Fannie Mae 3210 2001-2026 free printable template

Show details

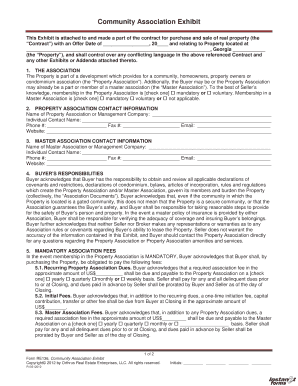

NOTE, Date, City State Property Address 1. BORROWER? S PROMISE TO PAY In return for a loan that I have received, I promise to pay U.S. $ (this amount is called ? Principal?), plus interest, to the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Fannie Mae 3210

Edit your Fannie Mae 3210 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Fannie Mae 3210 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Fannie Mae 3210 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Fannie Mae 3210. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Fannie Mae 3210

How to fill out Fannie Mae 3210

01

Obtain the Fannie Mae 3210 form from the official website or your lender.

02

Fill in the borrower’s name and contact information at the top of the form.

03

Provide the loan number associated with the application.

04

Complete the sections detailing the property address and type of property.

05

Indicate the loan amount you are requesting.

06

Review and fill in any additional required information, such as income details and employment history.

07

Ensure that all co-borrowers are listed and their information is filled in correctly.

08

Sign and date the form at the bottom, confirming that all information is accurate.

09

Submit the completed form to your lender or mortgage broker for processing.

Who needs Fannie Mae 3210?

01

Individuals applying for a mortgage loan through Fannie Mae.

02

Homebuyers seeking to purchase a new home with the assistance of Fannie Mae.

03

Real estate agents who need to guide their clients through the mortgage application process.

04

Lenders who need documentation from borrowers to process Fannie Mae loans.

Fill

form

: Try Risk Free

People Also Ask about

Can I make my own promissory note?

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Does a promissory note need to be signed by the lender?

Only the borrower signs a promissory note, whereas both the lender and the borrower sign a loan agreement. Once the document is signed, it means that the borrower agrees to pay back the loan.

What is a lender's note?

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

Is a handwritten promissory note legal?

Is a promissory note a legal document? Yes, even if it's not written by a lawyer. If you sign the document, you're bound as the payer or payee to abide by the terms of the agreement.

How do you write a lending note?

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

What is needed to make a promissory note legal?

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Fannie Mae 3210 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Fannie Mae 3210 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get Fannie Mae 3210?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the Fannie Mae 3210 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit Fannie Mae 3210 on an Android device?

You can edit, sign, and distribute Fannie Mae 3210 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is Fannie Mae 3210?

Fannie Mae 3210 is a reporting form used by lenders to provide information regarding the details of mortgage loans being sold to Fannie Mae.

Who is required to file Fannie Mae 3210?

Lenders who sell mortgage loans to Fannie Mae are required to file the Fannie Mae 3210 form.

How to fill out Fannie Mae 3210?

To fill out Fannie Mae 3210, lenders need to complete sections detailing loan information, borrower details, and the terms of the sale according to the instructions provided by Fannie Mae.

What is the purpose of Fannie Mae 3210?

The purpose of Fannie Mae 3210 is to standardize the reporting process for lenders, ensuring that all necessary information about mortgage loans is accurately communicated to Fannie Mae.

What information must be reported on Fannie Mae 3210?

Information that must be reported on Fannie Mae 3210 includes loan characteristics, borrower information, terms of the mortgage, and details of the sale transactions.

Fill out your Fannie Mae 3210 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fannie Mae 3210 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.