Get the free Autopayment Authorization - redfcu

Show details

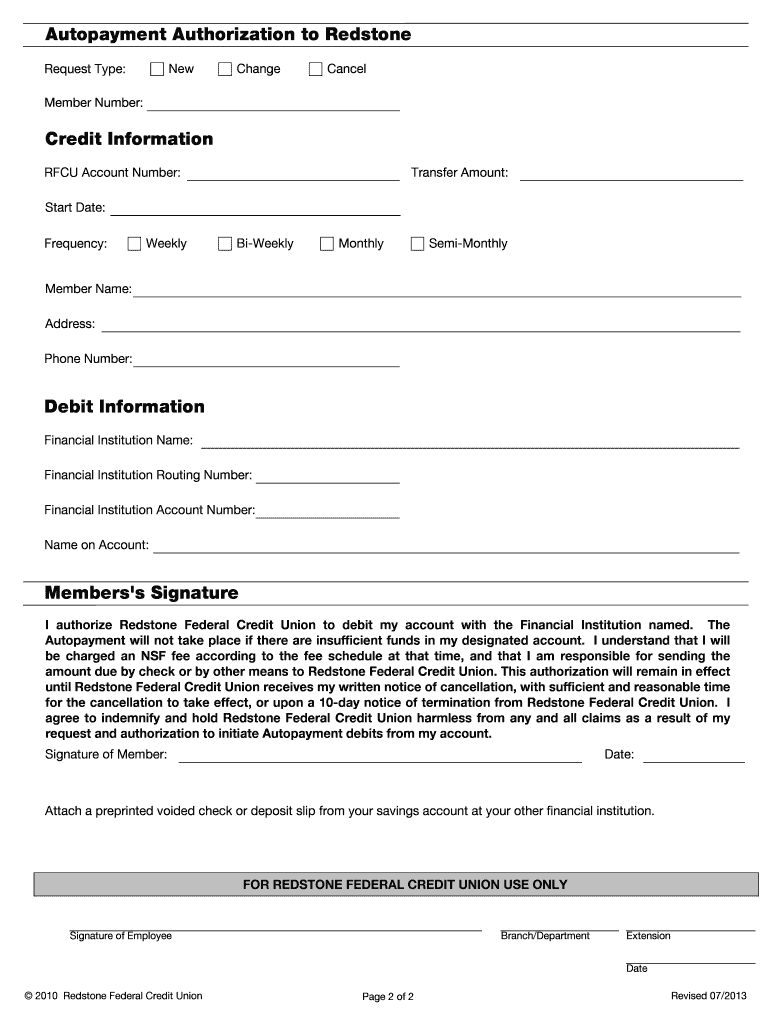

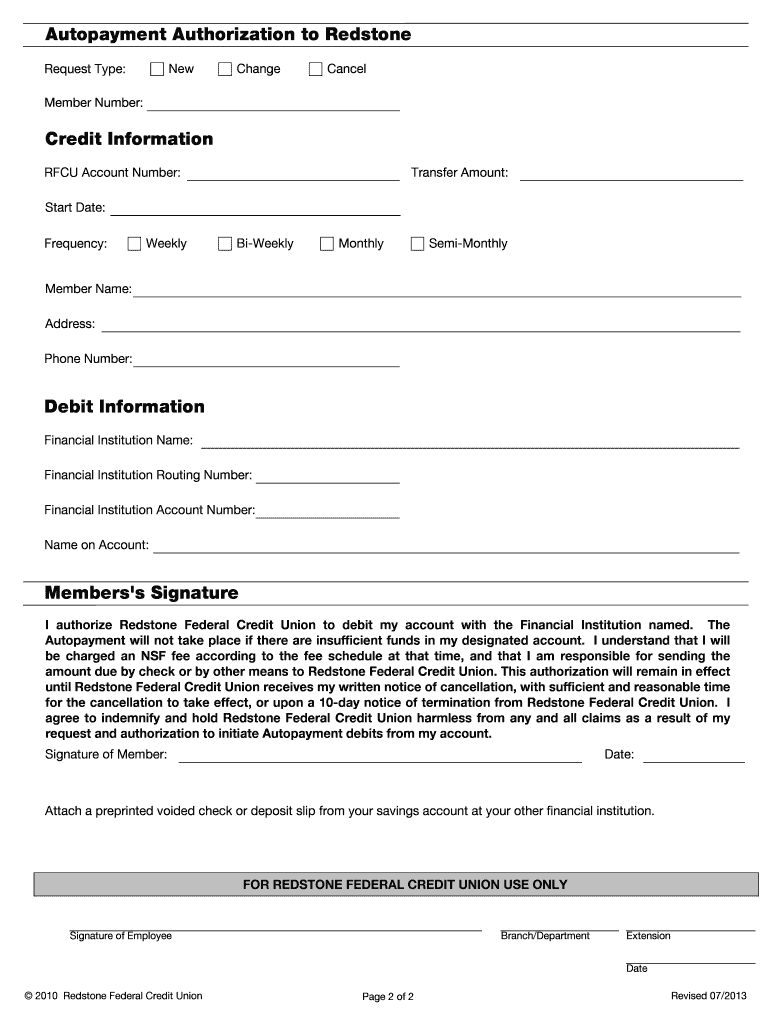

This document authorizes the Redstone Federal Credit Union to debit the specified financial institution account for regular payments to the member's RFCU account.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign autopayment authorization - redfcu

Edit your autopayment authorization - redfcu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your autopayment authorization - redfcu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit autopayment authorization - redfcu online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit autopayment authorization - redfcu. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out autopayment authorization - redfcu

How to fill out Autopayment Authorization

01

Obtain the Autopayment Authorization form from your service provider.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your account details, including the account number and any necessary reference numbers.

04

Specify the payment method you wish to use for autopay (e.g., bank account, credit card).

05

Indicate the frequency of payments (e.g., weekly, monthly).

06

Review the terms and conditions related to autopayment.

07

Sign and date the form to authorize the automatic deductions.

08

Submit the completed form to your service provider via the specified method (e.g., mail, email, online portal).

Who needs Autopayment Authorization?

01

Individuals or families who want to automate their regular bill payments.

02

Business owners seeking to streamline payment processes for recurring expenses.

03

Anyone looking to avoid late fees and maintain a good credit score.

04

Customers of service providers that offer autopayment options, such as utilities, insurance, or subscriptions.

Fill

form

: Try Risk Free

People Also Ask about

How long does payment authorization last?

In the case of debit cards, authorization holds can fall off the account, thus rendering the balance available again, anywhere from one to eight business days after the transaction date, depending on the bank's policy. In the case of credit cards, holds may last as long as thirty days, depending on the issuing bank.

What is the payment authorization process?

Payment Authorization is a process through which the amount to be paid on a payment method is verified. In case of credit cards, authorization specifically involves contacting the payment system and blocking the required amount of funds against the credit card.

What is the meaning of payment authorization?

Payment Authorization is a process through which the amount to be paid on a payment method is verified. In case of credit cards, authorization specifically involves contacting the payment system and blocking the required amount of funds against the credit card.

What does payment authorization declined mean?

