Get the free Mortgage Loan Application Documentation

Show details

This document includes various forms and notices related to the application for a mortgage loan from Summit Mortgage Advisors, Inc., detailing fees, credit score disclosures, certifications, authorizations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loan application documentation

Edit your mortgage loan application documentation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loan application documentation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage loan application documentation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage loan application documentation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loan application documentation

How to fill out Mortgage Loan Application Documentation

01

Gather necessary personal information including your full name, Social Security number, and contact information.

02

Provide employment history for the last two years, including the names of employers, addresses, and your job titles.

03

Disclose your income details, including salary, bonuses, and any other sources of income.

04

List your assets, including bank account balances, investment accounts, and other properties you own.

05

Detail your existing debts, such as credit cards, student loans, and any other loans you may have.

06

Specify the type of mortgage you are applying for, including the loan amount and property type.

07

Review and complete any additional forms required by the lender, including credit authorization and property appraisal requests.

08

Sign and date the application, ensuring all information is accurate and complete.

Who needs Mortgage Loan Application Documentation?

01

Individuals or families looking to purchase a new home.

02

Homeowners seeking to refinance their existing mortgage.

03

Real estate investors acquiring additional properties.

Fill

form

: Try Risk Free

People Also Ask about

What does a mortgage contain?

There are four components to a mortgage payment. Principal, interest, taxes and insurance. Principal is the amount of the loan.

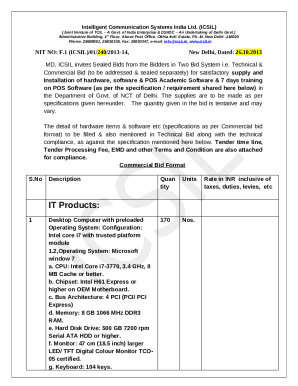

What is included in a loan document?

A set of loan documents should include the following terms and conditions: Parties to the loan. Loan amount. Repayment terms, including applicable interest rate, method of interest accrual, payment type (interest-only or principal and interest), payment amount, payment due dates, required method of payment.

What is the mortgage document?

Generally speaking, a mortgage is an official agreement between a lender and a homebuyer to use the property as security to buy a home. The type of document and requirements may vary by state or loan type. For example, in some states you may use a security deed and in other states a deed of trust.

Which document is very necessary for a mortgage?

A filled application form. Credit information. KYC documents of the applicant and co-applicant/guarantor (if any), including identity proof (such as PAN card, Voter ID, Passport, Aadhaar, etc.), address proof (such as Driving license, Passport, Aadhaar, etc.), and two latest passport size photographs.

How do I write a letter of explanation for a mortgage lender?

Writing this letter is often simpler than it sounds. All you need to do is clearly explain the situation, provide any relevant dates, and include any documentation that supports your explanation. Being honest and direct can help your lender better understand your financial picture and keep your loan on track.

What is in a mortgage document?

The lender will include the potential details of the loan transaction including the loan amount, purchase price of your home, and total cost of your loan.

What is considered a mortgage statement?

A mortgage statement is a document from your lender that provides details about your loan. Lenders are required to send a mortgage statement for each billing cycle, which is usually monthly. Your mortgage statement provides up-to-date details about your loan, including: Principal balance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Loan Application Documentation?

Mortgage Loan Application Documentation refers to the necessary forms and supporting documents that individuals must provide when applying for a mortgage loan. This often includes personal financial information, employment verification, and property details.

Who is required to file Mortgage Loan Application Documentation?

Anyone seeking a mortgage loan, including individuals and entities, is required to file Mortgage Loan Application Documentation to demonstrate their eligibility and financial stability to lenders.

How to fill out Mortgage Loan Application Documentation?

To fill out Mortgage Loan Application Documentation, applicants should provide accurate personal and financial information, detail their income and employment history, disclose assets and liabilities, and complete any required forms as instructed by the lender.

What is the purpose of Mortgage Loan Application Documentation?

The purpose of Mortgage Loan Application Documentation is to assess the applicant's creditworthiness, verify financial status, and determine their ability to repay the loan, thereby aiding lenders in making informed lending decisions.

What information must be reported on Mortgage Loan Application Documentation?

Mortgage Loan Application Documentation must report information such as personal identification, income, employment history, debts, assets, the desired loan amount, property details, and credit history.

Fill out your mortgage loan application documentation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loan Application Documentation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.