Get the free Bankruptcy or personal insolvency agreement - ASIC

Show details

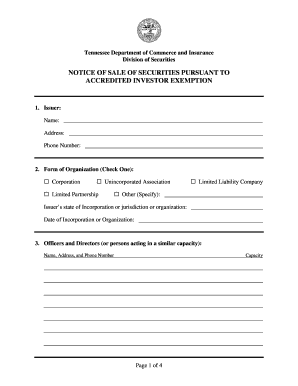

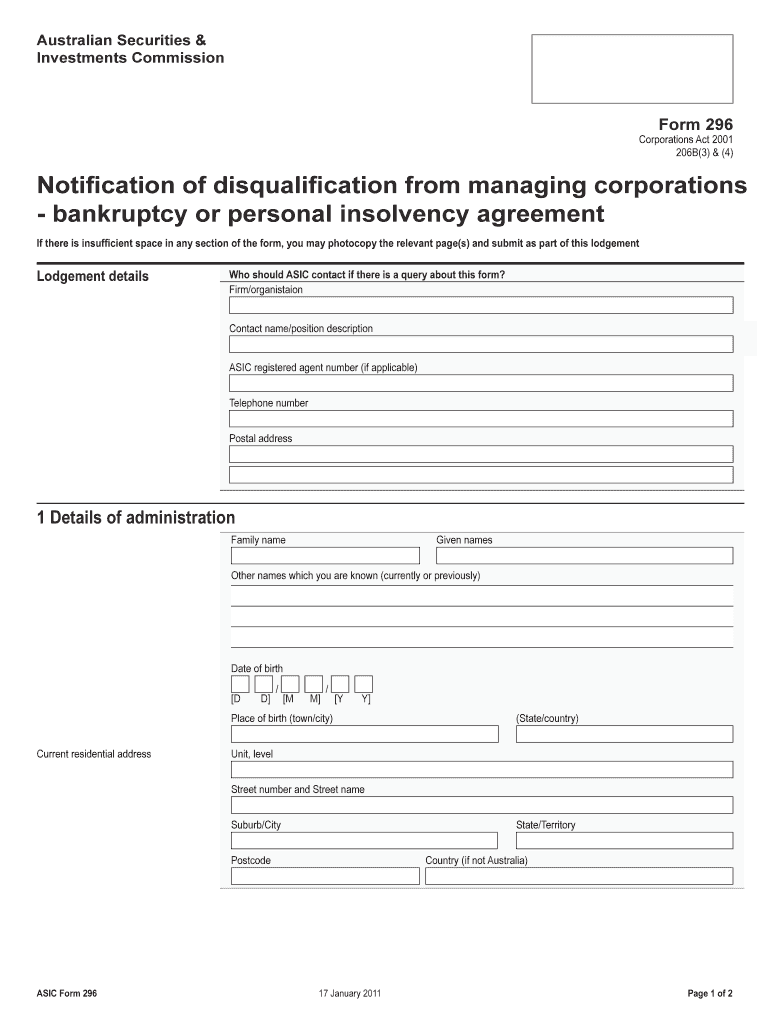

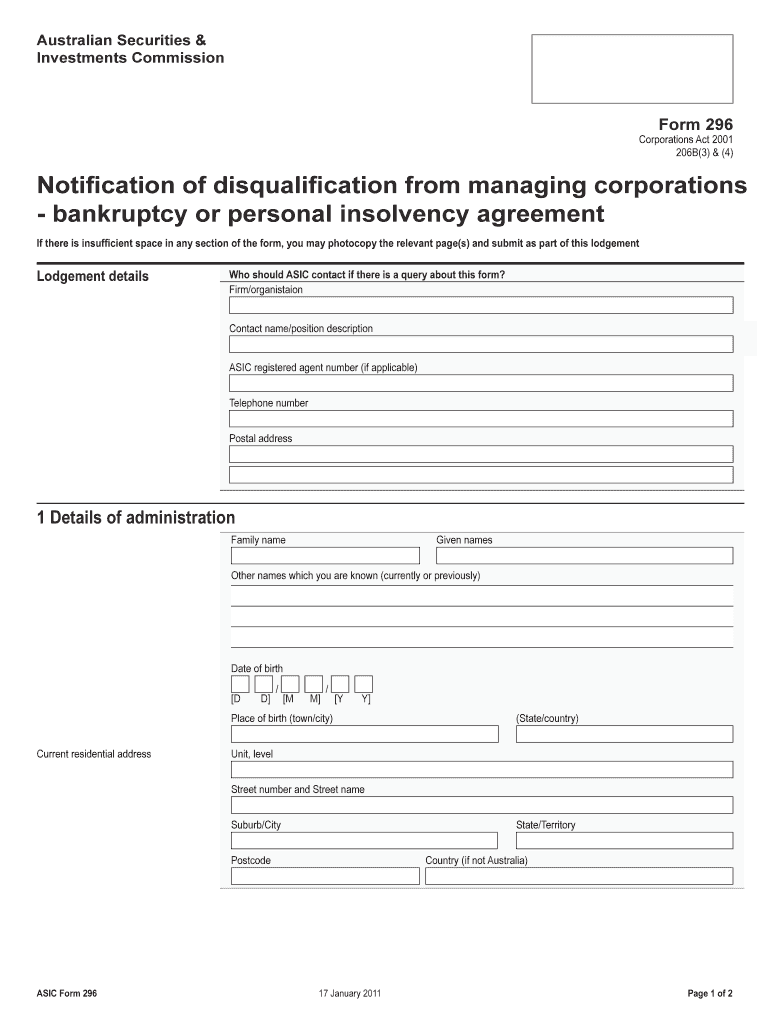

Australian Securities & Investments Commission Form 296 Corporations Act 2001 206B(3) & (4) Notification of disqualification from managing corporations bankruptcy or personal insolvency agreement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bankruptcy or personal insolvency

Edit your bankruptcy or personal insolvency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bankruptcy or personal insolvency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bankruptcy or personal insolvency online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bankruptcy or personal insolvency. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bankruptcy or personal insolvency

How to fill out bankruptcy or personal insolvency:

01

Gather all necessary financial documents: Start by organizing all your financial information, including bank statements, tax returns, loan agreements, and any other relevant documents.

02

Determine which bankruptcy or insolvency process to proceed with: There are different types of bankruptcy and insolvency processes, such as Chapter 7 liquidation, Chapter 13 debt repayment plan, or personal insolvency arrangements. Consult a legal professional or financial advisor to determine the most suitable process for your situation.

03

Complete the necessary forms and paperwork: Each bankruptcy or insolvency process requires specific forms and paperwork to be completed. These forms typically ask for information about your assets, debts, income, and expenses. Ensure that you provide accurate and complete information.

04

Submit your forms to the appropriate authority: Once you have completed the necessary forms, submit them to the relevant authority overseeing bankruptcies or insolvencies in your jurisdiction. This could be a court, a government agency, or a licensed insolvency practitioner.

05

Attend mandatory meetings and counseling sessions: Depending on the bankruptcy or insolvency process you choose, you may be required to attend meetings with creditors or participate in credit counseling sessions. Make sure to adhere to all requirements and provide any requested information.

Who needs bankruptcy or personal insolvency:

01

Individuals with overwhelming debt: Bankruptcy or personal insolvency may be necessary for individuals who are unable to repay their debts and have no other viable options for financial recovery.

02

Businesses facing insurmountable financial issues: Companies that are unable to meet their financial obligations, pay creditors, or sustain their operations may need to consider bankruptcy or insolvency as a last resort.

