Get the free Credit/Debit/HELOC Card Dispute Notification - redfcu

Show details

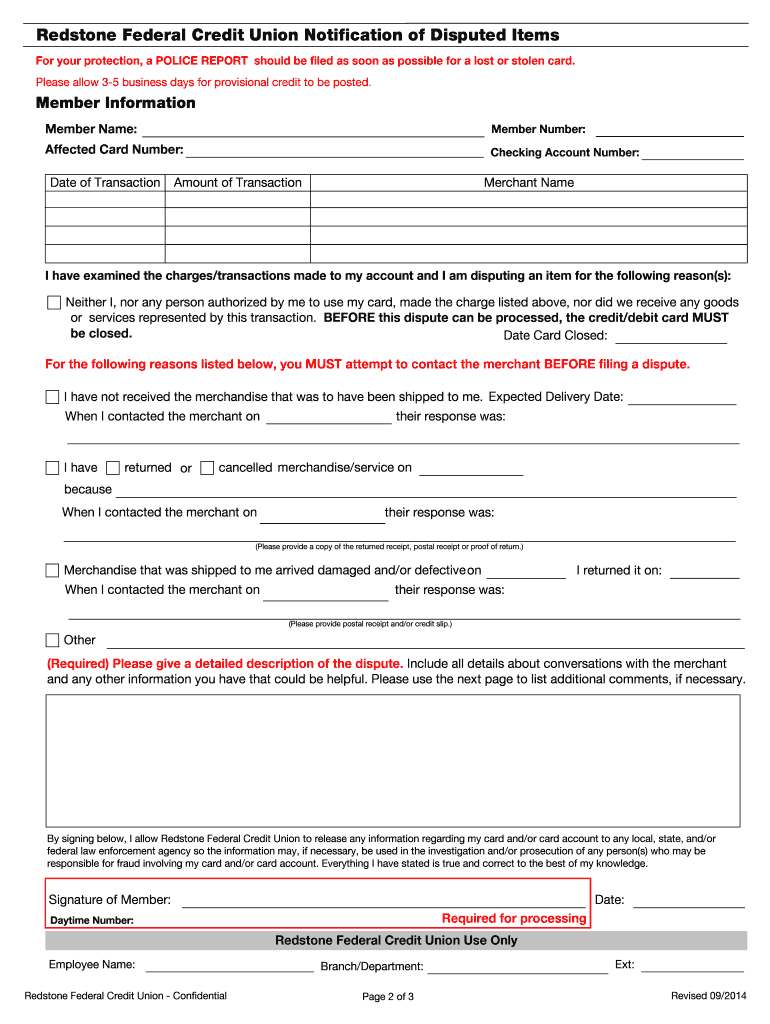

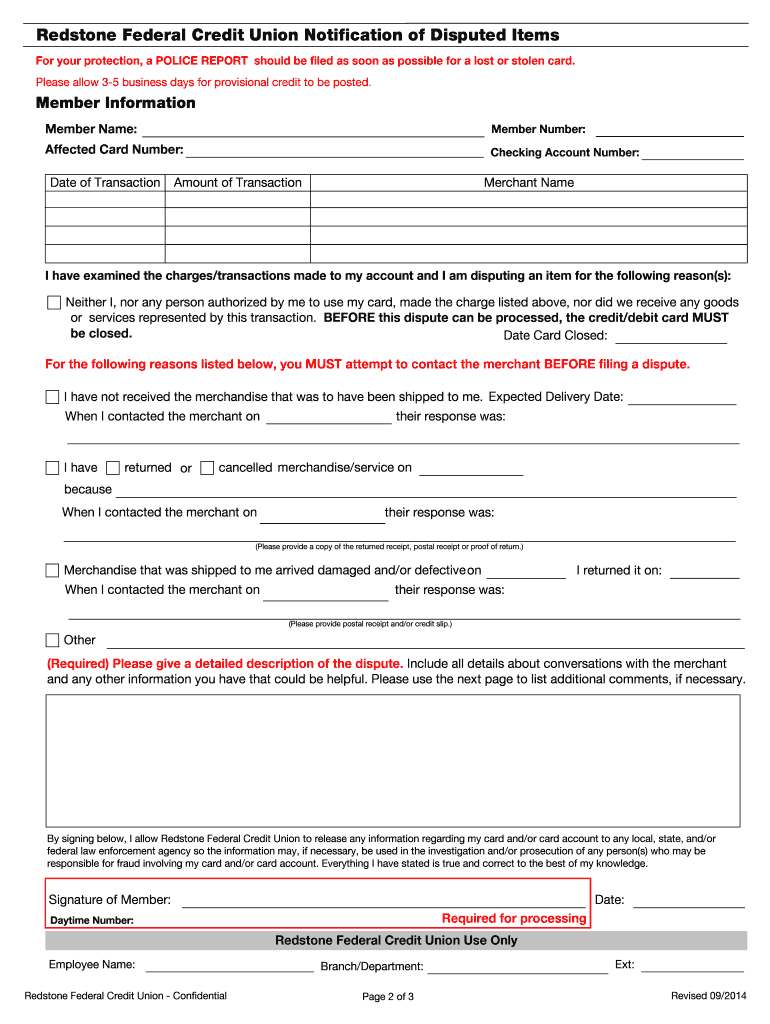

This document serves as a notification and guidelines form for disputing charges on credit, debit, or HELOC cards, outlining necessary steps, timelines, and requirements for filing a dispute.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign creditdebiformloc card dispute notification

