Get the free SPONSOR AND GIFT AID SAGA - filesdownesecurecouk

Show details

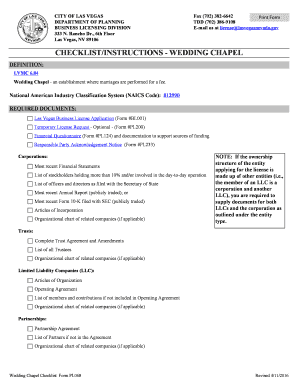

WWW.keswick2barrow.co.UK SPONSOR AND GIFT AID (SAGA) Forms Will walkers please preferably use K2Bs OLGA (Online Gift Aid) System if possible. Online or on paper, please ask sponsors: 1. To complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sponsor and gift aid

Edit your sponsor and gift aid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sponsor and gift aid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sponsor and gift aid online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sponsor and gift aid. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sponsor and gift aid

How to fill out sponsor and gift aid:

01

Start by obtaining the necessary forms: In order to fill out sponsor and gift aid, you will need to acquire the appropriate forms. These forms can usually be obtained from the organization or institution that is offering the sponsorship or gift aid.

02

Provide your personal information: The forms will typically require you to provide your personal information, including your full name, contact details, and address. Make sure to fill out this information accurately and legibly to avoid any delays or errors.

03

State the purpose of the sponsorship or gift aid: Clearly articulate the reason for seeking sponsorship or gift aid. Whether it is for educational purposes, medical expenses, or any other specific need, it is essential to provide a detailed explanation of why you require support.

04

Specify the amount requested: Indicate the specific amount of sponsorship or gift aid you are requesting. It is advisable to provide a clear and reasonable amount that aligns with your needs and financial situation.

05

Provide supporting documentation: Attach any necessary supporting documents that validate your request. This may include relevant financial statements, medical reports, or academic records, depending on the nature of the sponsorship or gift aid.

06

Complete the gift aid declaration: If the sponsorship or gift aid involves a charitable donation, you may be required to complete a gift aid declaration form. This declaration allows the organization to claim tax relief on the donation, which can significantly benefit both parties.

Who needs sponsor and gift aid:

01

Students and educational institutions: Sponsor and gift aid can be crucial for students who require financial assistance to pursue their education. It allows them to cover tuition fees, purchase study materials, or meet other educational expenses. Educational institutions may also seek sponsor and gift aid to support their programs or facilities.

02

Non-profit organizations: Charitable organizations and non-profit institutions often rely on sponsor and gift aid to fund their activities and support their specific causes. This financial contribution can help them provide essential services, carry out research, or organize events for the community.

03

Individuals with specific needs: Individuals who are facing financial difficulties due to medical expenses, disabilities, or unforeseen circumstances may require sponsor and gift aid. This assistance can help them cover medical bills, obtain necessary equipment or support, and improve their quality of life.

In conclusion, filling out sponsor and gift aid involves providing accurate personal information, explaining the purpose and amount of funding required, attaching supporting documentation, and completing any necessary declarations. Both students and educational institutions, non-profit organizations, and individuals with specific needs could benefit from sponsor and gift aid.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sponsor and gift aid?

Sponsor and gift aid is a scheme where donors can increase the value of their donations by allowing the charity to reclaim basic tax on the donation.

Who is required to file sponsor and gift aid?

Charities and individuals who make donations and want to have the value of their donation increased must file sponsor and gift aid.

How to fill out sponsor and gift aid?

To fill out sponsor and gift aid, donors must complete a declaration form confirming that they are a UK taxpayer and give permission for the charity to claim tax back on their donation.

What is the purpose of sponsor and gift aid?

The purpose of sponsor and gift aid is to encourage more donations to charities by providing an incentive for donors to give more.

What information must be reported on sponsor and gift aid?

Donors must provide their full name, address, and confirm their UK taxpayer status on the declaration form for sponsor and gift aid.

How can I send sponsor and gift aid to be eSigned by others?

Once you are ready to share your sponsor and gift aid, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get sponsor and gift aid?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the sponsor and gift aid in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit sponsor and gift aid on an iOS device?

Create, edit, and share sponsor and gift aid from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your sponsor and gift aid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sponsor And Gift Aid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.