Get the free FINAL ACCOUNTING - WASHINGTON - Moco Inc

Show details

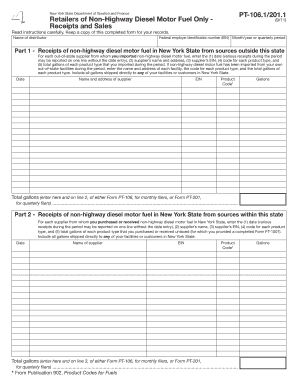

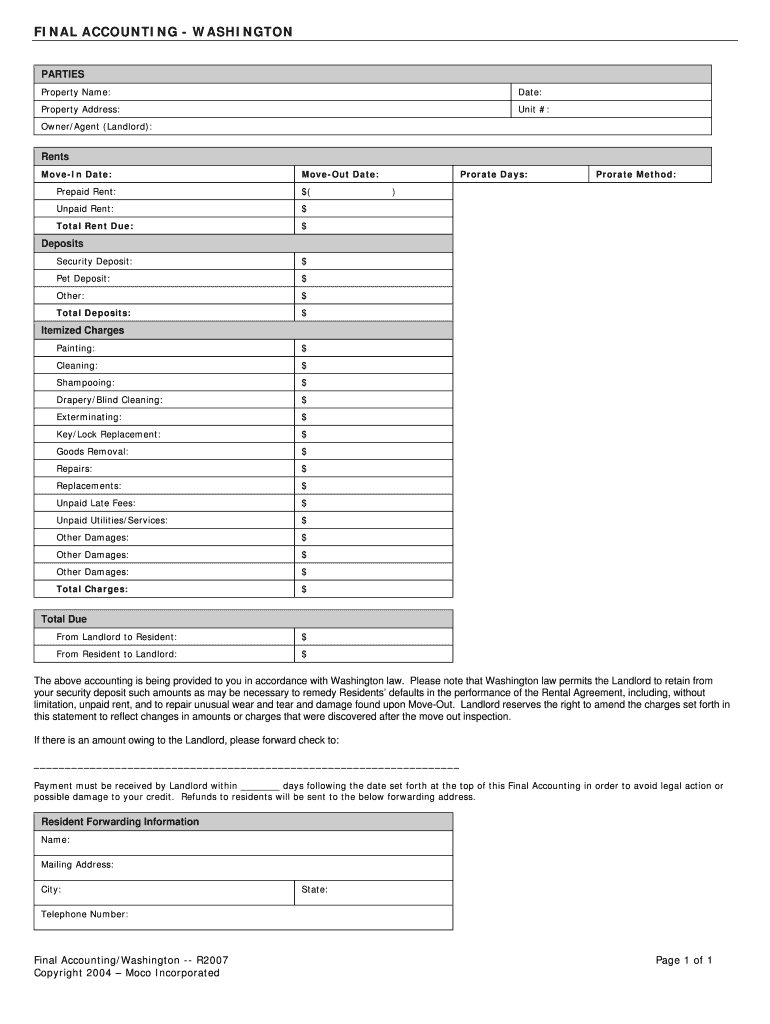

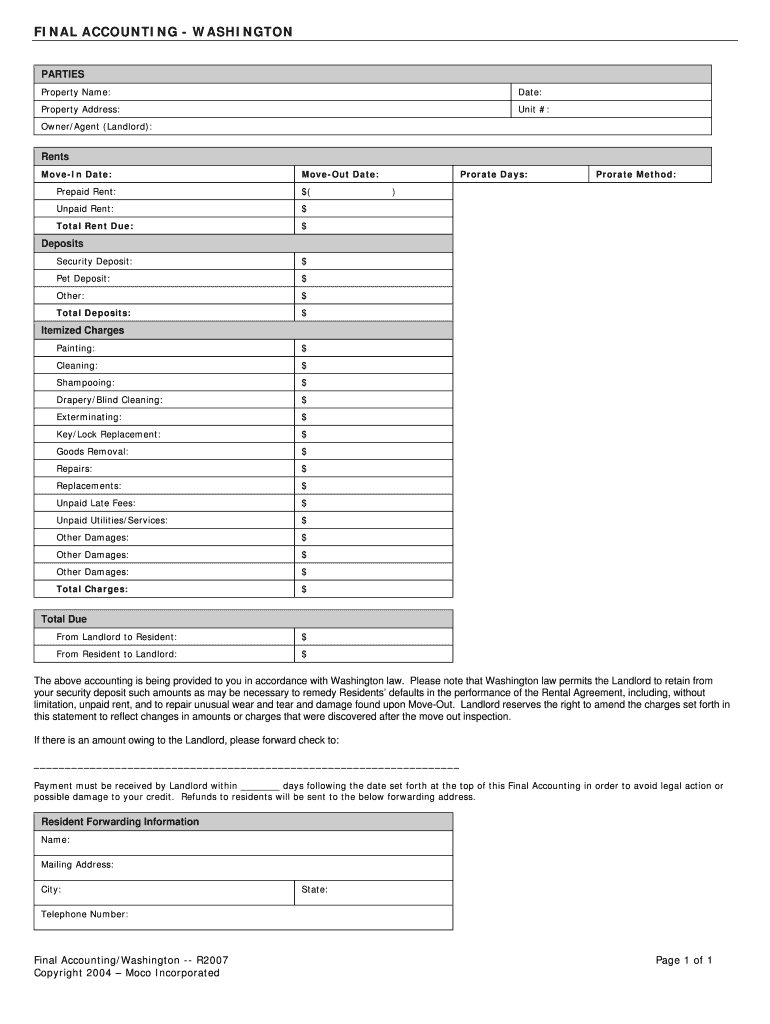

FINAL ACCOUNTING WASHINGTON PARTIES Property Name: Date: Property Address: Unit #: Owner/Agent (Landlord): Rents Move In Date: Move Date: Prepaid Rent: $(Unpaid Rent: Prorate Method: $ Total Rent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final accounting - washington

Edit your final accounting - washington form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final accounting - washington form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit final accounting - washington online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit final accounting - washington. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final accounting - washington

How to Fill Out Final Accounting - Washington:

01

Gather all necessary financial documents, including bank statements, receipts, invoices, and any other relevant records.

02

Organize the documents by category, such as income, expenses, assets, and liabilities.

03

Utilize accounting software or create a spreadsheet to input all financial information accurately.

04

Summarize income sources and list them separately, ensuring to include details like dates, amounts, and sources.

05

Deduct any allowable expenses from the total income to calculate the net profit or loss.

06

Document any assets acquired, sold, or disposed of during the accounting period.

07

Calculate the total value of all assets held at the end of the accounting period.

08

Identify any outstanding liabilities, such as debts, loans, or owed payments.

09

Subtract the liabilities from the total asset value to determine the net worth.

10

Prepare a statement of financial position or a balance sheet to present the financial standing at the end of the accounting period.

11

Finally, review the final accounting statements for accuracy and completeness before submitting them.

Who Needs Final Accounting - Washington:

01

Individuals or businesses who are required to file taxes in Washington state.

02

Executors or administrators of estates who need to provide an accurate financial report to distribute assets.

03

