Get the free Total Loss Coverage GAP Claim Request - Wildfire Aftermarket

Show details

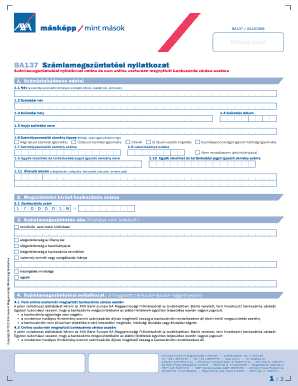

Total Loss Coverage GAP Claim Request Customer Information Name: Waiver #: Date of Loss: Address: Phone Number: Work Number: City: Email Address: Fax Number: State: Zip: Address: Phone Number: City:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign total loss coverage gap

Edit your total loss coverage gap form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your total loss coverage gap form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit total loss coverage gap online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit total loss coverage gap. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out total loss coverage gap

How to fill out total loss coverage gap:

01

Review your insurance policy: Start by carefully reading your insurance policy to understand the terms and coverage provided. Look for any mention of total loss coverage gap and familiarize yourself with the requirements and limitations.

02

Assess your current coverage: Determine if you already have coverage for total loss or if there is a gap that needs to be filled. This can usually be identified by checking the coverage limits for your vehicle's actual cash value (ACV). If the ACV is significantly lower than the cost to replace your vehicle, you may need total loss coverage gap.

03

Contact your insurance company: Reach out to your insurance provider and inform them about your need for total loss coverage gap. They will guide you through the process and provide any necessary forms or documents to complete.

04

Fill out the required forms: Complete any paperwork provided by your insurance company accurately and thoroughly. Make sure to provide all requested information, including details about your vehicle, its current market value, and any outstanding loan or lease obligations.

05

Provide supporting documentation: Along with the forms, you may need to provide supporting documentation such as vehicle appraisals, receipts, or loan/lease agreements. Verify with your insurance company what documents are needed to ensure a smooth and efficient process.

06

Submit the completed forms and documentation: Once you have filled out the required forms and gathered all necessary documentation, submit them to your insurance company. Follow any specific submission instructions provided by your insurer, such as mailing, faxing, or uploading the forms online.

Who needs total loss coverage gap:

01

Vehicle owners with significant loan or lease obligations: If you have a vehicle that is financed or leased, you may benefit from total loss coverage gap. It can help cover any outstanding loan or lease amount that exceeds the actual cash value of your vehicle in case of total loss.

02

Owners of vehicles with high depreciation rates: Some vehicles tend to depreciate rapidly, meaning their actual cash value decreases faster than average. If you own a vehicle that falls into this category, having total loss coverage gap can offer financial protection in the event of a total loss.

03

Individuals seeking peace of mind: Even if you don't have a loan or lease obligation or own a vehicle with high depreciation, you may still opt for total loss coverage gap for added peace of mind. It can give you confidence knowing that you won't face financial difficulties if your vehicle is declared a total loss.

Remember, it is essential to consult with your insurance provider to fully understand the terms and conditions of total loss coverage gap and to determine if it is the right choice for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is total loss coverage gap?

Total loss coverage gap is the difference between the actual cash value of a vehicle and the amount owed on the loan or lease.

Who is required to file total loss coverage gap?

Insurance companies and financial institutions are required to file total loss coverage gap.

How to fill out total loss coverage gap?

Total loss coverage gap can be filled out by providing information on the vehicle, the loan or lease amount, and the insurance coverage.

What is the purpose of total loss coverage gap?

The purpose of total loss coverage gap is to ensure that the vehicle is adequately insured in the event of a total loss.

What information must be reported on total loss coverage gap?

Information such as the vehicle's make, model, year, VIN, loan or lease amount, insurance coverage details, and total loss coverage gap amount must be reported.

How can I manage my total loss coverage gap directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your total loss coverage gap and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete total loss coverage gap online?

Completing and signing total loss coverage gap online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the total loss coverage gap in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your total loss coverage gap and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your total loss coverage gap online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Total Loss Coverage Gap is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.