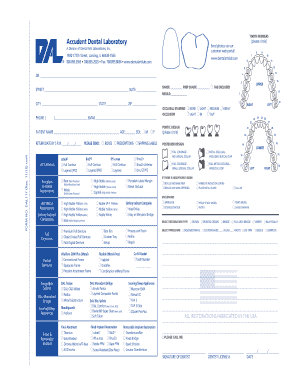

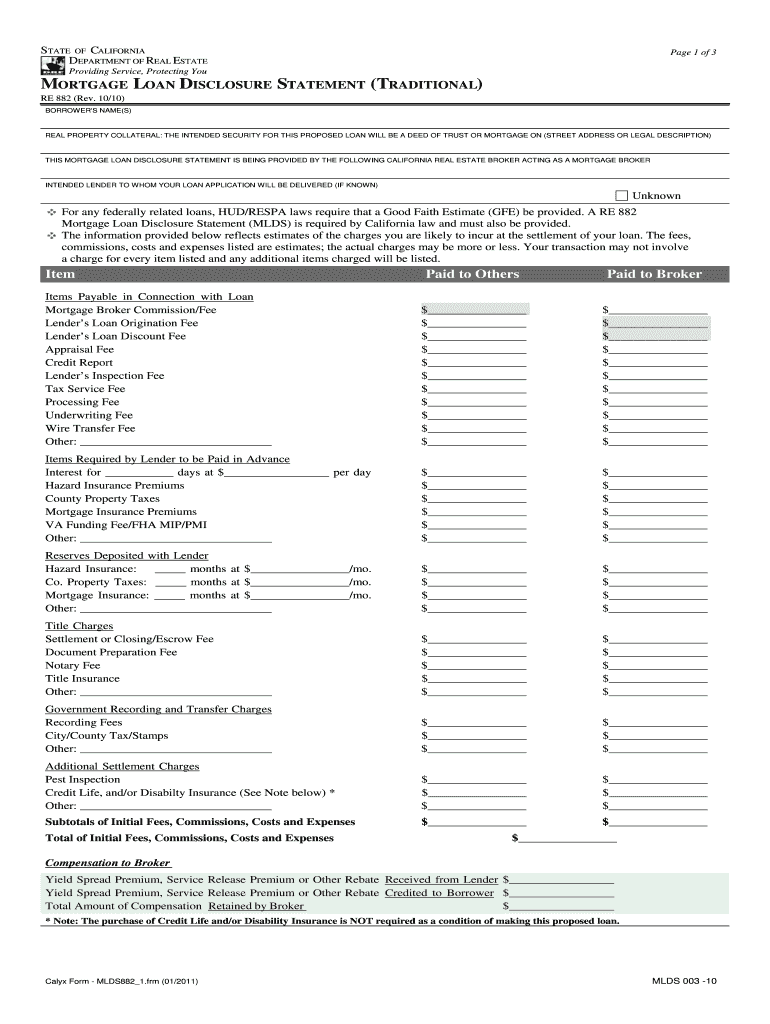

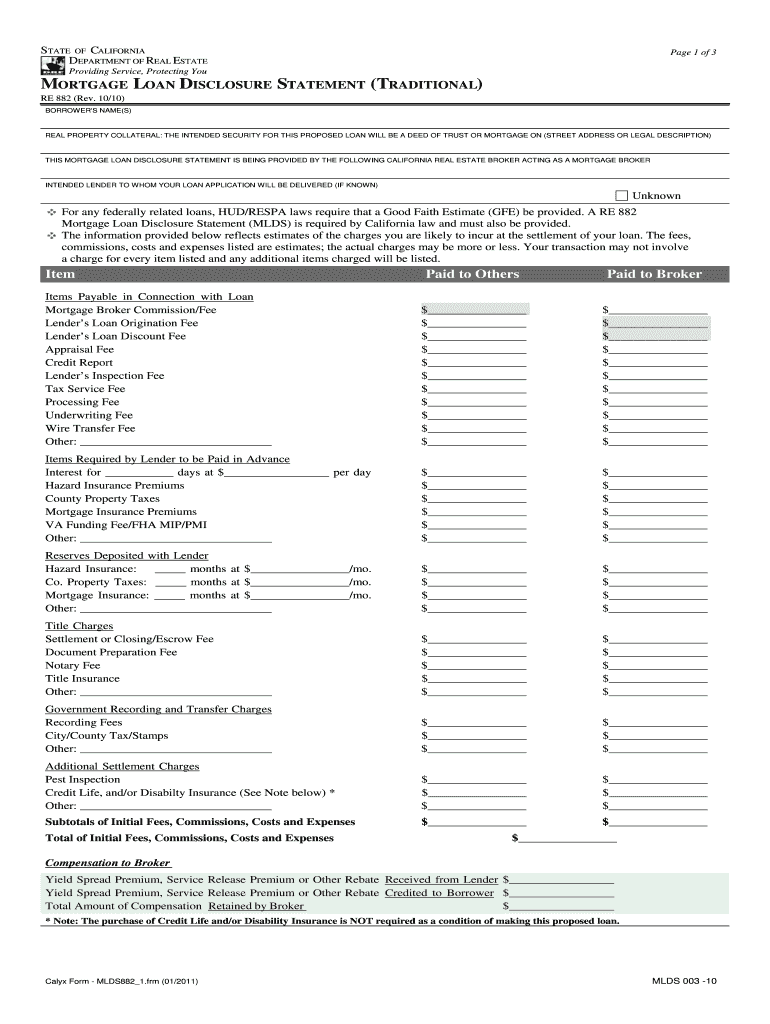

Get the free MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)

Show details

This document provides a disclosure statement required by California law for mortgage loans, detailing the estimated charges, fees, and obligations related to the loan.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage loan disclosure statement

Edit your mortgage loan disclosure statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage loan disclosure statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage loan disclosure statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit mortgage loan disclosure statement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage loan disclosure statement

How to fill out MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)

01

Obtain the Mortgage Loan Disclosure Statement form.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide information about the property, such as its address and type.

04

Complete the loan details section, including the loan amount, interest rate, and loan term.

05

Disclose your income and employment details as required.

06

Include information about any other debts or financial obligations.

07

Review the terms and conditions outlined in the statement.

08

Sign and date the document where required.

09

Keep a copy for your records and submit it to the lender.

Who needs MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)?

01

Homebuyers seeking a mortgage loan.

02

Individuals refinancing their existing mortgage.

03

Real estate agents assisting clients with mortgage processes.

04

Lenders providing financing options to borrowers.

Fill

form

: Try Risk Free

People Also Ask about

What is the most important disclosure made in the loan process?

The closing disclosure is one of the most important documents a buyer gets during the mortgage lending process, because it spells out all the details of their mortgage loan, including the interest rate, the total borrowing costs, the amount of the monthly payment, and how much money will be required at closing.

Which of the 5 C's is the most important in lending decisions?

Each of the five Cs has its own value, and each should be considered important. Some lenders may carry more weight for categories than others based on prevailing circumstances. Character and capacity are often most important for determining whether a lender will extend credit.

What is a loan disclosure statement?

Disclosure Statements The disclosure statement informs the borrower of the date(s) the loan funds are expected to be disbursed and the anticipated disbursement amounts, and discloses certain loan terms and conditions, such as how the borrower may cancel all or part of the loan.

What is the purpose of the mortgage servicing disclosure statement?

A mortgage servicing disclosure provides information from the lender about whether or not the servicing of the loan may be transferred, sold, or assigned to some other person or entity during the life of the loan.

