Get the free NFE - 151115 - Paris horror V3 - ESL Teachers Board

Show details

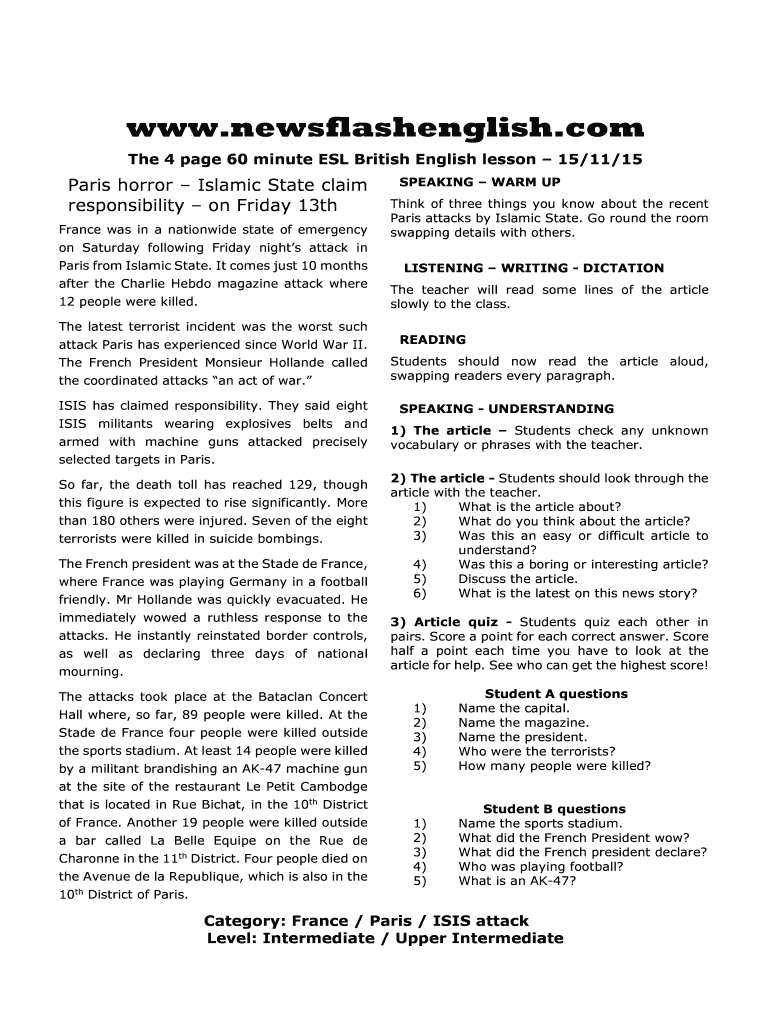

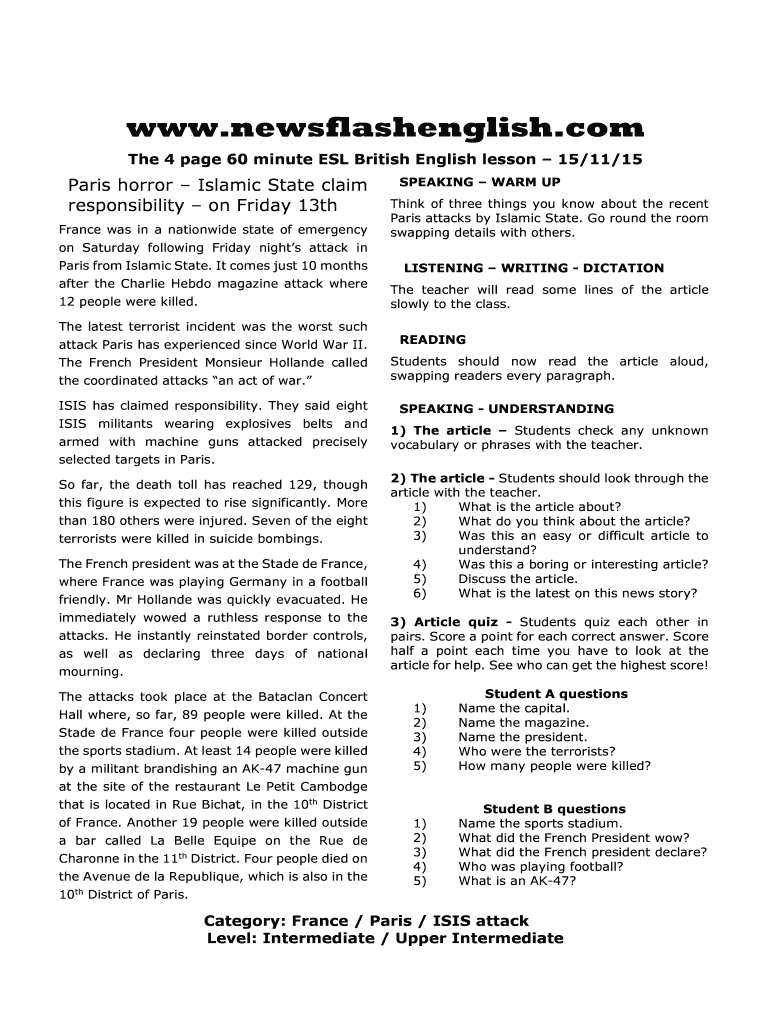

WWW.newsflashenglish.com The 4 page 60 minute ESL British English lesson 15/11/15 Paris horror Islamic State claim responsibility on Friday 13th France was in a nationwide state of emergency SPEAKING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nfe - 151115

Edit your nfe - 151115 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nfe - 151115 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nfe - 151115 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nfe - 151115. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nfe - 151115

How to fill out NFE - 151115:

01

Start by gathering all the necessary information. You will need the buyer's details such as name, address, and tax identification number (CPF or CNPJ), as well as the seller's information.

02

Identify the products or services being sold and ensure you have accurate descriptions and quantities. It is important to include the individual price and total amount for each item.

03

Calculate the taxes involved, such as ICMS, PIS, COFINS, and IPI. Each tax should be properly identified and calculated based on the applicable rates.

04

Include any additional discounts or charges related to the transaction if applicable. These may include freight costs or payment discounts.

05

Verify that the NFE - 151115 format is the correct one required by the tax authority. This includes checking the layout and fields required.

06

Input all the gathered information into the NFE - 151115 form. This can be done using an electronic invoicing system or manually.

Who needs NFE - 151115?

01

Companies or individuals who are selling goods or providing services in Brazil are required by law to issue NFE - 151115. It is necessary for tax compliance and documentation purposes.

