Get the free When a Loan Customer Dies 15 Issues You Should Consider - lba

Show details

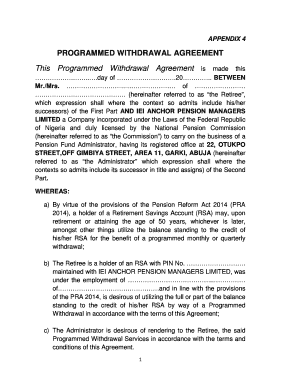

2013 WEBINAR TRAINING SERIES When a Loan Customer Dies: 15 Issues You Should Consider (Webinar) May 29, 2013 3:30pm5:00 pm As lenders, we work hard to make good underwriting decisions regarding a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign when a loan customer

Edit your when a loan customer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your when a loan customer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit when a loan customer online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit when a loan customer. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out when a loan customer

How to fill out when a loan customer?

01

Gather necessary documentation: Begin by gathering all the necessary documents required for the loan application. This typically includes proof of identity, such as a valid ID or passport, proof of income, such as payslips or tax returns, and proof of address, such as utility bills or rental agreements.

02

Understand the loan options: Before filling out the loan application, it's important to have a clear understanding of the different loan options available. Research and compare different lenders, interest rates, loan terms, and any additional fees or charges associated with the loan. This knowledge will help you make an informed decision and choose the loan that best suits your needs.

03

Complete the application form: Once you have gathered all the necessary documents and have a clear understanding of the loan options, you can proceed to fill out the loan application form. Make sure to provide accurate and honest information, as any discrepancies or false information could lead to a rejection of your application. Pay attention to details and fill out all the required fields.

04

Provide additional information: Depending on the loan type and lender's requirements, you may be asked to provide additional information or supporting documents. This could include bank statements, employment details, references, or any other information that helps verify your financial stability and creditworthiness. Ensure that you submit all the requested information promptly to avoid delays.

05

Review and double-check: Before submitting your loan application, take the time to review and double-check all the information provided. Ensure that there are no errors or missing details that could hinder the review process or delay approval. It's also a good idea to have someone else review your application to spot any mistakes or oversights.

06

Submit the application: Once you are confident that all the information is accurate and complete, submit the loan application to the lender. Follow their instructions regarding the submission process, whether it's online, in-person, or through mail. Keep a copy of the application for your records.

Who needs when a loan customer?

01

Individuals seeking financial assistance: Anyone who is in need of financial assistance, whether it's for personal reasons, business purposes, or any other valid reason, may need to fill out a loan application. People who require a loan to purchase a home, a vehicle, pay for education, or cover unexpected expenses would fall under this category.

02

Entrepreneurs and business owners: Business owners and entrepreneurs often require loans to start or expand their businesses. They may need to fill out loan applications to seek funding for equipment purchases, inventory, working capital, or other business-related expenses.

03

Individuals with low credit scores: People with low credit scores or a limited credit history may find it challenging to secure a loan. Consequently, they may need to put additional effort into filling out loan applications accurately and providing additional documentation to address any doubts or concerns lenders may have.

In summary, filling out a loan application requires careful attention to detail, understanding loan options, providing necessary documentation, and submitting the application accurately. Any individual in need of financial assistance or entrepreneurs seeking funding for their business ventures may need to go through the process of filling out a loan application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is when a loan customer?

When a loan customer is an individual or entity who has borrowed money from a lender.

Who is required to file when a loan customer?

The borrower who has taken out the loan is required to file when a loan customer.

How to fill out when a loan customer?

To fill out when a loan customer, the borrower must provide information about the loan amount, interest rate, repayment terms, and any other relevant details.

What is the purpose of when a loan customer?

The purpose of when a loan customer is to report to the lender the status of the loan, including any changes or updates that may affect the repayment.

What information must be reported on when a loan customer?

The borrower must report information such as loan amount, interest rate, repayment schedule, any defaults or changes in repayment terms.

How do I fill out the when a loan customer form on my smartphone?

Use the pdfFiller mobile app to complete and sign when a loan customer on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out when a loan customer on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your when a loan customer from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

How do I complete when a loan customer on an Android device?

Use the pdfFiller app for Android to finish your when a loan customer. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your when a loan customer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

When A Loan Customer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.