Get the free Business Expenses - kayethetaxlady - Home -

Show details

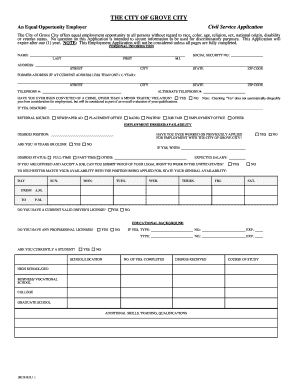

Business Expenses

The following is a list of areas to consider when submitting your business expenses to the IRS. Please list your totals for each category

below that applies to your business. If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business expenses - kayeformtaxlady

Edit your business expenses - kayeformtaxlady form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business expenses - kayeformtaxlady form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business expenses - kayeformtaxlady online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business expenses - kayeformtaxlady. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business expenses - kayeformtaxlady

How to fill out business expenses - kayeformtaxlady:

01

Gather all relevant receipts and records of your business expenses. This includes receipts for purchases, invoices, payment records, and any other documentation related to your business expenses.

02

Categorize your expenses. Group similar expenses together, such as office supplies, travel expenses, advertising costs, etc. This will make it easier to report and track your expenses.

03

Use a dedicated accounting software or spreadsheet to record your expenses. There are various tools available, such as QuickBooks or Excel, that can help you keep track of your business expenses efficiently.

04

Enter each expense into your accounting software or spreadsheet. Make sure to include details such as the date of the expense, amount, vendor, and a brief description of the expense. Accuracy and completeness are key here.

05

Reconcile your expenses with your bank statements or credit card statements. This helps ensure that all expenses are accounted for and accurately reflected in your financial records.

06

Keep a backup of all your expense records. It is important to maintain accurate records for tax purposes and potential audits. Consider keeping both physical and digital copies of your receipts and other supporting documentation.

Who needs business expenses - kayeformtaxlady:

01

Self-employed individuals: If you are a sole proprietor, freelancer, consultant, or any other form of self-employment, you need to keep track of your business expenses. Properly documenting and reporting your expenses can help reduce your taxable income and potentially save you money on taxes.

02

Small business owners: If you own a small business, regardless of its legal structure (e.g., LLC, partnership, corporation), you are responsible for accurately reporting your business expenses. This includes not only tracking expenses but also understanding the rules and regulations regarding what can be deducted.

03

Contractors and freelancers: If you work as a contractor or freelancer, you are typically responsible for your own business expenses. These can include things like supplies, equipment, travel expenses, and self-employment taxes. Tracking and reporting these expenses accurately can help you maximize deductions and minimize tax liability.

It is important to consult with a tax professional or accountant like kayeformtaxlady to ensure that you are correctly documenting and reporting your business expenses according to the specific tax laws and regulations in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business expenses - kayeformtaxlady to be eSigned by others?

Once you are ready to share your business expenses - kayeformtaxlady, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete business expenses - kayeformtaxlady online?

Completing and signing business expenses - kayeformtaxlady online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit business expenses - kayeformtaxlady on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share business expenses - kayeformtaxlady on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is business expenses - kayeformtaxlady?

Business expenses are the costs incurred in the operation of a business, such as rent, supplies, and utilities.

Who is required to file business expenses - kayeformtaxlady?

Anyone who operates a business and incurs expenses related to that business is required to file business expenses.

How to fill out business expenses - kayeformtaxlady?

To fill out business expenses, you will need to keep detailed records of all expenses incurred for the operation of your business, and report them accurately on your tax return.

What is the purpose of business expenses - kayeformtaxlady?

The purpose of business expenses is to accurately reflect the costs incurred in the operation of a business and to determine the taxable income of the business owner.

What information must be reported on business expenses - kayeformtaxlady?

When filing business expenses, you must report all expenses related to the operation of your business, including receipts, invoices, and documentation.

Fill out your business expenses - kayeformtaxlady online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Expenses - Kayeformtaxlady is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.