Get the free Sole Proprietor Partner or Corporate Of cer Statement

Show details

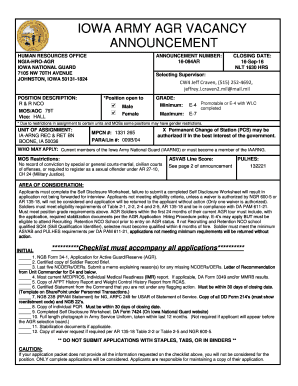

Sole Proprietor, Partner or

Corporate Offer Statement

Small Group requirements for proof of eligibility for owners/officers when no DE6

available or if not listed on DE6

I attest that while I am not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sole proprietor partner or

Edit your sole proprietor partner or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sole proprietor partner or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sole proprietor partner or online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sole proprietor partner or. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sole proprietor partner or

How to Fill Out Sole Proprietor Partner OR:

Gather Relevant Information:

Start by collecting all the necessary information needed to fill out the sole proprietor partner form. This may include personal details, business information, and tax identification numbers.

Choose the Right Form:

Identify the specific form required to fill out for sole proprietor partner or. Different jurisdictions may have different forms, so make sure to select the correct one that aligns with your location and business type.

Provide Personal Details:

Begin by entering your personal information, such as your full name, address, contact information, and social security number. Ensure that all the provided details are accurate and up to date.

Include Business Information:

Fill out the form by providing relevant details about your business, including its name, address, contact information, nature of the business, and any licenses or permits required. If there are multiple partners, provide their information as well.

Determine Partnership Structure:

Specify the partnership structure, whether it is a general partnership, limited partnership, or any other form of partnership. Include the names and roles of other partners involved in the business.

Identify Tax Obligations:

Indicate the tax obligations associated with the sole proprietor partner or situation. This may include information about reporting income, employment taxes, and any deductions or credits applicable to the partnership.

Review and Sign:

Before submitting the form, carefully review all the information provided. Make sure there are no errors or omissions. Once satisfied, sign the form, acknowledging the accuracy of the provided details.

Who Needs Sole Proprietor Partner OR?

Small Business Owners:

Small business owners who want to expand their operations or seek additional expertise often opt for forming a partnership. This allows them to collaborate with another individual or entity in managing and growing the business.

Entrepreneurs:

Entrepreneurs who have limited resources but wish to share the risks and responsibilities of running a business often choose sole proprietor partnership. By partnering with someone else, they can pool their skills, finances, and networks to achieve mutual growth and success.

Professionals offering Specialized Services:

Professionals like doctors, lawyers, accountants, or consultants who want to join forces and establish a joint practice can benefit from forming a sole proprietor partnership. By partnering with others in the same field, they can offer a wider range of services and attract more clients.

Real Estate Investors:

Real estate investors who wish to combine their resources to purchase and manage properties commonly form sole proprietor partnerships. This allows them to pool funds, share risks, and leverage each other's expertise in the real estate market.

Startups and Tech Companies:

Startups and tech companies often need strategic partners to support their growth and provide essential resources. By forming sole proprietor partnerships, they can access capital, expertise, and market connections to fuel their innovations and expand their reach.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sole proprietor partner or?

A sole proprietor partner is an individual who owns and operates a business by themselves.

Who is required to file sole proprietor partner or?

Any individual who operates a business as a sole proprietor is required to file a sole proprietor partner or form.

How to fill out sole proprietor partner or?

To fill out a sole proprietor partner or form, the individual must provide information about their business income, expenses, and deductions.

What is the purpose of sole proprietor partner or?

The purpose of a sole proprietor partner or form is to report the business income and expenses of a sole proprietorship for tax purposes.

What information must be reported on sole proprietor partner or?

Information such as business income, expenses, deductions, and any other relevant financial data must be reported on a sole proprietor partner or form.

How do I complete sole proprietor partner or online?

pdfFiller has made it easy to fill out and sign sole proprietor partner or. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit sole proprietor partner or on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing sole proprietor partner or right away.

How do I fill out the sole proprietor partner or form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign sole proprietor partner or and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your sole proprietor partner or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sole Proprietor Partner Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.