Get the free NOTFORPROFIT BUSINESS ENTITY - iola

Show details

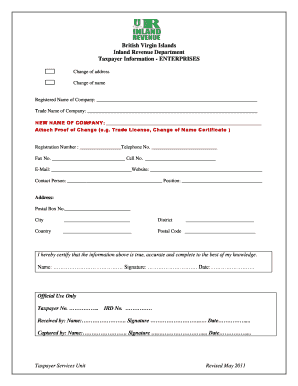

NEW YORK STATE VENDOR RESPONSIBILITY QUESTIONNAIRE NOTFORPROFIT BUSINESS ENTITY INFORMATION Legal Business Name EIN Address of the Principal Place of Business/Executive Office Phone Number Email Fax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notforprofit business entity

Edit your notforprofit business entity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notforprofit business entity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notforprofit business entity online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notforprofit business entity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notforprofit business entity

How to fill out not-for-profit business entity:

01

Research the requirements: Before filling out the not-for-profit business entity forms, it is important to understand the specific requirements for your jurisdiction. Research the laws and regulations that govern not-for-profit organizations in your area to ensure that you are following the correct procedures.

02

Choose a legal structure: Determine the appropriate legal structure for your not-for-profit organization. Common options include nonprofit corporations, charitable trusts, and unincorporated associations. Consult with an attorney or legal professional if you are unsure which structure is best for your organization.

03

Complete the necessary forms: Obtain the required forms for establishing a not-for-profit business entity. These forms can typically be obtained through the appropriate government agency or website. Fill out the forms accurately and provide all requested information, including the organization's name, purpose, board of directors, and any bylaws.

04

Pay the filing fees: In most cases, there will be fees associated with filing the not-for-profit business entity forms. Ensure that you have the necessary funds available to cover these costs. The fees can vary depending on your jurisdiction, so be sure to check the specific requirements.

05

Submit the forms: Once all the necessary information has been completed and the filing fees have been paid, submit the forms to the appropriate government agency. This can usually be done online or through mail. Be sure to follow the submission instructions provided and retain copies of all documents for your records.

06

Wait for approval: After submitting the forms, you will typically need to wait for approval from the government agency. This process can take several weeks or months, so it is important to be patient. Keep track of any communication or requests for additional information during this waiting period.

Who needs not-for-profit business entity?

01

Charitable organizations: Charities that operate for the benefit of the public and have a focus on social or community-based causes often need a not-for-profit business entity. This includes organizations such as food banks, educational foundations, and homeless shelters.

02

Religious institutions: Churches, synagogues, mosques, and other religious organizations often require a not-for-profit business entity to legally operate and fulfill their religious missions.

03

Art and cultural organizations: Museums, art galleries, theaters, and other cultural institutions that exist for the purpose of promoting and preserving art and culture typically need a not-for-profit business entity.

04

Social clubs and associations: Nonprofit social clubs, hobby groups, and community organizations often utilize not-for-profit business entities to facilitate their activities and provide a legal framework for their operations.

05

Educational institutions: Schools, colleges, and educational programs that are operated for the public benefit and not for profit typically require a not-for-profit business entity to fulfill legal and regulatory requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is notforprofit business entity?

A not-for-profit business entity is an organization that is formed for purposes other than making a profit.

Who is required to file notforprofit business entity?

Not-for-profit business entities are required to file with the appropriate government agencies, such as the IRS in the United States.

How to fill out notforprofit business entity?

To fill out a not-for-profit business entity, you will need to provide information about the organization's mission, activities, finances, and governance.

What is the purpose of notforprofit business entity?

The purpose of a not-for-profit business entity is to serve a specific social, educational, religious, or charitable purpose.

What information must be reported on notforprofit business entity?

Information that must be reported on a not-for-profit business entity includes financial statements, governance structure, and activities conducted.

How do I make edits in notforprofit business entity without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing notforprofit business entity and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete notforprofit business entity on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your notforprofit business entity, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out notforprofit business entity on an Android device?

On Android, use the pdfFiller mobile app to finish your notforprofit business entity. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your notforprofit business entity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notforprofit Business Entity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.