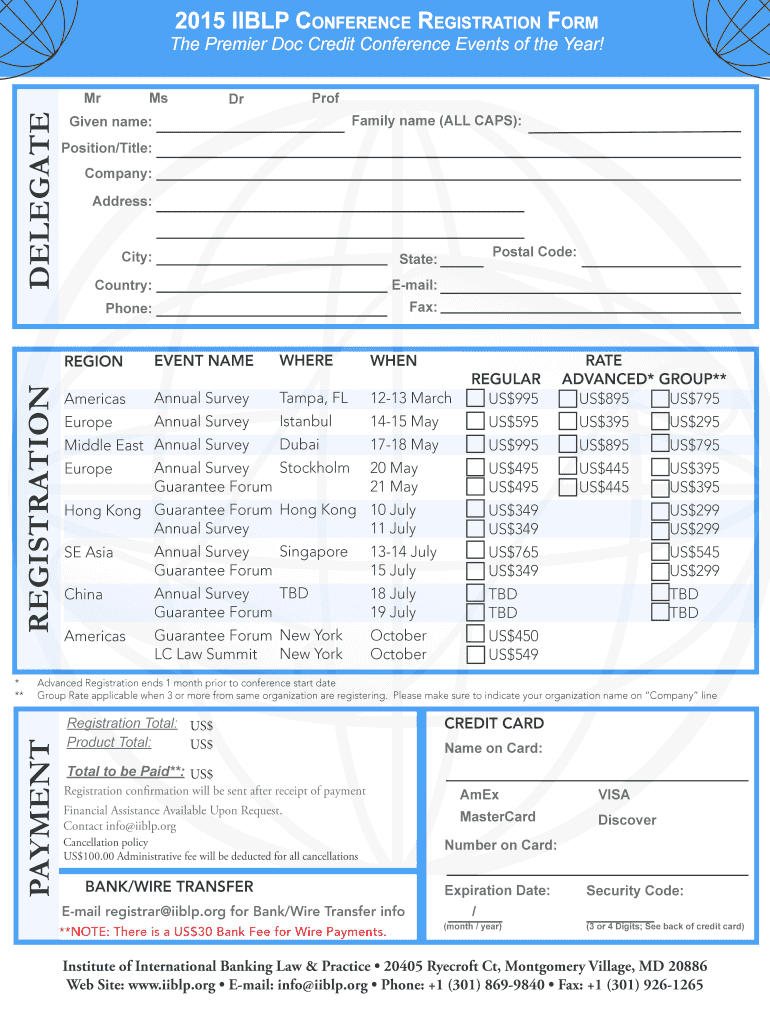

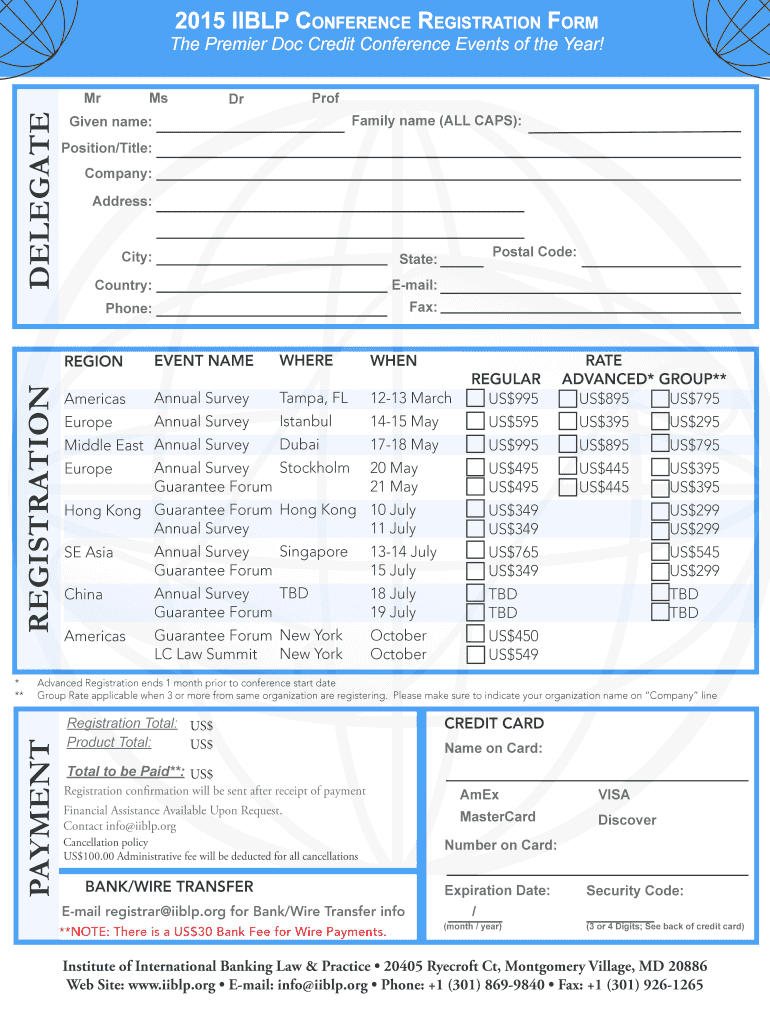

2015 Americas Annual Survey of Letter of Credit Law & Practice 12-13 March Tampa Hilton Garden Inn Tampa East/Brandon 10309 Highland Manor Dr. Tampa, FL 33610 CDs Specialists earn 13 Plus II BLP 2015

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign of letter of credit

Edit your of letter of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of letter of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit of letter of credit online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit of letter of credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out of letter of credit

How to fill out a letter of credit:

01

Start by obtaining the necessary forms from your bank or financial institution. These forms typically require information such as the beneficiary's name, address, and contact details.

02

Next, specify the amount of the credit and the currency in which it should be issued.

03

Indicate the expiration date of the letter of credit, which is the date by which the beneficiary must present the required documents to the issuing bank to claim the payment.

04

Specify the terms and conditions that need to be met for the letter of credit to be honored, such as the required shipping documents, inspection certificates, and other evidentiary documents.

05

Provide detailed information about the goods or services being traded, including their description, quantity, unit price, and any applicable packaging or labeling requirements.

06

Include any additional instructions or special requirements that the issuing bank must be aware of, such as partial shipments, transshipment permissions, or specific insurance coverage.

07

Sign and date the letter of credit, ensuring that it is properly executed and authorized by the appropriate parties.

Who needs a letter of credit?

01

Importers: Importers often require letters of credit to ensure that the exporter receives payment for the goods or services provided before they are shipped. This helps to mitigate the risks associated with international trade, such as non-payment or non-delivery of the goods.

02

