Get the free Equity to Cash - Fair Market Offer Questionnaire

Show details

This form is designed to collect information from individuals looking to convert their mortgage notes and real estate equity into cash, including personal details, property information, and financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign equity to cash

Edit your equity to cash form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your equity to cash form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing equity to cash online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit equity to cash. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

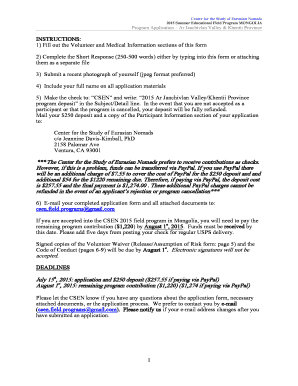

How to fill out equity to cash

How to fill out Equity to Cash - Fair Market Offer Questionnaire

01

Start with your personal information at the top of the questionnaire, including your name and contact details.

02

Read through the introduction to understand what the questionnaire is used for.

03

Gather documentation related to your equity holdings, including stock certificates or statements.

04

Begin filling out the sections that detail your current equity positions - include the type of equity, number of shares, and the fair market value.

05

If applicable, provide any additional context or notes regarding limitations or restrictions on your equity.

06

Review your entries for accuracy and completeness before submitting.

07

Sign and date the questionnaire as required, ensuring you adhere to any submission guidelines given.

Who needs Equity to Cash - Fair Market Offer Questionnaire?

01

Individuals or businesses looking to convert their equity into cash through a fair market offer.

02

Employees who have stock options or restricted stock units and want to evaluate their cash-out options.

03

Investors seeking to assess the value of their equity holdings for financial planning or liquidation purposes.

Fill

form

: Try Risk Free

People Also Ask about

Is FV the same as market value?

Fair value (FV) and market value are often used interchangeably, but they have distinct meanings. Market value specifically refers to the current price at which an asset is traded in the market.

What is the difference between futures price and fair value?

The actual futures price will not necessarily trade at the theoretical price, as short-term supply and demand will cause price to fluctuate around fair value. Price discrepancies above or below fair value should cause arbitrageurs to return the market closer to its fair value.

Is fair value the same as fair market value?

Part of what differentiates fair market value from fair value is the market and control discounts. Fair market value typically includes the following discounts and premiums: The discount for marketability accounts for the cost in time and money to get the business to market.

How to calculate fair market value of equity shares?

The Fair Market Value of shares is determined by their average trading price on a specific day. This method helps to provide an accurate valuation by mitigating the effects of daily market fluctuations, ensuring a fair assessment for transactions and taxation purposes. What is the role of FMV in income tax?

Where to find FMV in Carta?

Navigate to Compliance & Tax and click Manage valuations under 409A Valuations. From the Valuations Dashboard, click Manage fair market value > Add fair market value.

How to determine the fair value of equity?

The Peter Lynch fair value calculation assumes that when a stock is fairly valued, the trailing P/E ratio of the stock (Price/EPS) will equal its long-term EPS growth rate: Fair Value = EPS * EPS Growth Rate.

Is FMV the same as NBV?

Hence, the net book value (NBV) is not equivalent to its fair market value (FMV) because the former is intended for bookkeeping purposes, while the latter is meant to reflect the current value.

What is the difference between FMV and FV?

The distinction between fair market value and fair value is in some ways as simple as noting that the only difference between the two terms is that one contains the word “market” and the other does not.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Equity to Cash - Fair Market Offer Questionnaire?

The Equity to Cash - Fair Market Offer Questionnaire is a form used to assess the fair market value of real estate properties and determine the equity available for cash offers.

Who is required to file Equity to Cash - Fair Market Offer Questionnaire?

Individuals or entities that are considering a sale or a buyout of a property and need to establish its fair market value are required to file this questionnaire.

How to fill out Equity to Cash - Fair Market Offer Questionnaire?

To fill out the questionnaire, provide detailed information about the property, including its location, condition, and any relevant financial data, as per the instructions provided in the form.

What is the purpose of Equity to Cash - Fair Market Offer Questionnaire?

The purpose of the questionnaire is to gather accurate information to evaluate the property's fair market value, which helps in making informed decisions regarding cash offers or equity sales.

What information must be reported on Equity to Cash - Fair Market Offer Questionnaire?

The questionnaire typically requires information such as property description, ownership details, valuation data, recent comparable sales, and any liens or encumbrances on the property.

Fill out your equity to cash online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Equity To Cash is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.