Get the free Charitable Gift Substantiation Requirements

Show details

Este documento destaca los requisitos de la IRS para la justificación de deducciones por donaciones caritativas, incluyendo contribuciones en efectivo y no en efectivo, y las formas necesarias para

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable gift substantiation requirements

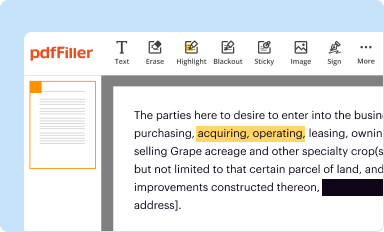

Edit your charitable gift substantiation requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

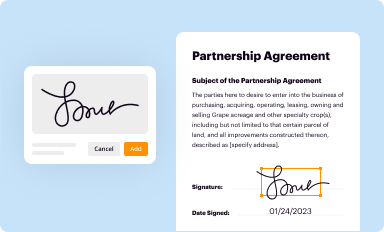

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

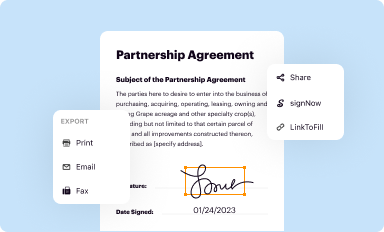

Share your form instantly

Email, fax, or share your charitable gift substantiation requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

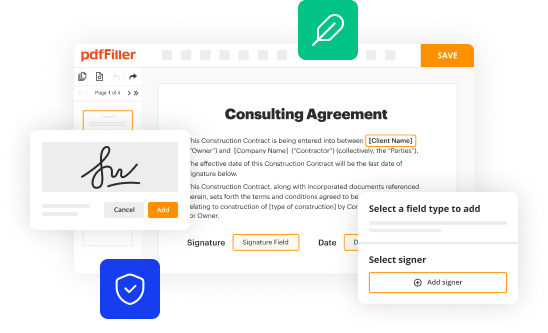

Editing charitable gift substantiation requirements online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit charitable gift substantiation requirements. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable gift substantiation requirements

How to fill out Charitable Gift Substantiation Requirements

01

Obtain a receipt from the charity that includes its name and address.

02

Ensure the receipt states the date of the contribution.

03

Specify the amount of cash contributed or describe the property donated.

04

If the contribution exceeds $250, ensure that the receipt includes a statement that no goods or services were provided in exchange for the donation, or describe any goods/services if provided.

05

Keep personal records of the donation, including bank statements or credit card charges as additional verification.

06

Complete and attach IRS Form 8283 if the total contribution for non-cash donations exceeds $500.

Who needs Charitable Gift Substantiation Requirements?

01

Individuals making charitable contributions of $250 or more.

02

Taxpayers itemizing deductions on federal income tax returns.

03

Organizations that receive charitable contributions need to provide substantiation for donors.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum amount you can claim for charitable donations?

For individual cash donations, the limit on tax deductions for charitable contributions to qualified charitable organizations is up to 60% of your adjusted gross income (AGI).

What is the maximum write-off allowed for charitable donations?

No matter how generously you gave to charities in 2024, you'll only be able to deduct up to 60% of your AGI if you gave in cash to standard public charities. For donations of appreciated assets, the maximum charitable deduction in 2024 is 30% of your AGI.

What is a qualified charitable gift?

A qualified charitable distribution (QCD) is a distribution of funds from your IRA (other than a SEP or SIMPLE IRA) directly to a qualified charitable organization, such as the American Red Cross.

What is section 170 C?

A charitable contribution is defined in IRC 170(c)(1) as a contribution or gift. to or for the use of a state, a possession of the United States, or any political. subdivision of any of the foregoing, or the United States or the District of. Columbia, made exclusively for public purposes, and in IRC 170(c)(2) as a.

What are qualifying charitable donations in the UK?

A QCD is a payment of money to a charity that does not fall to be treated as a 'distribution' in respect of shares or is not otherwise deductible as a trading expense (CTA 2010, s. 190(2) and 191). QCDs are made gross without deducting any basic rate tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Charitable Gift Substantiation Requirements?

Charitable Gift Substantiation Requirements refer to the documentation and information that donors must provide to substantiate their charitable contributions for tax deduction purposes, as mandated by the IRS.

Who is required to file Charitable Gift Substantiation Requirements?

Donors who make charitable contributions of $250 or more are required to obtain and keep substantiation documentation to support their claims for tax deductions.

How to fill out Charitable Gift Substantiation Requirements?

To fill out Charitable Gift Substantiation Requirements, donors should retain a written acknowledgment from the charity including the amount of the contribution, date, and whether any goods or services were received in exchange for the donation.

What is the purpose of Charitable Gift Substantiation Requirements?

The purpose of Charitable Gift Substantiation Requirements is to provide proof of charitable donations, ensuring that taxpayers can claim deductions while minimizing the risk of fraud.

What information must be reported on Charitable Gift Substantiation Requirements?

The information that must be reported includes the name of the charitable organization, the date of the contribution, the amount donated, and a statement regarding any goods or services received in return for the contribution.

Fill out your charitable gift substantiation requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Gift Substantiation Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.