Get the free Affidavit for wage deduction order2-10pmd

Show details

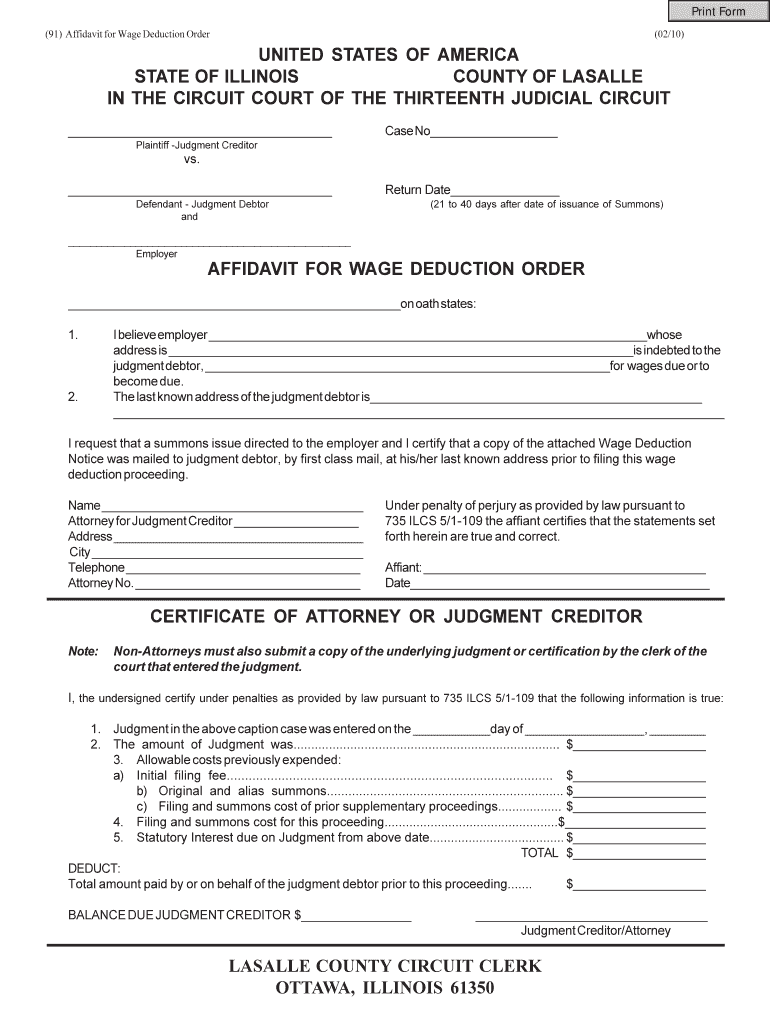

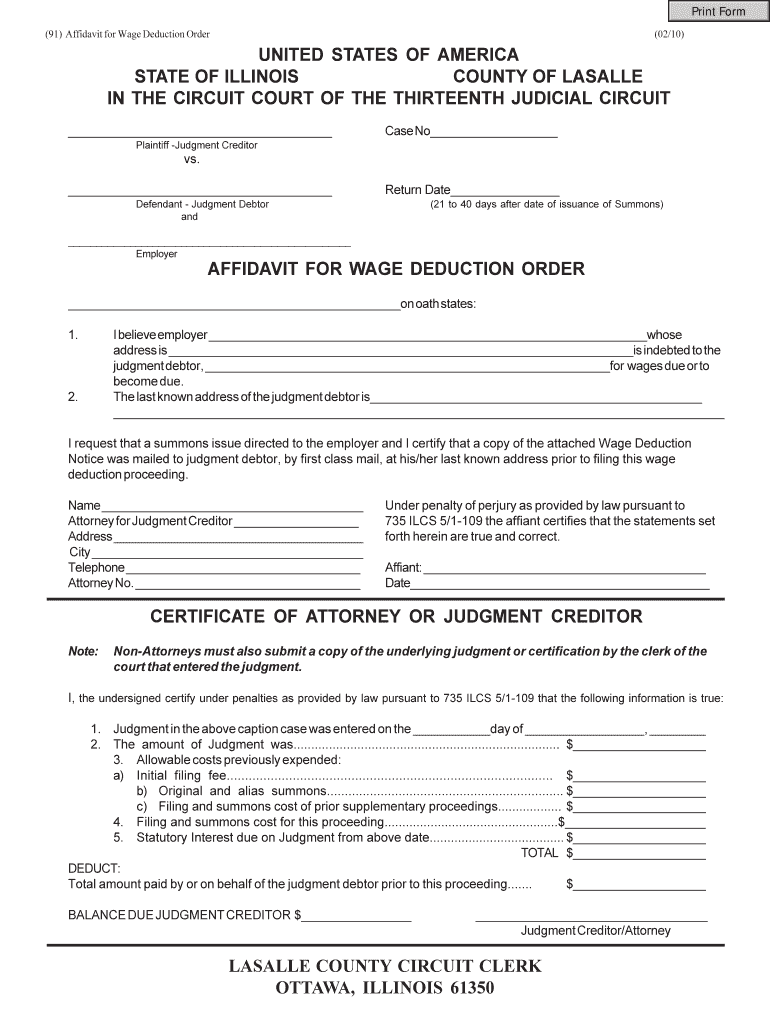

Print Form (91) Affidavit for Wage Deduction Order (02/10) UNITED STATES OF AMERICA STATE OF ILLINOIS COUNTY OF BASALLY IN THE CIRCUIT COURT OF THE THIRTEENTH JUDICIAL CIRCUIT Case No Plaintiff Judgment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign affidavit for wage deduction

Edit your affidavit for wage deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your affidavit for wage deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit affidavit for wage deduction online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit affidavit for wage deduction. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out affidavit for wage deduction

How to fill out an affidavit for wage deduction:

01

Start by gathering all the necessary information such as your name, contact details, and employment information. This includes your employer's name, address, and contact information.

02

Clearly state the purpose of the affidavit, which is to authorize your employer to deduct a certain portion of your wages for a specified reason. For example, if you have outstanding debt or if the deduction is required by law.

03

Provide a detailed explanation of the reason for the wage deduction. This should include any relevant dates, amounts owed, or any specific agreements or contracts that pertain to the deduction.

04

Include any supporting documents or evidence that validate the need for the wage deduction. This could include copies of outstanding bills, legal orders, or any other relevant paperwork that backs up your claim.

05

Sign the affidavit in the presence of a notary public or authorized witness. This is important to ensure the document's authenticity and legal validity. Make sure to follow the specific instructions of your jurisdiction regarding notarization.

06

Keep a copy of the completed affidavit for your records. It is essential to have a personal copy of all legal documents, especially ones that involve financial matters.

Who needs an affidavit for wage deduction?

01

Employees who owe outstanding debts to their employer or have any other financial obligations that require a deduction from their wages may need to fill out an affidavit for wage deduction.

02

