Get the free Request to Reset ACH Draft Date

Show details

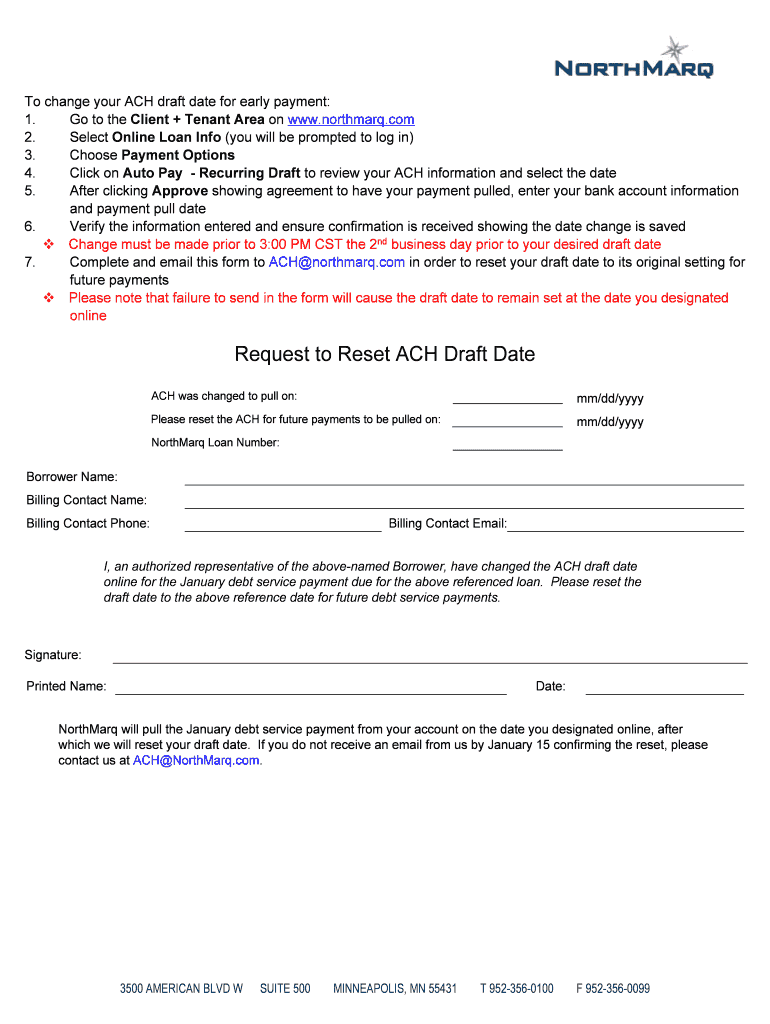

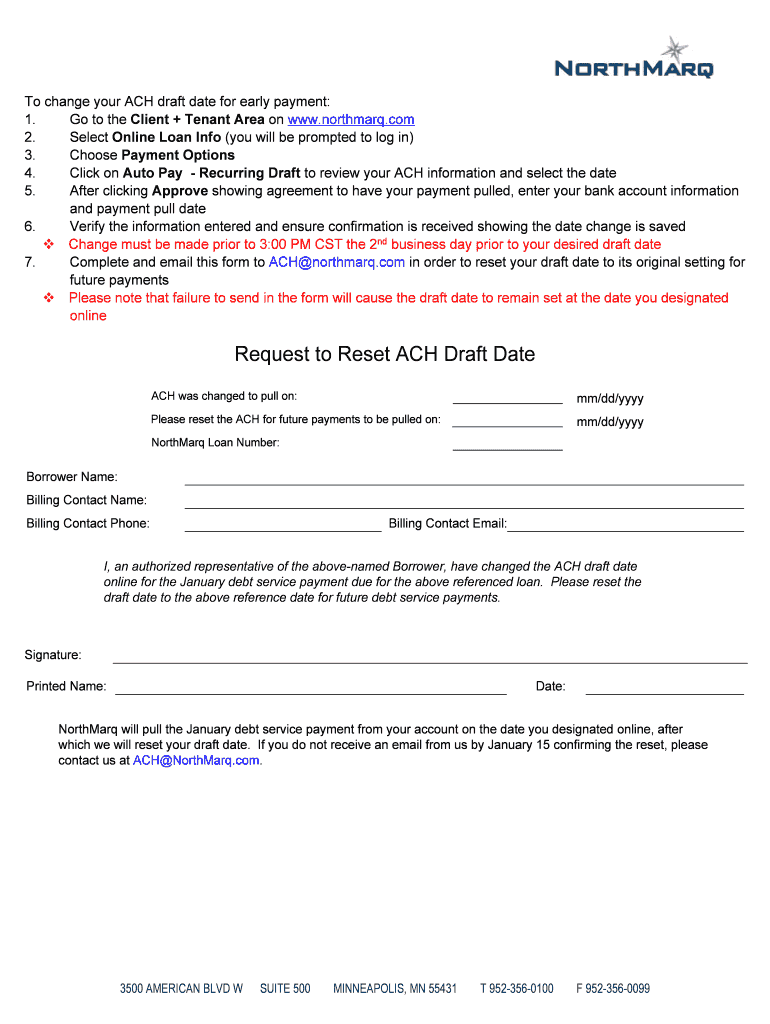

This document provides instructions on changing the ACH draft date for early payments and includes a request form to reset the draft date for future payments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request to reset ach

Edit your request to reset ach form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request to reset ach form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit request to reset ach online

Follow the steps down below to use a professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request to reset ach. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

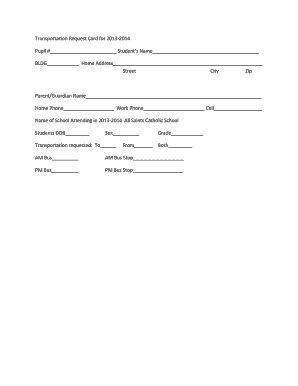

How to fill out request to reset ach

How to fill out Request to Reset ACH Draft Date

01

Obtain the Request to Reset ACH Draft Date form from your financial institution.

02

Fill in your personal details, including name, account number, and contact information.

03

Specify the current ACH draft date that you want to reset.

04

Provide the new desired ACH draft date.

05

Review the form for accuracy and completeness.

06

Sign and date the form to authorize the request.

07

Submit the form to your financial institution via the specified method (mail, email, or in-person).

Who needs Request to Reset ACH Draft Date?

01

Individuals or businesses that wish to change the scheduled date of their ACH transactions.

02

Customers who are experiencing issues with their current draft dates.

03

Anyone who wants to manage their payment schedules more effectively.

Fill

form

: Try Risk Free

People Also Ask about

What is an ACH notice of change?

ACH Notification of Change (NOC) A Notification of Change (NOC) is used to notify the sender of an ACH payment to correct or change information related to a customer's bank account. ACH Payment Returns.

What is an ACH request?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due.

What is an ACH recall request?

An ACH reversal or ACH reverse payment allows businesses and individuals to rectify errors or unauthorized transactions efficiently. ACH reversals can be initiated by contacting the bank to stop, cancel, or recall a payment and filling out a Reversal Request form.

