Get the free Salary Packaging—Superannuation - hr uwa edu

Show details

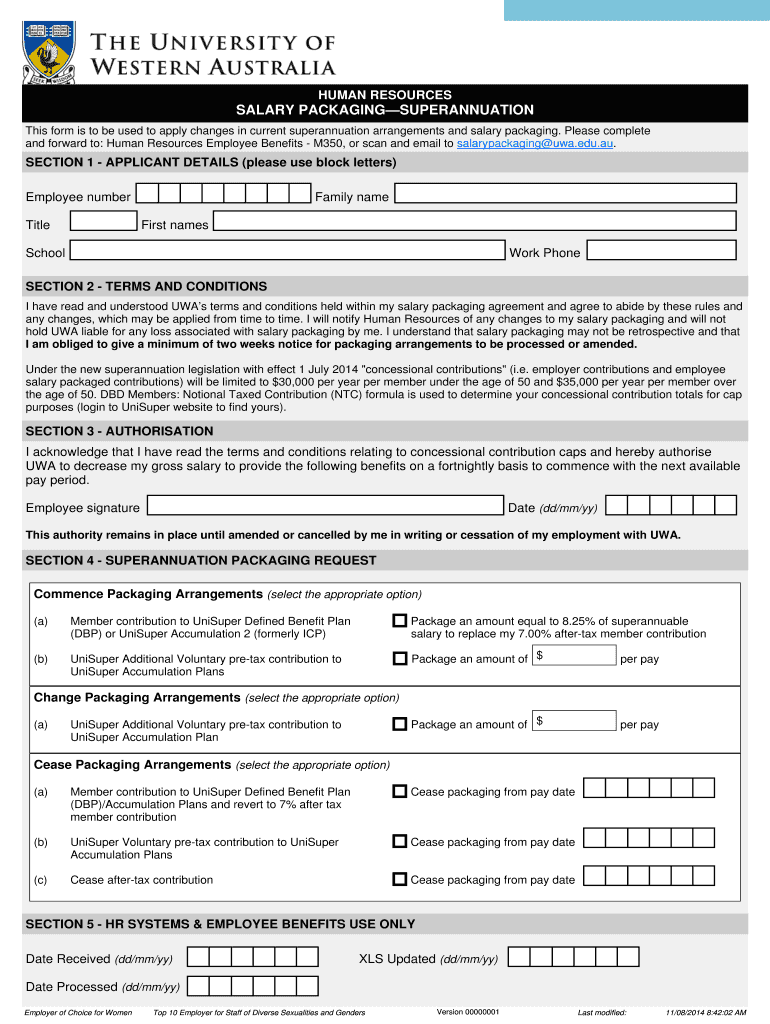

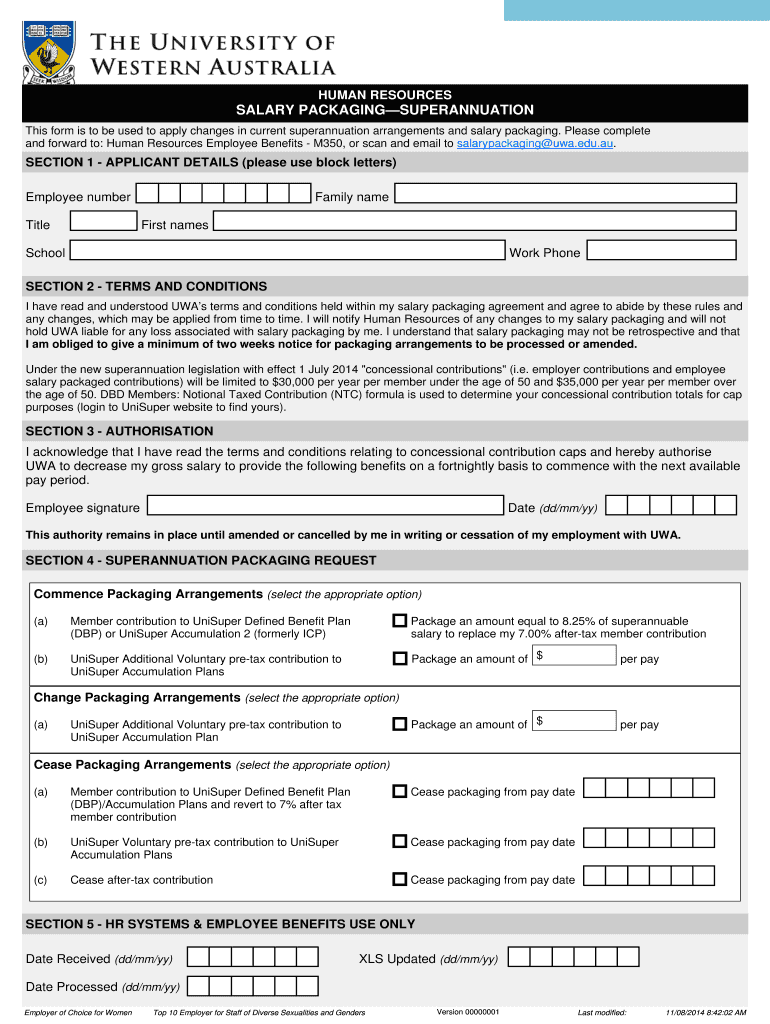

This form is to be used to apply changes in current superannuation arrangements and salary packaging at UWA.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary packagingsuperannuation - hr

Edit your salary packagingsuperannuation - hr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary packagingsuperannuation - hr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit salary packagingsuperannuation - hr online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit salary packagingsuperannuation - hr. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary packagingsuperannuation - hr

How to fill out Salary Packaging—Superannuation

01

Review your current salary and understand your total remuneration package.

02

Identify eligible expenses that can be included in your salary packaging arrangement.

03

Consult with your employer or salary packaging provider to understand the specific terms and conditions of the program.

04

Complete the necessary paperwork provided by your employer or salary packaging provider.

05

Provide documentation for eligible expenses, ensuring they meet the criteria for salary packaging.

06

Submit your salary packaging application for approval.

07

Monitor your salary packaging deductions on your payslip to ensure correctness.

Who needs Salary Packaging—Superannuation?

01

Employees looking to maximize their take-home pay.

02

Individuals in higher tax brackets who can benefit from tax savings.

03

Workers wanting to save for retirement or enhance their superannuation contributions.

04

Those seeking to access a wider range of benefits beyond their base salary.

Fill

form

: Try Risk Free

People Also Ask about

Is superannuation salary?

You might see this referred to as your salary 'plus super' or 'excluding super'. So, if your ordinary time earnings are $65,000 per year, your employer must contribute an extra $7,150 to your super as SG. If your salary package is inclusive of super, this can be described as your salary 'including super'.

What is the meaning of salary sacrifice contribution?

What is salary sacrificing? Salary sacrificing is also known as salary packaging or total remuneration packaging. You and your employer agree for you to receive less income before tax and in return your employer pays for certain benefits of similar value for you. This means you pay less tax on your income.

What is an example of salary sacrifice to super?

