Get the free Customer Identification Program

Show details

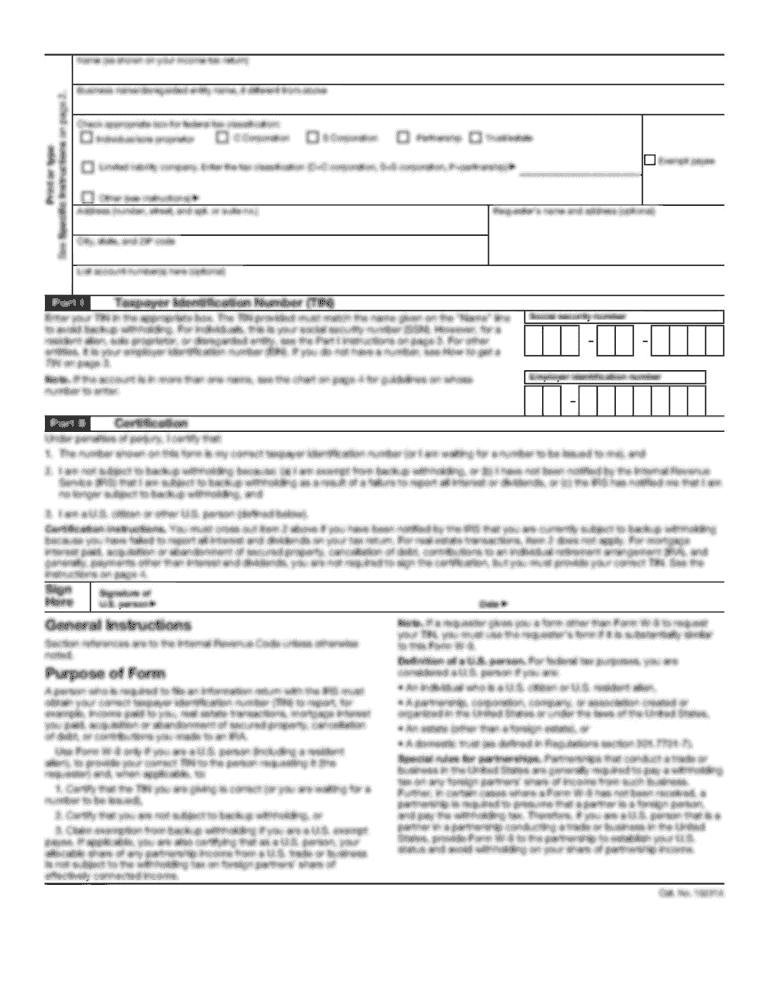

This document is required for the establishment of new accounts and related transactions, aimed at verifying the identity of the account holder to comply with Federal law against terrorism funding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customer identification program

Edit your customer identification program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customer identification program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit customer identification program online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit customer identification program. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customer identification program

How to fill out Customer Identification Program

01

Gather necessary identification documents from the customer, such as a government-issued ID, proof of address, and Social Security number.

02

Complete a Customer Identification Program form that includes the customer's personal information and the type of documents provided.

03

Verify the authenticity of the identification documents provided by the customer.

04

Record the verification results and any discrepancies found during the verification process.

05

Store the completed Customer Identification Program form and supporting documents securely for compliance with regulations.

Who needs Customer Identification Program?

01

Financial institutions, including banks and credit unions.

02

Securities firms and brokerages.

03

Insurance companies that offer products with cash value.

04

Money service businesses, such as money transmitters and check cashers.

05

Real estate brokers and agents involved in financial transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is required for a Customer Identification Program?

CIP requirements The financial services firm is required to maintain records of the information it uses to verify a potential customer's identity, including name, address, date of birth, and other identifying information (notably, a tax ID, Social Security Number, or other identification number).

What is the CIP process involves?

Customer Identification Program (CIP) CIPs focus on verifying the identity of a customer during the onboarding process. The CIP process involves collecting and verifying specific identifying information such as name, date of birth, address, and government-issued identification number.

What are the 4 pieces of information for CIP?

Collect customer information: Financial institutions must collect a minimum of four pieces of identifying information from every consumer: name, date of birth, address, and taxpayer identification number, i.e., a Social Security number for a U.S. citizen.

What does a Customer Identification Program include?

Customer Identification Program (CIP) CIPs focus on verifying the identity of a customer during the onboarding process. The CIP process involves collecting and verifying specific identifying information such as name, date of birth, address, and government-issued identification number.

What's the difference between KYC and CIP?

Know Your Customer (KYC) and Customer Identification Procedures (CIP) are vital for business operations. KYC involves knowing a customer's identity and the business activities they engage in. CIP, in contrast, involves verifying the information provided by a customer.

What are the four elements of CIP?

What information is required for CIP? At a minimum, businesses must collect and verify four pieces of identifying information to satisfy CIP requirements: the individual's name, date of birth, address, and identification number.

What is a CIP checklist?

A customer identification program checklist is an essential tool that identity management experts, compliance officers, AML specialists, and other professionals can use to complete various CIP tasks in order to create and manage a Customer Identification Program (CIP).

What are the 4 requirements of CIP?

Customer Identification Program requirements This includes: Establishing a documented CIP program. Collecting four specific pieces of identifying information: the customer's name, address, date of birth, and government-issued identification number. Establishing identity verification procedures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Customer Identification Program?

The Customer Identification Program (CIP) is a set of regulations that requires financial institutions to verify the identity of individuals opening new accounts to help prevent money laundering and terrorist financing.

Who is required to file Customer Identification Program?

Financial institutions, including banks, credit unions, and brokerages, are required to implement a Customer Identification Program as part of their anti-money laundering (AML) compliance requirements.

How to fill out Customer Identification Program?

To fill out a Customer Identification Program form, provide required information such as the customer's name, address, date of birth, and identification number (e.g., Social Security number or passport number) and submit it along with valid identification documents.

What is the purpose of Customer Identification Program?

The purpose of the Customer Identification Program is to prevent financial institutions from being used for illegal activities by ensuring that they know the identity of their customers and maintain accurate records.

What information must be reported on Customer Identification Program?

The information that must be reported includes the customer's name, residential address, date of birth, and identification number, along with any identification documents used to verify their identity.

Fill out your customer identification program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customer Identification Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.