Get the free SS-044 - tcc

Show details

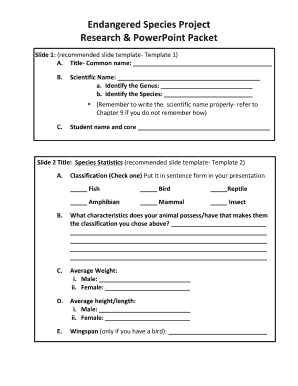

This document serves as a request form for student clubs and organizations to organize fundraising events, detailing required information and responsibilities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ss-044 - tcc

Edit your ss-044 - tcc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ss-044 - tcc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ss-044 - tcc online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ss-044 - tcc. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ss-044 - tcc

How to fill out SS-044

01

Obtain the SS-044 form from the IRS website or local tax office.

02

Complete your personal information at the top of the form, including your name, address, and Social Security number.

03

Fill out the relevant sections of the form based on your specific situation, ensuring accuracy.

04

Review the instructions on each section to provide the necessary details.

05

If applicable, attach any required documentation as specified in the instructions.

06

Sign and date the form in the designated areas.

07

Submit the completed form to the appropriate IRS address indicated in the instructions.

Who needs SS-044?

01

Individuals who need to report specific information to the IRS, typically related to tax obligations or requests.

Fill

form

: Try Risk Free

People Also Ask about

How do I stop Irmaa surcharges?

How to Avoid IRMAA: 9 (Simple) Ways to Reduce Medicare Costs 1.) Charitable Giving. 2.) Tax Deductible Retirement Account Contributions. 3.) Tax-Free Retirement Income. 4.) Tax-Efficient Investments. 5.) Tax-Efficient Withdrawal Strategies. 6.) Medicare Savings Accounts (MSAs) 7.) Roth Conversions. 8.) Tax Gain Harvesting.

How do I reduce my irmaa?

Call +1 800-772-1213 and tell the representative you want to lower your Medicare Income-Related Monthly Adjustment Amount (IRMAA) if you had an amended income tax return.

How much is the Irmaa for 2025?

The 2025 IRMAA surcharge amounts for Part B will added on top of the basic Part B premium of $185.00, an increase of $10.60 from 2024. Part B surcharges range from $74.00 to $443.90.

What is the income for Irmaa?

Medicare beneficiaries who earn over $106,000 a year2 and who are enrolled in Medicare Part B and/or Medicare Part D – pay the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

How long does an Irmaa appeal take?

Please note that the processing time for the appeal may take several weeks. If the appeal is successful, Social Security will rectify the situation by incorporating the additional premiums into the benefits for one month.

What income counts towards Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

What is an SS 44?

The SSA-44 is an essential document for individuals and businesses who are looking to receive Supplemental Security Income (SSI). This form is used to provide evidence of your financial eligibility in order to qualify for SSI benefits.

Does investment income affect Irmaa?

Your IRMAA amount is determined based on the modified adjusted gross income (MAGI) from your tax return two years ago. Do capital gains count toward IRMAA? Yes, since capital gains are included in MAGI, they can affect your IRMAA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SS-044?

SS-044 is a form used for reporting certain tax-related information to the Internal Revenue Service (IRS) in the United States.

Who is required to file SS-044?

Individuals or entities that meet specific criteria set by the IRS regarding tax reporting requirements must file SS-044.

How to fill out SS-044?

To fill out SS-044, one should complete the required fields with accurate information, including personal or business details and any financial data requested by the form.

What is the purpose of SS-044?

The purpose of SS-044 is to ensure compliance with tax regulations by collecting pertinent information from taxpayers.

What information must be reported on SS-044?

Information that must be reported on SS-044 typically includes taxpayer identification, financial data related to income or deductions, and any other relevant details needed for tax assessment.

Fill out your ss-044 - tcc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ss-044 - Tcc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.