Get the free DEED OF TRUST - ATTORNEY AFFIDAVIT OF SATISFACTION Deed of Trust Satisfaction

Show details

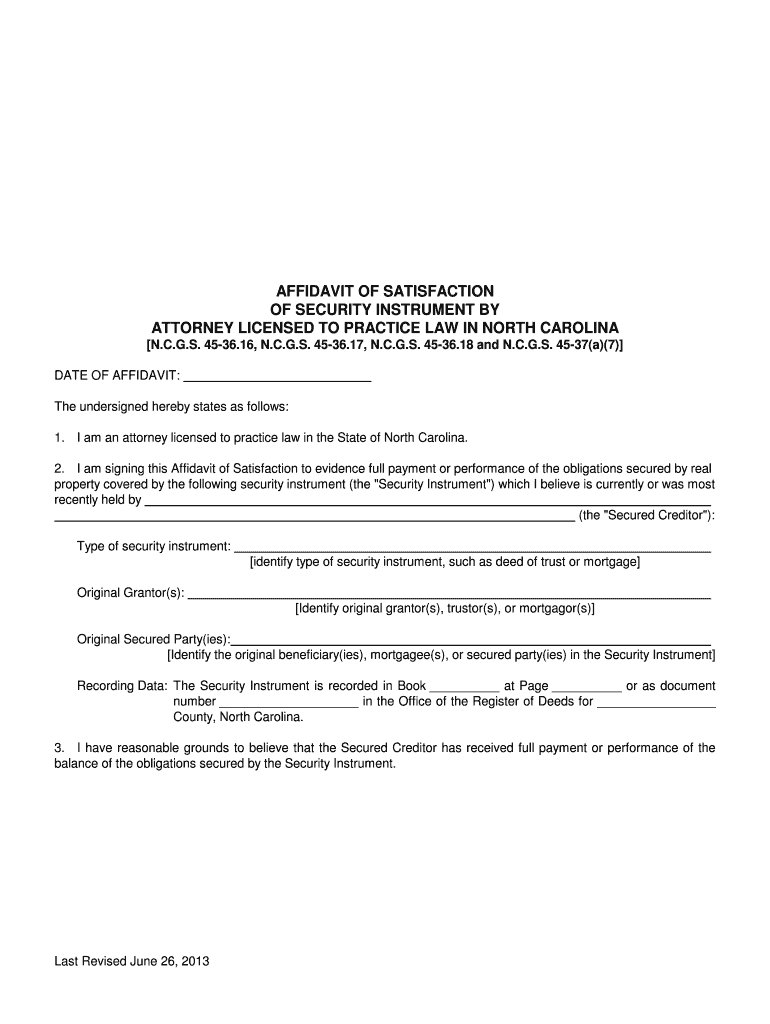

AFFIDAVIT OF SATISFACTION OF SECURITY INSTRUMENT BY ATTORNEY LICENSED TO PRACTICE LAW IN NORTH CAROLINA N.C.G.S. 4536.16, N.C.G.S. 4536.17, N.C.G.S. 4536.18 and N.C.G.S. 4537(a)(7) DATE OF AFFIDAVIT:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of trust

Edit your deed of trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deed of trust online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deed of trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of trust

How to fill out a deed of trust?

01

Start by gathering all the necessary information and documents. You will need the property details including the legal description, the names and contact information of all parties involved such as the borrower, lender, and trustee, and any relevant loan details.

02

Determine the format and language for your deed of trust. Each state may have specific requirements, so it is important to check with the local recording office or consult an attorney to ensure compliance with local laws.

03

Begin by identifying the parties involved. Clearly state the names of the borrower, lender, and trustee. Include their addresses and contact information for clarity.

04

Provide a detailed legal description of the property. This should include information such as the street address, lot number, block number, and any other identifying details that accurately describe the property.

05

Specify the terms of the loan. This includes the loan amount, interest rate, repayment terms, and any late payment fees or penalties. Clearly outline the obligations and responsibilities of both the borrower and the lender.

06

Include any additional provisions or conditions that may be required. This could include clauses related to insurance requirements, maintenance of the property, or any other specific agreements between the parties.

07

Clearly state the rights and remedies in case of default. Outline the steps that will be taken if the borrower fails to meet their obligations, such as foreclosure or appointment of a new trustee.

08

Include signature lines for all parties involved. This is crucial to ensure the validity of the deed of trust. Make sure all parties sign and date the document in the presence of a notary public or authorized witness if required.

Who needs a deed of trust?

01

Homebuyers: Deed of trust is commonly used in real estate transactions when financing a property. It serves as security for the loan and protects the lender's interests in case of default.

02

Lenders: Lenders require a deed of trust to secure their investment in a property. It provides legal protection and establishes the terms of the loan.

03

Trustee: The trustee is usually a neutral third party who holds the legal title to the property until the loan is repaid. They are responsible for enforcing the terms of the deed of trust and carrying out any necessary actions in case of default.

In summary, anyone involved in a real estate transaction that involves financing or lending can benefit from a deed of trust. It provides legal protection, defines the terms of the loan, and outlines the rights and responsibilities of all parties involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in deed of trust?

With pdfFiller, it's easy to make changes. Open your deed of trust in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the deed of trust in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your deed of trust.

How do I fill out deed of trust using my mobile device?

Use the pdfFiller mobile app to fill out and sign deed of trust. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is deed of trust?

A deed of trust is a legal document that is used in real estate transactions to secure a loan by transferring the title of the property to a trustee.

Who is required to file deed of trust?

The borrower is required to file a deed of trust in order to secure the loan with the property being used as collateral.

How to fill out deed of trust?

To fill out a deed of trust, you will need to include information about the borrower, lender, property being used as collateral, and amount of the loan.

What is the purpose of deed of trust?

The purpose of deed of trust is to provide security for the lender in case the borrower defaults on the loan.

What information must be reported on deed of trust?

The deed of trust must include information about the borrower, lender, property being used as collateral, and amount of the loan.

Fill out your deed of trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.