Get the free DOCUMENTATION REQUIRED FOR LOAN APPLICATION

Show details

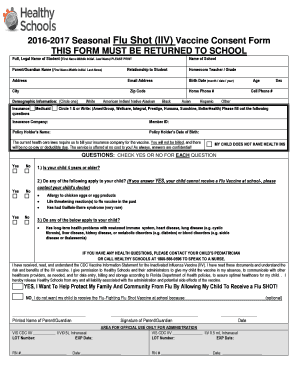

DOCUMENTATION REQUIRED FOR LOAN APPLICATION 1) Current first mortgage statement (If you do not receive statements from your first mortgage company, please send a copy of your current payment coupon

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign documentation required for loan

Edit your documentation required for loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your documentation required for loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit documentation required for loan online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit documentation required for loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out documentation required for loan

Who needs documentation required for loan?

01

Individuals applying for a loan from a financial institution.

02

Businesses seeking to secure a loan for their operations or investments.

03

Mortgage applicants looking to purchase a property or refinance their existing mortgage.

How to fill out documentation required for loan?

01

Gather personal identification documents such as a valid passport, driver's license, or national ID card. Financial institutions need these documents to confirm your identity and ensure you meet their eligibility criteria.

02

Provide proof of income, including recent pay stubs, tax returns, and bank statements. Lenders need this information to assess your ability to repay the loan. If you are self-employed or a business owner, you may need to submit additional documents such as profit and loss statements or business financial statements.

03

Prepare details about your employment history, including names of employers, job titles, and durations of employment. Lenders use this information to evaluate your stability and assess the likelihood of you maintaining a consistent income stream.

04

Outline your assets and liabilities. This includes information about your bank accounts, investments, real estate properties, outstanding debts, and any other valuable assets. Providing this information helps lenders in determining your overall financial position and ability to repay the loan.

05

Compile documentation related to the loan purpose. For example, if you are applying for a mortgage, you will need to provide property details, purchase agreements, and property valuation reports. In the case of a business loan, you may need to submit business plans, financial projections, and details about the intended use of funds.

06

If applicable, provide additional documentation such as divorce decrees, child support orders, or bankruptcy records. These documents may be necessary to assess your financial situation accurately.

07

Carefully review all documentation requirements provided by the lender. Ensure that all information is accurate, up-to-date, and properly organized. Mistakes or missing information can lead to delays or even denial of the loan application.

08

Submit the completed documentation to the relevant financial institution according to their prescribed method. This could involve physically visiting a branch, uploading documents through an online portal, or sending them via mail.

09

Keep copies of all submitted documents for your records. This will be useful for future reference and to resolve any potential discrepancies during the loan application process.

10

Maintain open communication with the lender throughout the application process. They may request additional documentation or clarification on certain aspects. Respond promptly and provide any requested information to expedite the loan approval process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is documentation required for loan?

Documentation required for a loan typically includes proof of income, identification documents, credit history, and other financial records.

Who is required to file documentation required for loan?

Individuals or businesses applying for a loan are required to file the necessary documentation.

How to fill out documentation required for loan?

Documentation for a loan can typically be filled out online or in person with the lender. It is important to provide accurate and complete information.

What is the purpose of documentation required for loan?

The purpose of documentation required for a loan is to verify the borrower's financial situation and creditworthiness, and to ensure that the loan can be repaid.

What information must be reported on documentation required for loan?

Information such as income verification, identification documents, credit history, and other financial records must be reported on documentation required for a loan.

Can I create an electronic signature for signing my documentation required for loan in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your documentation required for loan directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit documentation required for loan on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as documentation required for loan. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I complete documentation required for loan on an Android device?

Use the pdfFiller Android app to finish your documentation required for loan and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your documentation required for loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Documentation Required For Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.