Exporters: Exporters may request letters of credit to safeguard themselves against non-payment or other financial risks. By using a letter of credit, exporters can ensure that they will be paid once they have met all the specified conditions, giving them confidence to proceed with the transaction.

03

Banks and financial institutions: Banks play a crucial role in issuing and managing letters of credit. They act as intermediaries between importers and exporters, providing a secure payment mechanism and facilitating international trade transactions. Financial institutions may also require letters of credit as collateral for providing financing options to businesses involved in international trade.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get of letter of credit?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific of letter of credit and other forms. Find the template you need and change it using powerful tools.

How do I edit of letter of credit online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your of letter of credit to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I fill out of letter of credit on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your of letter of credit by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is of letter of credit?

A letter of credit is a financial tool used in international trade transactions to ensure that the seller will be paid for the goods or services provided.

Who is required to file of letter of credit?

The seller and the buyer are typically required to file a letter of credit in international trade transactions.

How to fill out of letter of credit?

To fill out a letter of credit, the seller and the buyer must agree on the terms and conditions of the transaction and provide the necessary information to the issuing bank.

What is the purpose of of letter of credit?

The purpose of a letter of credit is to guarantee payment to the seller in a transaction, providing security for both parties involved.

What information must be reported on of letter of credit?

Information such as the names of the buyer and seller, description of the goods or services, payment terms, and expiration date must be reported on a letter of credit.

Fill out your of letter of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Of Letter Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.