What is a disclosure on a loan?

Disclosure is the key information about a loan that you must give to borrowers. It helps borrowers understand what the loan will cost them and what their and your obligations are under the loan.

What is the most commonly used type of disclosure?

Community Answer. The most commonly used type of disclosure in real estate transactions is the seller disclosure. It provides potential buyers with detailed information about the property's condition and any known defects, offering transparency and protecting both the seller and buyer.

What are the initial disclosures for a mortgage?

Initial disclosures are the preliminary disclosures that must be acknowledged and signed in order to move forward with your loan application. These disclosures outline the initial terms of the mortgage application and also include federal and state required mortgage disclosures.

What are the two most important disclosures that are required under the truth in the Lending Act?

Some of the most important aspects of the TILA concern the information that must be disclosed to a borrower before extending credit, such as the annual percentage rate (APR), the term of the loan, and the total costs to the borrower.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)?

The Mortgage Loan Disclosure Statement (Traditional) is a document that provides detailed information about the terms and conditions of a mortgage loan, including costs, interest rates, and payment schedules, ensuring that borrowers are fully informed before committing to a loan.

Who is required to file MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)?

Lenders and mortgage brokers who are involved in the loan process are required to provide and file the Mortgage Loan Disclosure Statement (Traditional) to ensure compliance with federal and state regulations.

How to fill out MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)?

To fill out the Mortgage Loan Disclosure Statement (Traditional), lenders must input accurate details including the borrower's personal information, the loan amount, interest rate, payment schedule, and any associated fees and costs, ensuring all information is clear and truthful.

What is the purpose of MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)?

The purpose of the Mortgage Loan Disclosure Statement (Traditional) is to inform borrowers about the specifics of the mortgage loan, helping them understand their obligations, potential costs, and the overall impact of the loan on their financial situation.

What information must be reported on MORTGAGE LOAN DISCLOSURE STATEMENT (TRADITIONAL)?

The information that must be reported on the Mortgage Loan Disclosure Statement (Traditional) includes the loan amount, interest rate, payment terms, closing costs, estimated monthly payment, and other terms associated with the mortgage.

Fill out your mortgage loan disclosure statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Loan Disclosure Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.