An issuer decline happens when a cardholder's bank (the issuer) rejects a transaction during the authorization process. This response is typically triggered by the bank's fraud systems, risk policies, or account limitations.

What is the difference between direct debit authorization and autopay?

A direct debit is a regular payment that's approved by you but set up and controlled by the business you are paying. The amount can change with each payment. An automatic payment is a regular payment that's set up and controlled by you. You pay the same amount every time.

What does payment authorization mean?

Defining Payment Authorization Prior to a transaction being completed, payment authorization is the process of getting the customer's financial institution or credit card company's approval. It entails confirming the client has the money or credit to cover the purchase.

What does it mean when it says payment authorized?

Payment authorization is when an issuing bank gives the green light on a transaction, confirming it's prepared to release the authorized amount of funds from the customer's account. But before this authorization is granted, the issuing bank conducts thorough checks.

What is auto debit authorization?

Auto-debit is a financial arrangement that allows institutions to withdraw funds from an individual's account automatically at predefined intervals. It operates based on a standing instruction provided by the account holder, authorising a bank or service provider to debit a specific amount on a recurring basis.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Autopayment Authorization?

Autopayment Authorization is a consent form that allows a service provider to automatically withdraw payments from a customer's bank account on a regular basis for the services they provide.

Who is required to file Autopayment Authorization?

Customers who wish to set up automatic payments for bills or services are required to file an Autopayment Authorization.

How to fill out Autopayment Authorization?

To fill out an Autopayment Authorization, a customer typically needs to provide their personal information, banking details, and the specifics about the service they are authorizing payments for, including frequency and amount.

What is the purpose of Autopayment Authorization?

The purpose of Autopayment Authorization is to simplify the payment process for both the customer and the service provider by ensuring timely payments and reducing the risk of late fees.

What information must be reported on Autopayment Authorization?

The information that must be reported on Autopayment Authorization includes the customer's name, address, bank account details, payment frequency, service provider's details, and the specific authorization agreement terms.

Fill out your autopayment authorization - redfcu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Autopayment Authorization - Redfcu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.