02

NFE - 151115 is particularly relevant for businesses engaged in commercial activities. It ensures transparency and accuracy in the billing process, facilitating tax collection and minimizing tax fraud.

03

It is important for both buyers and sellers to keep a copy of the NFE - 151115 for record-keeping purposes. Buyers may use it to claim tax credits or deductions, while sellers can use it as proof of sale and for accounting purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit nfe - 151115 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including nfe - 151115, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I complete nfe - 151115 online?

Easy online nfe - 151115 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete nfe - 151115 on an Android device?

Use the pdfFiller Android app to finish your nfe - 151115 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is nfe - 151115?

NFE-151115 refers to a specific form or document for reporting financial information to tax authorities.

Who is required to file nfe - 151115?

Entities or individuals with financial activities that fall under the reporting requirements set by tax authorities.

How to fill out nfe - 151115?

NFE-151115 can usually be filled out electronically through a designated platform or software provided by tax authorities.

What is the purpose of nfe - 151115?

The purpose of NFE-151115 is to ensure transparency and accuracy in financial reporting for tax compliance.

What information must be reported on nfe - 151115?

Information such as income, expenses, assets, liabilities, and other financial details relevant to taxation must be reported on NFE-151115.

Fill out your nfe - 151115 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nfe - 151115 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.