Get the free Form 13449 Rev 3-2011 Agreement to Assessment and Collection of Penalties Under 31 U...

Show details

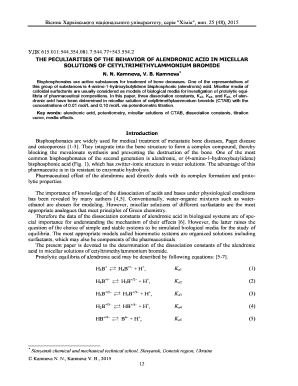

Form 13449 (Rev. March 2011) Name of Account Holder Department of the Treasury Internal Revenue Service Agreement to Assessment and Collection of Penalties Under 31 USC 5321(a)(5) and 5321(a)(6) Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 13449 rev 3-2011

Edit your form 13449 rev 3-2011 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 13449 rev 3-2011 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 13449 rev 3-2011 online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 13449 rev 3-2011. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 13449 rev 3-2011

How to fill out form 13449 rev 3-2011:

01

Start by entering your personal information in the designated fields. This includes your full name, social security number, address, and contact information.

02

Next, provide information about the tax period and tax form to which the form 13449 rev 3-2011 is applicable. Specify the type of tax involved and the tax year or period being referenced.

03

In section A, indicate the type of tax relief being sought by selecting the appropriate box. This could include innocent spouse relief, separation of liability relief, or equitable relief.

04

If you are seeking innocent spouse relief, complete section B by providing information about the joint return filed, the allegedly erroneous items, and your knowledge or involvement in the items.

05

For separation of liability relief, fill out section C by providing information about the applicable tax year, your marital status, and the allocation of the liability between you and your former spouse.

06

If you are requesting equitable relief, complete section D by providing reasons why it would be unfair to hold you liable for the outstanding tax, as well as any additional information supporting your claim.

07

Attach any necessary supporting documentation to substantiate your claim. This may include joint tax returns, financial records, divorce decrees, or other relevant documents.

08

Review and sign the form, certifying that all the information provided is true, correct, and complete to the best of your knowledge.

09

Finally, submit the completed form to the appropriate IRS office address as specified in the instructions provided with the form.

Who needs form 13449 rev 3-2011:

01

Individuals who have filed joint tax returns and believe they qualify for innocent spouse relief, separation of liability relief, or equitable relief.

02

Spouses who are seeking relief from being held jointly liable for outstanding tax liabilities.

03

Individuals who believe it would be unfair to hold them responsible for the tax liability incurred on a joint return.

04

Those who wish to provide additional information or assert their rights to relief under specific provisions of the Internal Revenue Code.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 13449 rev 3-2011 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 13449 rev 3-2011 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the form 13449 rev 3-2011 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your form 13449 rev 3-2011 in seconds.

How do I complete form 13449 rev 3-2011 on an Android device?

Complete form 13449 rev 3-2011 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your form 13449 rev 3-2011 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 13449 Rev 3-2011 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.