Get the free Private Placement Offer Document

Show details

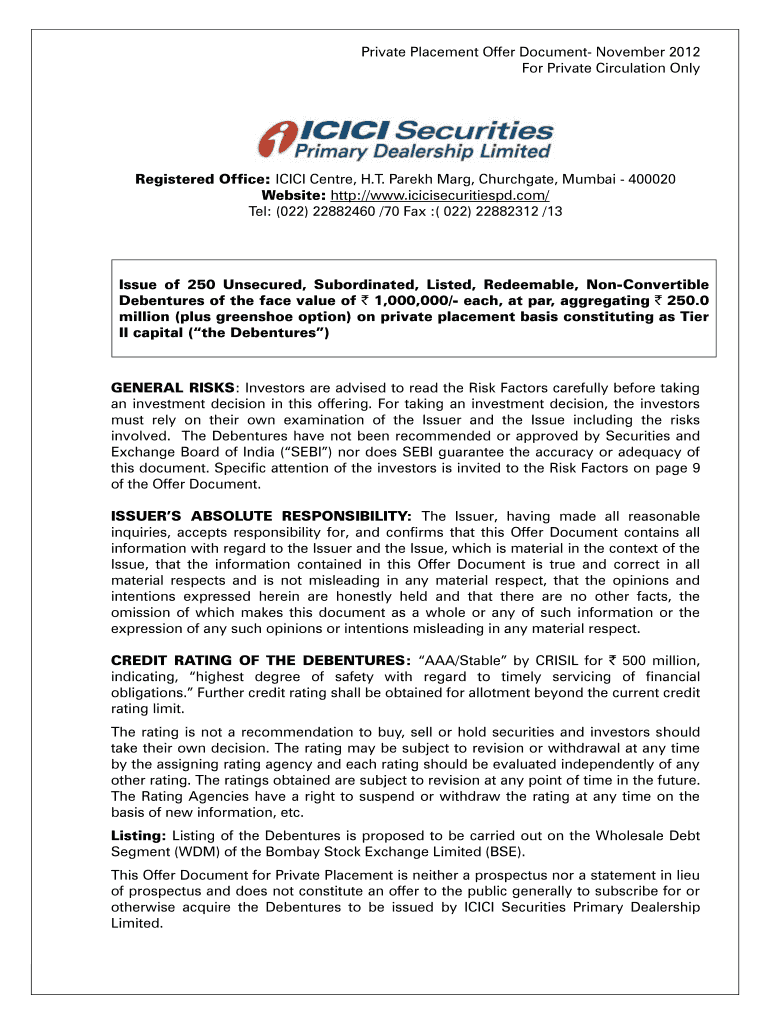

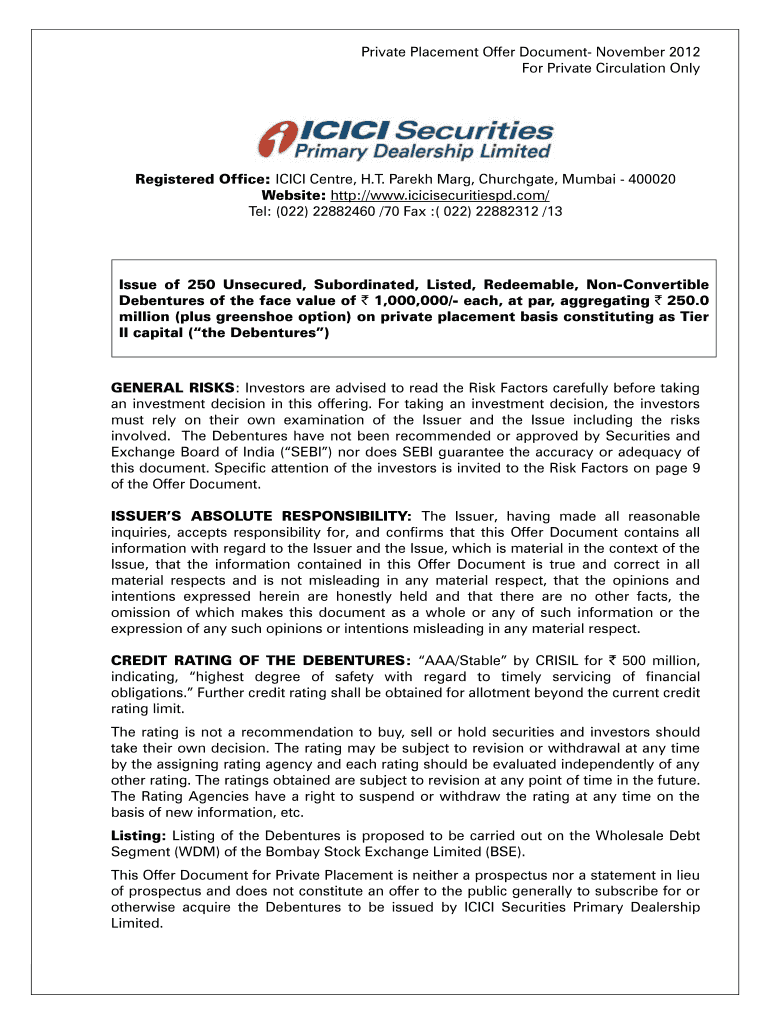

This document provides details regarding the private placement of unsecured, subordinated, listed, redeemable, non-convertible debentures issued by ICICI Securities Primary Dealership Limited, highlighting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private placement offer document

Edit your private placement offer document form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private placement offer document form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing private placement offer document online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit private placement offer document. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private placement offer document

How to fill out Private Placement Offer Document

01

Obtain the Private Placement Offer Document template from a reliable source or advisor.

02

Fill in the basic information such as the name of the issuer, type of securities being offered, and the offering amount.

03

Include detailed descriptions of the business, management team, and financial statements.

04

Outline the terms and conditions of the offering, including subscription procedures and investor qualifications.

05

Ensure compliance with applicable securities regulations and include any necessary disclosures.

06

Review the document for accuracy and completeness.

07

Seek legal and financial advice if necessary before finalizing the document.

08

Distribute the document to potential investors.

Who needs Private Placement Offer Document?

01

Issuers looking to raise capital through private investments.

02

Investors who are considering investing in privately offered securities.

03

Brokers and financial advisors involved in private placements.

04

Legal and compliance teams ensuring adherence to securities regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a private placement offering?

Here are some examples of private placements: When a startup obtains $200,000 in exchange for a share of their business, it's often the result of a private placement aimed at high-net-worth individuals, commonly known as angel investors.

What is the difference between private placement and offer for sale?

An IPO is underwritten by investment banks, which then make the securities available for sale on the open market. Private placement offerings are securities released for sale only to accredited investors such as investment banks, pensions, or mutual funds.

What is a private placement offer?

Private placement (or non-public offering) is a funding round of securities which are sold not through a public offering, but rather through a private offering, mostly to a small number of chosen investors.

