Get the free Investment choice

Show details

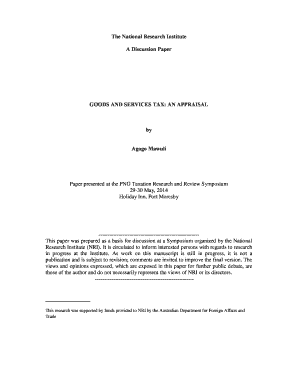

This form allows members of West State Super to change their investment plan. Members can choose a MY plan or select from four Readymade investment plans. The form includes sections for personal details,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment choice

Edit your investment choice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment choice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing investment choice online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit investment choice. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment choice

How to fill out Investment choice

01

Gather all necessary financial documents, including income statements and existing investments.

02

Research different investment options available to you, such as stocks, bonds, and mutual funds.

03

Assess your financial goals and risk tolerance to determine suitable investment choices.

04

Visit the investment platform or institution's website or application.

05

Locate the Investment Choice section or investment selection tool.

06

Input your financial information and preferences as prompted.

07

Review the available investment options that match your criteria.

08

Select your preferred investments and specify the amount to allocate to each.

09

Double-check all details for accuracy before submission.

10

Submit your Investment Choice application and retain confirmation for your records.

Who needs Investment choice?

01

Individuals looking to grow their wealth through investments.

02

Retirement account holders wanting to allocate funds effectively.

03

People seeking to diversify their financial portfolios.

04

Employees enrolling in employer-sponsored retirement plans.

05

Anyone interested in learning about investment opportunities and strategies.

Fill

form

: Try Risk Free

People Also Ask about

How to make investment choices?

Key Takeaways Commit to a timeline. Give your money time to grow and compound. Determine your risk tolerance, then pick the types of investments that match it. Learn the 5 key facts of stock-picking: dividends, P/E ratio, beta, EPS, and historical returns.

Is a 7% return realistic?

In short, the average stock market return since the S&P 500's inception in 1926 through 2018 is approximately 10-11%. When adjusted for inflation, it's closer to about 7%. [Since we're talking citations in this post: Investopedia.]

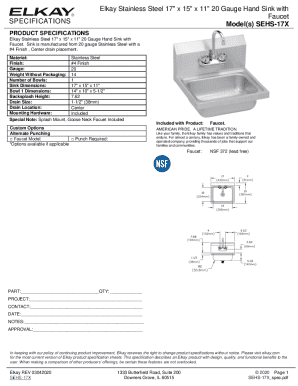

What is an investment option?

Investment refers to putting your money into assets to generate income and growing wealth. Financial investment plans come in various forms, including stocks, FDs, mutual funds, PPF, and NPS. OPEN FD. Secure your future with guaranteed returns! Open a Fixed Deposit today and earn up to 7.30% p.a.

How to turn $100 into $1000 investing?

High-Yield Savings Accounts. It may seem a bit safe, but a high-yield savings account could turn your $100 into $1,000 just by leaving it alone. Invest in the Stock Market. Start a Blog. Use Robo-Advisors. Invest in Cryptocurrency. Start an E-Commerce Business. Grow a YouTube Audience. Collect Dividends.

What is investment choice?

Investment options are financial assets that individuals or institutions can invest in to generate returns. These can include stocks, bonds, mutual funds, real estate, and more. Investing is the process of allocating resources, often money, with the expectation of generating a profit or income over time.

What is the meaning of investment choice?

Investment Choice means the fund, trust, company stock or similar investment vehicle in which a Participant's Investment Funds Account is notionally invested. The Committee shall designate the Investment Choices available with respect to each Award.

What investment decision means?

An investment decision refers to the process of determining the amount of capital required to produce the desired level of output, taking into account the optimal profitability and the cost of investment.

How much is $1000 a month for 5 years?

In fact, at the end of the five years, if you invest $1,000 per month you would have $83,156.62 in your investment account, ing to the SIP calculator (assuming a yearly rate of return of 11.97% and quarterly compounding).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Investment choice?

Investment choice refers to the selection of specific investment options or strategies that an individual or organization makes to manage their assets and achieve financial goals.

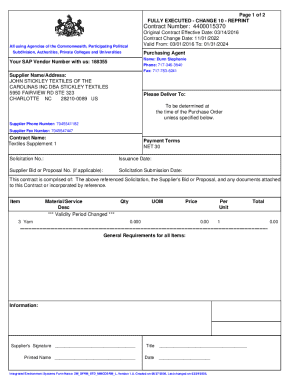

Who is required to file Investment choice?

Individuals or entities managing investments, such as retirement accounts or managed funds, may be required to file an Investment choice, particularly when they need to declare their selected investment options to relevant regulatory bodies.

How to fill out Investment choice?

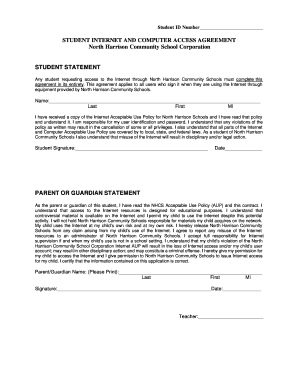

To fill out an Investment choice form, one typically needs to provide personal identification information, select the desired investment options from a provided list, and submit the form according to the instructions given by the managing entity.

What is the purpose of Investment choice?

The purpose of Investment choice is to empower investors to make informed decisions about how their money is managed, allowing them to tailor their investment strategy to their financial objectives and risk tolerance.

What information must be reported on Investment choice?

Information that must be reported on Investment choice generally includes personal details of the investor, the selected investment options, any relevant account numbers, and the signature or consent to the terms and conditions outlined by the investment provider.

Fill out your investment choice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Choice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.