Business owners or shareholders who want to assess the financial performance and status of their company.

04

Non-profit organizations or charitable institutions that need to present detailed financial statements to stakeholders or grantors.

05

Anyone who wants to ensure compliance with the financial reporting requirements in Washington state.

Remember, it is always recommended to consult with a certified public accountant or tax professional to ensure accurate completion of final accounting forms and adherence to relevant regulations and laws in Washington state.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find final accounting - washington?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific final accounting - washington and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the final accounting - washington electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your final accounting - washington in minutes.

Can I create an eSignature for the final accounting - washington in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your final accounting - washington and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is final accounting - washington?

Final accounting in Washington is the financial summary of all transactions and activities related to the estate of a deceased individual.

Who is required to file final accounting - washington?

The personal representative or executor of the estate is required to file the final accounting in Washington.

How to fill out final accounting - washington?

To fill out final accounting in Washington, the personal representative must gather all financial documents, summarize the transactions, and report them accurately.

What is the purpose of final accounting - washington?

The purpose of final accounting in Washington is to provide a clear and transparent overview of the estate's financial activities to the beneficiaries and the court.

What information must be reported on final accounting - washington?

Final accounting in Washington must include details of all financial transactions, expenses, income, assets, and liabilities related to the estate.

Fill out your final accounting - washington online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Accounting - Washington is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.