Get the free Trust Net Value Trust Net Value

Show details

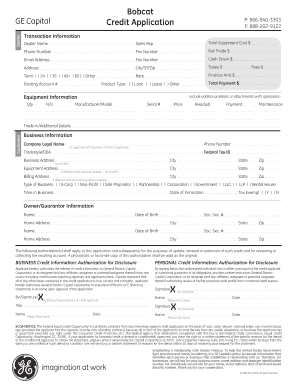

TRUST NET VALUE TRUST NAME DATE Assets DESCRIPTION SCHEDULE A SCHEDULE B JOINT ASSETS Cash Accounts (Savings, Checking, CD) Investment Accounts (Brokerage Accounts)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust net value trust

Edit your trust net value trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust net value trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit trust net value trust online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit trust net value trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust net value trust

How to fill out trust net value trust:

01

Gather necessary documentation: Start by collecting all the required documents, such as the trust agreement, beneficiary information, and financial statements.

02

Understand the trust net value: The trust net value refers to the total value of the assets held within the trust, minus any liabilities or debts.

03

Determine the value of trust assets: Evaluate the current market value of all the assets held within the trust, including real estate, investments, and personal property.

04

Assess any liabilities or debts: Take into account any outstanding debts, mortgages, or loans associated with the trust assets. Subtract these liabilities from the total value of the trust assets to calculate the net value.

05

Complete necessary forms: Fill out the required forms or paperwork provided by the trust administrator or trustee. Provide accurate and detailed information regarding the value of assets, liabilities, and any relevant financial transactions.

06

Review and verify the information: Double-check all the provided information to ensure its accuracy. Mistakes or discrepancies could lead to complications in managing the trust.

07

Seek professional assistance if needed: If you are unsure about any aspect of filling out the trust net value trust, consider consulting with a trust attorney, financial advisor, or tax professional who can offer guidance and ensure compliance with legal requirements.

Who needs trust net value trust:

01

Individuals with complex financial situations: Trust net value trusts are often used by individuals who have significant assets or need to protect their wealth for future generations. These trusts provide greater control and may offer tax advantages.

02

Estate planning purposes: Trust net value trusts are commonly used in estate planning to transfer assets to beneficiaries while minimizing estate taxes and ensuring the assets are distributed according to the grantor's wishes.

03

Wealthy families or business owners: Those with substantial wealth or ownership in a business may choose to create a trust net value trust to protect their assets, manage their financial affairs, and provide for their loved ones' long-term financial security.

In conclusion, filling out a trust net value trust involves gathering documentation, understanding the trust net value, assessing assets and liabilities, completing necessary forms, reviewing information, and seeking professional assistance if necessary. This type of trust is typically utilized by individuals with complex financial situations, for estate planning purposes, or by wealthy families or business owners seeking asset protection and long-term financial planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit trust net value trust straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing trust net value trust right away.

How do I complete trust net value trust on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your trust net value trust. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit trust net value trust on an Android device?

You can make any changes to PDF files, like trust net value trust, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is trust net value trust?

Trust net value trust refers to the total value of assets held in a trust after subtracting any liabilities or debts.

Who is required to file trust net value trust?

Trustees or fiduciaries of a trust are required to file trust net value trust with the applicable tax authorities.

How to fill out trust net value trust?

To fill out trust net value trust, trustees need to gather information on all trust assets, liabilities, income, and expenses, and report them accurately on the appropriate forms.

What is the purpose of trust net value trust?

The purpose of trust net value trust is to provide transparency and accountability regarding the financial status of a trust, for tax and regulatory purposes.

What information must be reported on trust net value trust?

Trust net value trust typically requires reporting on all assets held in the trust, any liabilities or debts, income earned by the trust, and expenses paid out of the trust.

Fill out your trust net value trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Net Value Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.