Get the free Personal Declaration for Salary Packaged Items - hr uwa edu

Show details

This document is used by employees to declare the primary business-related use of items for salary packaging or reimbursement at the University of Western Australia. It includes sections for employee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal declaration for salary

Edit your personal declaration for salary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal declaration for salary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing personal declaration for salary online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit personal declaration for salary. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal declaration for salary

How to fill out Personal Declaration for Salary Packaged Items

01

Obtain the Personal Declaration form from your HR department or their website.

02

Make sure to read the instructions on the form carefully.

03

Fill out your personal details accurately, including your full name, employee ID, and department.

04

List the salary packaged items for which you are making the declaration.

05

Provide any required supporting documentation, such as receipts or invoices.

06

Review the filled form to ensure all information is correct and complete.

07

Sign and date the declaration form at the designated area.

08

Submit the completed form to the appropriate HR or payroll contact within your organization.

Who needs Personal Declaration for Salary Packaged Items?

01

Employees participating in salary packaging arrangements.

02

Employees seeking to claim benefits on specific items under salary packaging.

03

Individuals who want to report their salary packaged benefits for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How much is the Maxxia fee?

The charge is $4.40 per benefit, per month (GST incl). This will be salary packaged and your deductions automatically increased to cover the charge. International transaction fees and disputed transaction fees also apply.

How much is the salary packaging fee?

How much does salary packaging cost? The new fee structure effective from 1 April 2023 will be as follows: For one salary packaging benefit item the fee is $23.50 per annum (ex GST). For two or more salary packaging benefit items the fee is $33.50 per annum (ex GST).

How much is the smart salary fee?

The Smartsalary Card costs $66 per year for each benefit (including GST).

What is the maximum amount of access pay?

Choose to package the things you pay for every day If you work for a charity or Public Benevolent Institution (PBI) you can salary package up to $15,900 tax-free each FBT year. If you work for a public or private not-for-profit hospital, the annual salary packaging tax-free limit is $9,010.

Can I cancel salary packaging?

Yes, there are no lock-in contracts; you can cease salary packaging with us at any time and return to paying your standard and any additional voluntary superannuation contributions with post-tax dollars.

What is an example of salary sacrifice super?

An example of salary sacrificing Terry earns $7,500 per month and decides that he can comfortably live off just $7,000 of that. He therefore asks his employer to pay $500 from his salary each month into his super account as a salary sacrifice.

What is the maximum amount you can salary sacrifice?

Salary sacrifice is a before-tax contribution, so the maximum salary sacrifice is $30,000 per financial year, but remember, this cap also includes any contributions your employer has made to your superannuation and any contributions you claim a deduction for.

How do you record salary sacrifices?

Salary sacrifice super Allocate the purchase of the item being sacrificed to a Salary Sacrifice liability account. Set up a salary sacrifice deduction and link it to this account. Record the employee's pay with the salary sacrifice amount deducted from their pay. The amount offsets the payable liability account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Declaration for Salary Packaged Items?

The Personal Declaration for Salary Packaged Items is a formal document that employees use to declare the items they wish to package as part of their salary, allowing them to potentially receive tax benefits on certain expenses.

Who is required to file Personal Declaration for Salary Packaged Items?

Employees who wish to take advantage of salary packaging arrangements and claim certain expenses for tax benefits are required to file a Personal Declaration for Salary Packaged Items.

How to fill out Personal Declaration for Salary Packaged Items?

To fill out the Personal Declaration for Salary Packaged Items, employees need to complete the required sections of the form, including their personal details, the items they wish to package, and any relevant financial information, ensuring all information is accurate and complete.

What is the purpose of Personal Declaration for Salary Packaged Items?

The purpose of the Personal Declaration for Salary Packaged Items is to enable employees to officially notify their employer about their salary packaging preferences and to comply with tax regulations regarding deduction claims.

What information must be reported on Personal Declaration for Salary Packaged Items?

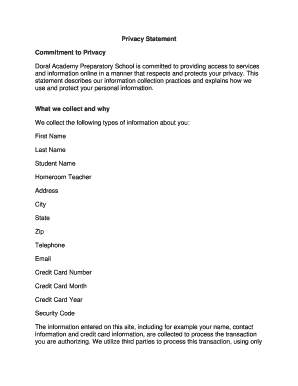

The information that must be reported on the Personal Declaration for Salary Packaged Items includes personal identification details, the specific packaged items being claimed, associated costs, and any supporting documentation related to those items.

Fill out your personal declaration for salary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Declaration For Salary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.