Get the free Casualty Losses - beaocorgb

Show details

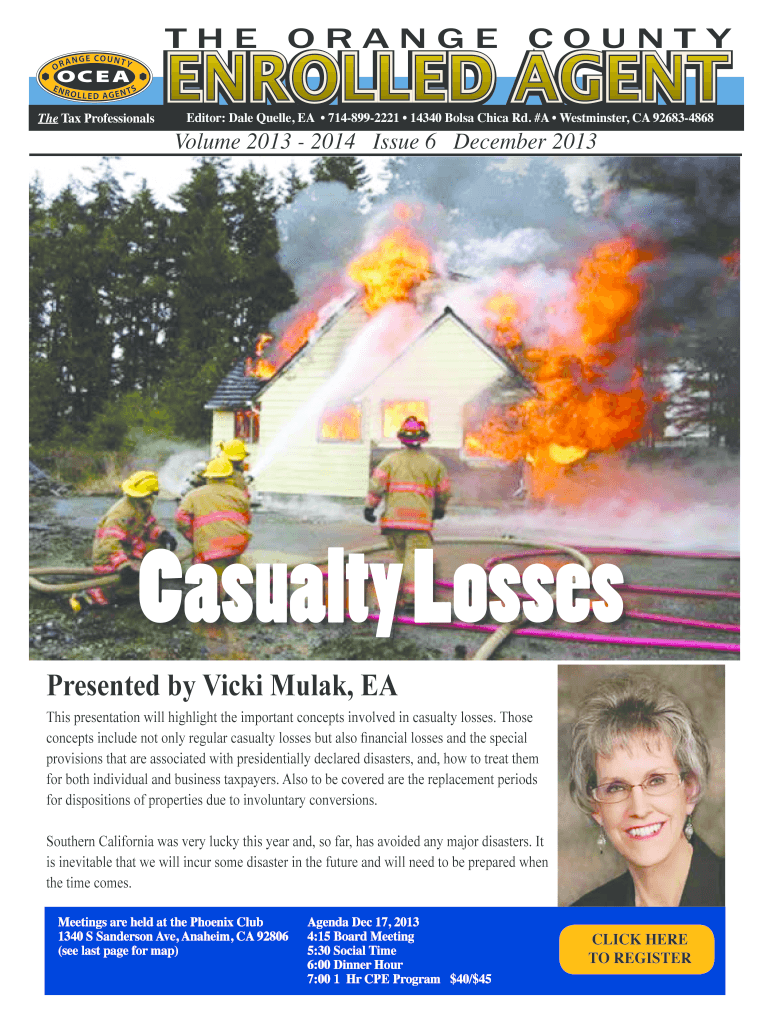

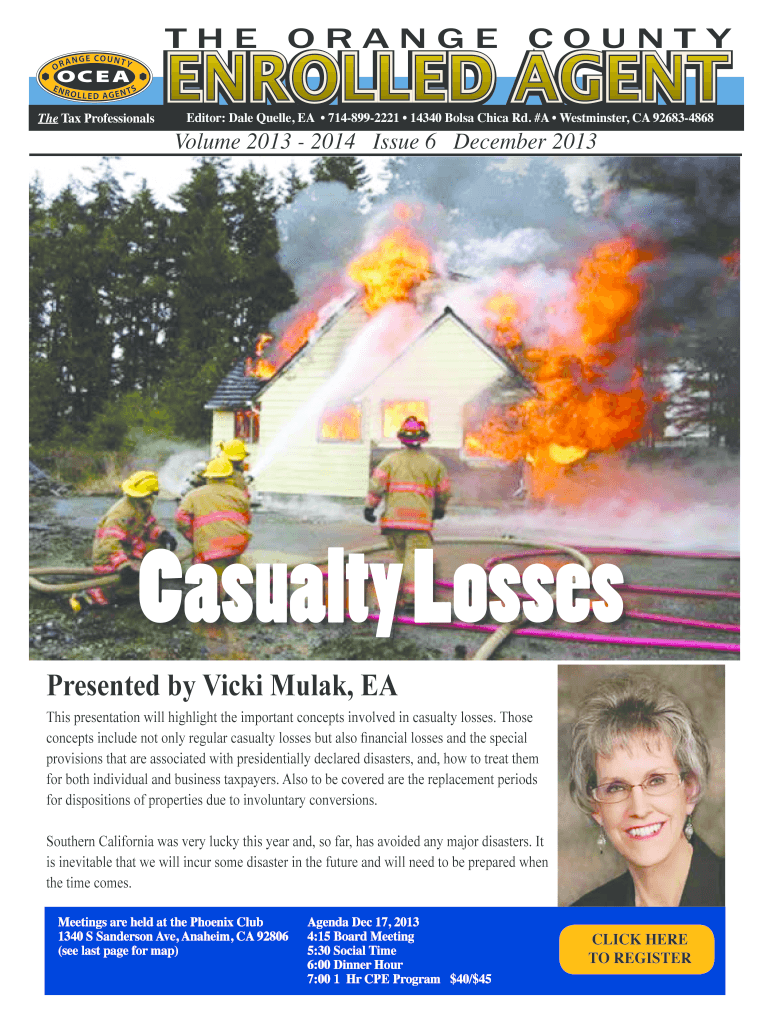

The Tax Professionals Editor: Dale Quell, EA 7148992221 14340 Balsa Chica Rd. #A Westminster, CA 926834868 Volume 2013 2014 Issue 6 December 2013 Casualty Losses Presented by Vicki Muzak, EA This

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign casualty losses - beaocorgb

Edit your casualty losses - beaocorgb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your casualty losses - beaocorgb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing casualty losses - beaocorgb online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit casualty losses - beaocorgb. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out casualty losses - beaocorgb

How to fill out casualty losses - beaocorgb?

01

Start by gathering all relevant information and documentation related to the casualty loss. This includes any records of the event causing the loss, such as photos, videos, or police reports, as well as any documentation of the value of the damaged or destroyed property.

02

Use Form 4684, Casualties and Thefts, to report the casualty loss on your federal tax return. This form requires you to provide details of the casualty event, including the date it occurred, a description of the property affected, and the fair market value before and after the loss.

03

Calculate the amount of the casualty loss by subtracting any insurance reimbursements or other reimbursements received from the decrease in fair market value of the property. This will give you the allowable casualty loss amount that you can claim on your tax return.

04

Determine whether you qualify for any special provisions or limitations. For example, if the casualty loss was the result of a federally declared disaster, you may be eligible for additional tax benefits. Consult IRS Publication 547, Casualties, Disasters, and Thefts, or speak with a tax professional for guidance on any specific circumstances that may apply to you.

Who needs casualty losses - beaocorgb?

01

Individuals who have experienced a casualty loss due to a sudden, unexpected, or unusual event may need to file casualty losses - beaocorgb. This includes situations such as damage or destruction of property due to fire, flood, theft, vandalism, or natural disasters.

02