Individuals who are required by law to have a portion of their wages deducted, such as for child support, tax arrears, or court-ordered garnishments, may also be required to complete this type of affidavit.

03

Employers may request employees to complete an affidavit for wage deduction when there are valid reasons to deduct money from their wages. This is done to ensure legal compliance and transparency in the deduction process.

Remember, it is always advisable to consult with a legal professional or seek advice from your employer's human resources department if you have any doubts or concerns about filling out an affidavit for wage deduction. They can provide guidance specific to your situation and ensure that you properly complete this legal document.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in affidavit for wage deduction without leaving Chrome?

affidavit for wage deduction can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the affidavit for wage deduction form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign affidavit for wage deduction and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete affidavit for wage deduction on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your affidavit for wage deduction from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is affidavit for wage deduction?

An affidavit for wage deduction is a legal document that allows an employer to deduct a certain amount from an employee's wages.

Who is required to file affidavit for wage deduction?

Employers are required to file affidavit for wage deduction if they need to deduct wages from an employee's paycheck.

How to fill out affidavit for wage deduction?

To fill out affidavit for wage deduction, the employer must provide information about the employee, the reason for the wage deduction, and the amount to be deducted.

What is the purpose of affidavit for wage deduction?

The purpose of affidavit for wage deduction is to document and authorize the deduction of wages from an employee's paycheck.

What information must be reported on affidavit for wage deduction?

The information that must be reported on an affidavit for wage deduction includes the employee's name, the reason for the deduction, the amount to be deducted, and the dates of the deductions.

Fill out your affidavit for wage deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Affidavit For Wage Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.