Get the free Post-Tax Salary Deduction Authorization - tcc

Show details

This form is used to authorize new insurance deductions, report changes, certify existing deductions, authorize deduction of administration fees, and/or cancel deductions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign post-tax salary deduction authorization

Edit your post-tax salary deduction authorization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your post-tax salary deduction authorization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

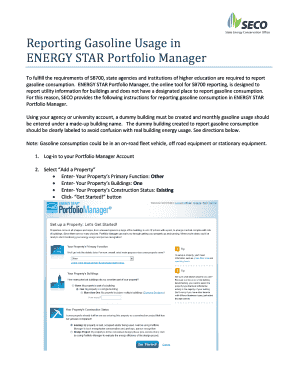

How to edit post-tax salary deduction authorization online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit post-tax salary deduction authorization. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out post-tax salary deduction authorization

How to fill out Post-Tax Salary Deduction Authorization

01

Obtain the Post-Tax Salary Deduction Authorization form from your employer or HR department.

02

Fill out your personal information, including your name, employee ID, and contact information.

03

Specify the amount to be deducted from your post-tax salary.

04

Indicate the reason for the deduction, such as contributions to a retirement plan or payment for benefits.

05

Review the terms and conditions associated with the deduction.

06

Sign and date the form to authorize the deduction.

07

Submit the completed form to your HR department or payroll administrator.

Who needs Post-Tax Salary Deduction Authorization?

01

Employees who want to make contributions to retirement plans or benefit programs using post-tax dollars.

02

Individuals who are required to set up deductions for specific payroll allocations after taxes have been applied.

Fill

form

: Try Risk Free

People Also Ask about

What is post or pre-tax deduction?

Post-tax deductions, or after-tax deductions, are expenses or contributions subtracted from an employee's income after taxes have been withheld. Unlike pre-tax deductions, which are taken out before calculating income tax, post-tax deductions are applied after taxes are taken out of an employee's gross pay.

How to write a letter for release of payment?

Begin with your contact information and the date. Then, clearly address the recipient, stating the purpose in the subject line. Detail the outstanding invoice amount, the due date and any relevant information like project completion. Conclude by politely requesting prompt payment and thanking them for their attention.

How to write a letter for salary deduction?

[HR Contact/HR Department], I'm writing to request a temporary reduction in my salary for the period [date range] due to [reason, such as unpaid leave or personal circumstances]. I know this will affect my paycheck during this time and I want to make sure this is documented.

How to write a counter letter for salary?

Clearly state the terms you would like to negotiate. Be specific about your desired changes and provide a persuasive justification for your counter offer. Use market research, industry standards, or your qualifications to support your request.

How to write a letter requesting for salary payment?

Key Components of this letter include the following: Employee's Information: Employer's Information: Date: Subject Line: E.g.Demand for Payment of Unpaid Salary. Reference to the Employment Agreement: Details of the Unpaid Salary: Statement of the Issue: Formal Request for Payment:

What is a post-tax deduction in the UK?

As noted above, post-tax deductions are amounts subtracted from an employee's paycheck after all applicable taxes have been calculated and subtracted from their gross salary. These deductions are diverse and reflect various aspects of an employee's personal, financial, and occupational interests.

How to write a mail for salary correction?

Dear (Manager's Name), I hope this message finds you well. I would like to schedule a time to discuss my salary. After reviewing my compensation package, I believe there may be a discrepancy that we should address. I appreciate your attention to this matter and look forward to our conversation. Thank you, (Your Name)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Post-Tax Salary Deduction Authorization?

Post-Tax Salary Deduction Authorization is a form that allows an employee to authorize deductions from their post-tax income for various purposes, such as retirement contributions, charitable donations, or other benefits.

Who is required to file Post-Tax Salary Deduction Authorization?

Employees who wish to have specific deductions taken from their post-tax salary, such as contributions to retirement plans after taxes have been deducted, are required to file this authorization.

How to fill out Post-Tax Salary Deduction Authorization?

To fill out the Post-Tax Salary Deduction Authorization, employees need to provide personal information, specify the amount or percentage of deduction, the purpose of the deduction, and sign the form to authorize the deduction.

What is the purpose of Post-Tax Salary Deduction Authorization?

The purpose of the Post-Tax Salary Deduction Authorization is to facilitate the processing of specific salary deductions after taxes have been calculated, ensuring that employees can allocate part of their income toward designated purposes.

What information must be reported on Post-Tax Salary Deduction Authorization?

The information that must be reported includes the employee's name, social security number, the deduction amount or percentage, the type of deduction, and the employee's signature for authorization.

Fill out your post-tax salary deduction authorization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Post-Tax Salary Deduction Authorization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.