Businesses that have suffered a casualty loss to their property or assets may also need to file casualty losses - beaocorgb. This could include damage to buildings, equipment, inventory, or other essential business assets.

03

Taxpayers who are insured but have unreimbursed losses beyond their insurance coverage may need to report and claim these casualty losses - beaocorgb. It is important to consult with a tax professional or refer to IRS guidelines to determine the eligibility and requirements for claiming casualty losses on your tax return.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my casualty losses - beaocorgb directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your casualty losses - beaocorgb and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I execute casualty losses - beaocorgb online?

pdfFiller makes it easy to finish and sign casualty losses - beaocorgb online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit casualty losses - beaocorgb on an iOS device?

You certainly can. You can quickly edit, distribute, and sign casualty losses - beaocorgb on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is casualty losses - beaocorgb?

Casualty losses refer to the financial losses incurred due to damage or destruction of property resulting from unexpected and sudden events such as natural disasters or accidents.

Who is required to file casualty losses - beaocorgb?

Individuals or businesses who have experienced casualty losses and are seeking to claim a deduction on their taxes are required to file casualty losses.

How to fill out casualty losses - beaocorgb?

To fill out casualty losses, individuals or businesses need to gather documentation of the losses incurred, report the losses on their tax return, and provide any other required supporting information.

What is the purpose of casualty losses - beaocorgb?

The purpose of casualty losses is to provide tax relief to individuals or businesses who have suffered financial losses due to unforeseen events beyond their control.

What information must be reported on casualty losses - beaocorgb?

On casualty losses reports, individuals or businesses must provide details on the type of loss, the amount of loss incurred, the date of the casualty event, and any insurance reimbursements received.

Fill out your casualty losses - beaocorgb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Casualty Losses - Beaocorgb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.