Get the free Receipt Log for RCSBSFSS Worker Expenditures

Show details

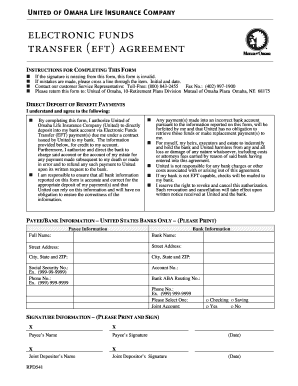

Receipt Log for RC/SBS/FSS Worker Expenditures HUBS Waiver Program Month/Year: Identified (Waiver) Child: Worker Name: ICC Name: Siblings names (if flex used on them) Date Of Service Receipt Number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign receipt log for rcsbsfss

Edit your receipt log for rcsbsfss form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your receipt log for rcsbsfss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit receipt log for rcsbsfss online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit receipt log for rcsbsfss. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out receipt log for rcsbsfss

How to fill out receipt log for rcsbsfss:

01

Gather all receipts: Start by collecting all the receipts related to the transactions made for rcsbsfss. This includes receipts from purchases, expenses, or any other financial activities.

02

Organize the receipts: Sort the receipts in chronological order or categorize them based on different types of expenses. This will make it easier to track and locate specific receipts when needed.

03

Record important details: Create a log or spreadsheet to record important information from each receipt. This may include the date of the transaction, the vendor's name, the amount spent, the purpose of the expense, and any other relevant details.

04

Keep track of receipts' status: As you enter the information into the log, mark each receipt to indicate whether it has been recorded or not. This will help avoid duplication or missing receipts while filling out the log.

05

Review and cross-reference: Regularly review the receipts log to ensure accuracy and completeness. Cross-referencing it with your bank statements or financial records can help identify any discrepancies or missing entries.

Who needs receipt log for rcsbsfss:

01

Business owners: Keeping a receipt log is essential for business owners who need to track and manage their financial transactions. It helps with budgeting, expense tracking, and tax filing processes.

02

Accountants or bookkeepers: Accountants or bookkeepers responsible for managing the financial records of rcsbsfss will require the receipt log to ensure accurate bookkeeping and prepare financial statements.

03

Auditors or tax authorities: Receipt logs are often requested by auditors or tax authorities during audits or tax investigations. Having a well-maintained log can provide evidence and support the legitimacy of the expenses claimed by rcsbsfss.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send receipt log for rcsbsfss to be eSigned by others?

Once you are ready to share your receipt log for rcsbsfss, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in receipt log for rcsbsfss?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your receipt log for rcsbsfss to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I complete receipt log for rcsbsfss on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your receipt log for rcsbsfss, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is receipt log for rcsbsfss?

The receipt log for rcsbsfss is a document used to track and record all incoming receipts for a specific purpose or project.

Who is required to file receipt log for rcsbsfss?

Any individual or organization handling receipts for rcsbsfss is required to file a receipt log.

How to fill out receipt log for rcsbsfss?

The receipt log for rcsbsfss can be filled out by documenting the date, amount, source, and purpose of each receipt received.

What is the purpose of receipt log for rcsbsfss?

The purpose of the receipt log for rcsbsfss is to maintain accurate records of all incoming receipts to ensure transparency and accountability.

What information must be reported on receipt log for rcsbsfss?

The receipt log for rcsbsfss must include details such as date of receipt, amount received, source of receipt, and purpose of the funds.

Fill out your receipt log for rcsbsfss online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Receipt Log For Rcsbsfss is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.