Example: Matt boosts his super and pays less tax Matt earns $65,000 before tax, excluding his employer's super guarantee contribution. If Matt decides to redirect $5,000 of his pay into salary sacrifice super contributions, he will save $925 in tax, with the extra money going into his super fund.

What happens if I put more than $25,000 into super?

Any contributions you make over the cap will be taxed at your marginal rate, less a 15% tax rebate. You may also be charged interest. At the end of the financial year, the ATO will give you the option to: withdraw up to 85% of your excess contributions for the financial year.

What is salary sacrifice for Supa?

Salary sacrifice at a glance Your employer redirects a portion of your before-tax salary to your super account. Before-tax contributions can help you to pay less tax on your take home pay. Salary sacrifice will count toward your before-tax contribution cap. Salary sacrifice is easy to set up by notifying your employer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Salary Packaging—Superannuation?

Salary Packaging—Superannuation is a financial arrangement where an employee agrees to forgo a portion of their pre-tax salary in exchange for an employer contribution to their superannuation fund. This can lead to tax benefits for the employee.

Who is required to file Salary Packaging—Superannuation?

Employees participating in salary packaging who wish to make superannuation contributions as part of their employment agreement are required to file Salary Packaging—Superannuation paperwork.

How to fill out Salary Packaging—Superannuation?

To fill out Salary Packaging—Superannuation, the employee needs to provide their personal details, specify the amount of salary to be packaged, select the superannuation fund, and sign the agreement. It may also require the signature of an authorized representative from the employer.

What is the purpose of Salary Packaging—Superannuation?

The purpose of Salary Packaging—Superannuation is to enable employees to maximize their retirement savings in a tax-effective manner while providing flexibility in their compensation structure.

What information must be reported on Salary Packaging—Superannuation?

The information that must be reported includes the employee's details, the agreed packaged salary amount, details of the chosen superannuation fund, contribution frequency, and signatures from both the employee and employer.

Fill out your salary packagingsuperannuation - hr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Packagingsuperannuation - Hr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.