What is a bank recall request?

A payment recall is where we try to get the funds back, in the instance where a payment has been made to the incorrect account or a duplicate payment has been made.

What is a ACH transfer in English?

ACH stands for Automated Clearing House. The Automated Clearing House is a centralized US financial network for banks and credit unions to send and receive electronic payments and money transfers.

What is an ACH recall?

Overview. An Automated Clearing House (ACH) reversal is a transaction that cancels a previously authorized electronic funds transfer.

Can you retract an ACH?

If you act quickly, you may be able to stop an ACH payment before it clears. But if the transaction has already been processed, you'll need to request an ACH reversal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request to Reset ACH Draft Date?

The Request to Reset ACH Draft Date is a formal request made to change the scheduled date on which Automatic Clearing House (ACH) transactions are processed.

Who is required to file Request to Reset ACH Draft Date?

Individuals or organizations that need to change the date for their ACH transactions must file a Request to Reset ACH Draft Date with their bank or financial institution.

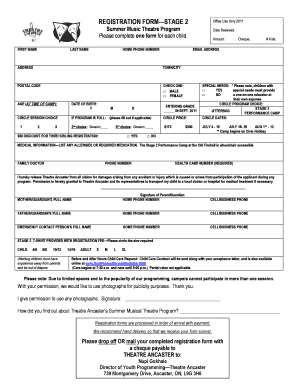

How to fill out Request to Reset ACH Draft Date?

To fill out the Request to Reset ACH Draft Date, you must provide your account information, the current draft date, the new requested draft date, and any necessary authorization signatures.

What is the purpose of Request to Reset ACH Draft Date?

The purpose of the Request to Reset ACH Draft Date is to allow account holders to modify the timing of their ACH transactions to better align with their financial scheduling.

What information must be reported on Request to Reset ACH Draft Date?

The information that must be reported includes the account holder's name, account number, current draft date, requested new draft date, and signatures for authorization.

Fill out your request to reset ach online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request To Reset Ach is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.