What is the purpose of a private placement?

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than on a public exchange. It is an alternative to an initial public offering (IPO) for a young company seeking to raise money to expand.

What is a ppm document?

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

What is a private placement offer letter?

Private Placement Offer Letter All private placement offers should be made only to those persons whose names are recorded by the company before sending the invitation to subscribe. The persons whose names are recorded will receive the offer, and the company should maintain a complete record of the offers in Form PAS-5.

How to write a private placement memorandum?

It generally includes: Full disclosure regarding the terms being offered. General information about the company, including financial statements. Operations information. Management information. Intended use of the investment funding. Risk factors associated with the specific business as well as the industry at large.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Private Placement Offer Document?

The Private Placement Offer Document (PPOD) is a legal document that outlines the terms and conditions of a private placement of securities to a select group of investors, typically accredited or institutional investors, rather than through a public offering.

Who is required to file Private Placement Offer Document?

Companies conducting a private placement of securities are required to file a Private Placement Offer Document, especially if they are soliciting funds from investors under specific regulations, such as the Securities and Exchange Commission (SEC) rules.

How to fill out Private Placement Offer Document?

To fill out a Private Placement Offer Document, the issuer must provide detailed information about the security being offered, terms of the offering, risks involved, the use of proceeds, and the investor qualifications, along with relevant financial statements and disclosures.

What is the purpose of Private Placement Offer Document?

The purpose of a Private Placement Offer Document is to inform potential investors about the investment opportunity, including its risks and potential returns, thus enabling them to make an informed decision before investing.

What information must be reported on Private Placement Offer Document?

The Private Placement Offer Document must report information such as the company's business description, financial statements, description of the securities being offered, use of proceeds, risk factors, and any other relevant disclosures related to the offering.

Fill out your private placement offer document online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Placement Offer Document is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.