Edit your creditdebiformloc card dispute notification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your creditdebiformloc card dispute notification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing creditdebiformloc card dispute notification online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit creditdebiformloc card dispute notification. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out creditdebiformloc card dispute notification

How to fill out Credit/Debit/HELOC Card Dispute Notification

01

Gather all relevant information about the transaction in question, including dates, amounts, and merchant details.

02

Obtain the Credit/Debit/HELOC Card Dispute Notification form from your bank or credit card issuer's website.

03

Fill in your personal information, including your name, address, and account number.

04

Clearly describe the transaction you are disputing and explain why you believe it is incorrect.

05

Attach any supporting documentation, such as receipts or statements, that validate your claim.

06

Review the completed form for accuracy and completeness.

07

Submit the form as instructed, either electronically or via mail, keeping a copy for your records.

Who needs Credit/Debit/HELOC Card Dispute Notification?

01

Consumers who see unauthorized charges on their credit or debit cards.

02

Individuals disputing a transaction due to dissatisfaction with a purchased product or service.

03

Homeowners utilizing HELOCs who need to dispute transactions related to their home equity line of credit.

04

Banking and credit card professionals managing customer inquiries regarding transaction disputes.

Fill

form

: Try Risk Free

People Also Ask about

How do I dispute a credit card billing error?

If you believe an error has been made on your credit card bill, you should send your credit card company a written letter within 60 days of the charge appearing on your billing statement. The letter should include information that identifies yourself and what you are disputing.

What grounds can I dispute a credit card charge?

You can contact the seller directly to try to fix the issue, or you can “dispute the charge” with the company that issued your credit card. For example, you can dispute a charge that you did not authorize, that is for the wrong amount, or that is for something that the seller didn't provide as agreed upon.

What to say to dispute something on your credit?

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

How to successfully win a credit card dispute?

Here are six do's and don'ts to help you win disputes and minimize hassles. Don't delay. Do double-check. Don't leapfrog the merchant. Do call your card issuer ASAP if you suspect fraud. Do be patient. Don't lose track of paperwork.

How do you write a good credit dispute letter?

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected.

What do you say when you dispute a debit card charge?

I am writing to dispute a charge of [$] to my [credit or debit card] account on [date of the charge]. The charge is in error because [explain the problem briefly.

What to write for a credit card dispute?

Narrate what happened with dates. Second, include any supporting documents in dealing with merchant with your dispute. That makes the letter stronger. Also if you have a lawyer contact, add the name as a cc to the letter to give it added leverage. Finally, make mention of the length of time you have been a customer.

Can you dispute a debit and credit card charge?

If you paid with a Visa debit, credit or pre-paid card, a chargeback is an option. If you need to make a chargeback claim, make sure you do it within 120 days of purchase. There's also the Consumer Rights Act that came into effect in 2015, which made consumer rights much easier to understand.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit/Debit/HELOC Card Dispute Notification?

A Credit/Debit/HELOC Card Dispute Notification is a formal communication indicating that a consumer disputes a charge or transaction on their credit, debit, or Home Equity Line of Credit card.

Who is required to file Credit/Debit/HELOC Card Dispute Notification?

Consumers who identify unauthorized, erroneous, or fraudulent transactions on their credit, debit, or HELOC accounts are required to file a Credit/Debit/HELOC Card Dispute Notification.

How to fill out Credit/Debit/HELOC Card Dispute Notification?

To fill out a Credit/Debit/HELOC Card Dispute Notification, consumers must provide details such as their account information, the details of the disputed transaction, the reason for the dispute, and any supporting documentation.

What is the purpose of Credit/Debit/HELOC Card Dispute Notification?

The purpose of the Credit/Debit/HELOC Card Dispute Notification is to formally notify the financial institution about the disputed transaction and initiate an investigation into the matter.

What information must be reported on Credit/Debit/HELOC Card Dispute Notification?

The information that must be reported includes the cardholder's name, account number, transaction date, transaction amount, description of the transaction, reason for the dispute, and any evidence supporting the claim.

Fill out your creditdebiformloc card dispute notification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Creditdebiformloc Card Dispute Notification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.