03

Individuals or businesses seeking debt relief and restructuring: Bankruptcy or insolvency can provide individuals and businesses with an opportunity to restructure their debts, negotiate payment plans with creditors, and potentially obtain debt relief.

04

Individuals or businesses facing legal action from creditors: If you are being sued by creditors or facing significant legal consequences due to your financial situation, bankruptcy or insolvency could help halt legal proceedings and provide a path towards resolution.

It is essential to consult with a qualified legal professional or financial advisor to understand the specific laws, processes, and implications related to bankruptcy or personal insolvency in your jurisdiction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send bankruptcy or personal insolvency for eSignature?

When you're ready to share your bankruptcy or personal insolvency, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit bankruptcy or personal insolvency in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your bankruptcy or personal insolvency, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out bankruptcy or personal insolvency using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign bankruptcy or personal insolvency and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is bankruptcy or personal insolvency?

Bankruptcy, also known as personal insolvency, is a legal process that helps individuals who cannot pay their debts to eliminate or repay their debt under the protection of the bankruptcy court.

Who is required to file bankruptcy or personal insolvency?

Individuals who are unable to repay their debts and are facing financial difficulties may file for bankruptcy or personal insolvency.

How to fill out bankruptcy or personal insolvency?

To file for bankruptcy or personal insolvency, individuals must complete a petition with the bankruptcy court, provide a list of their assets and liabilities, and attend a meeting with creditors.

What is the purpose of bankruptcy or personal insolvency?

The purpose of bankruptcy or personal insolvency is to provide individuals with a fresh start by restructuring or eliminating their debts and protecting them from creditors' collection actions.

What information must be reported on bankruptcy or personal insolvency?

Individuals filing for bankruptcy or personal insolvency must provide information about their assets, liabilities, income, expenses, and any recent financial transactions.

Fill out your bankruptcy or personal insolvency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bankruptcy Or Personal Insolvency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.