Get the free Deed of Trust Modification Agreement

Show details

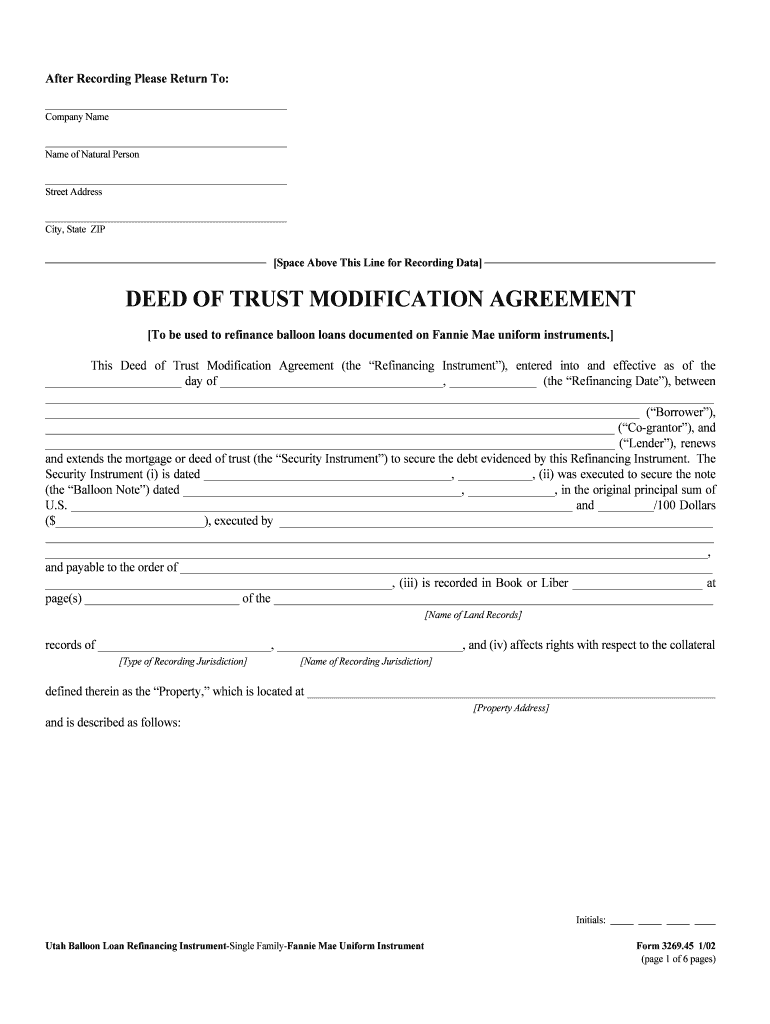

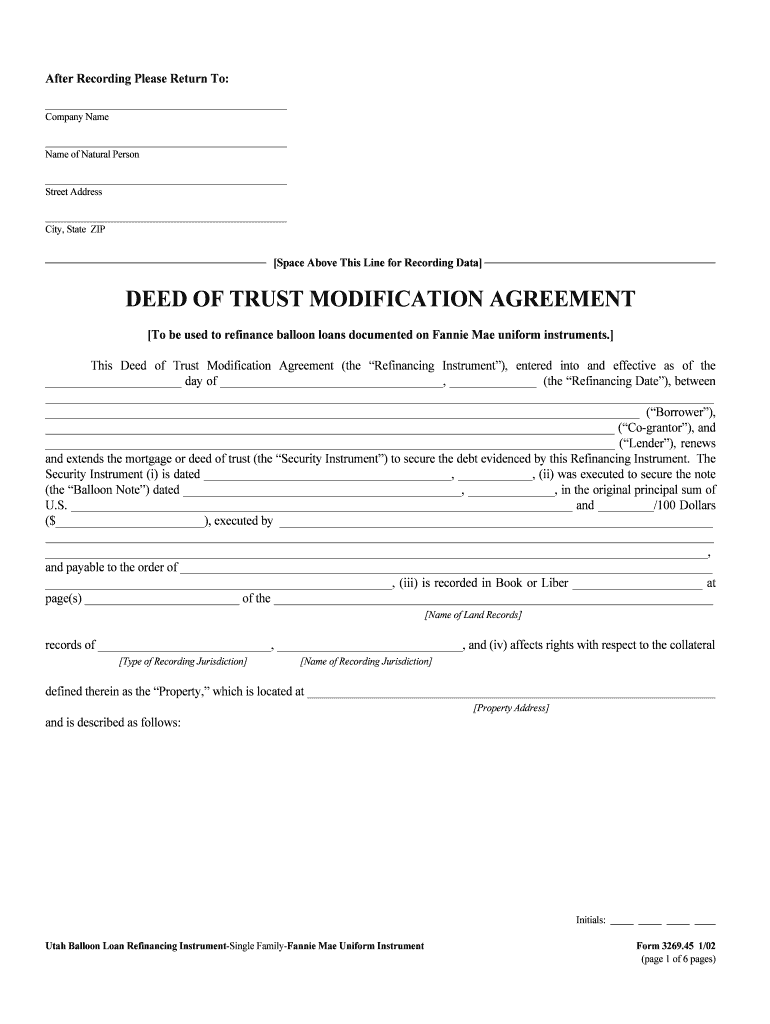

This document serves as a refinancing instrument for balloon loans documented on Fannie Mae uniform instruments, renewing and extending the existing mortgage or deed of trust to secure repayment of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of trust modification

Edit your deed of trust modification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of trust modification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deed of trust modification online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit deed of trust modification. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of trust modification

How to fill out Deed of Trust Modification Agreement

01

Begin by obtaining the Deed of Trust Modification Agreement form from your lender or a legal resource.

02

Review the existing deed of trust for any specific terms that need to be modified.

03

Fill out the borrower's information, including names and contact details.

04

Specify the current loan terms that are being modified, including the principal amount, interest rate, and payment schedule.

05

Clearly outline the new terms you wish to establish in the modification agreement.

06

Include any necessary disclosures related to the modification process.

07

Ensure both parties (borrower and lender) date and sign the document.

08

Have the modified agreement notarized if required by your lender or state law.

09

Submit the signed modification agreement to the lender for their records.

Who needs Deed of Trust Modification Agreement?

01

Homeowners looking to adjust their mortgage terms due to financial hardship or changing circumstances.

02

Borrowers seeking better loan terms, such as a lower interest rate or extended payment schedule.

03

Individuals undergoing a divorce or separation who need to modify the terms of a shared mortgage.

04

Anyone who has encountered a significant change in financial circumstances and needs to negotiate updated loan terms.

Fill

form

: Try Risk Free

People Also Ask about

What is a modification agreement for a deed of trust?

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make

What is the purpose of a trust deed?

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure. Late payments should be avoided to prevent escalation and property loss.

What is a deed of trust in English?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Why a lender may prefer to have a deed of trust instead of a mortgage?

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure. Late payments should be avoided to prevent escalation and property loss.

What is the disadvantage of a deed of trust?

Being on the mortgage note makes you the party obligated to pay the mortgage. Signing the mortgage creates your agreement to allow the lender to use the real estate as. collateral for the debt. Being on the deed makes you an owner of the property, whether that property does or does not have a mortgage against it.

What is a deed of trust in simple terms?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Why use a deed of trust instead of a mortgage?

Under a deed of trust, the property can be sold if the borrower is in default without going through a costly, lengthy legal procedure. The process is known as a nonjudicial foreclosure. The deed of trust allows the trustee to maintain the controlling interest in the property until the debt is paid in full.

What is an amended deed of trust?

Amendment to Deed of Trust means that certain Amendment to the Deed of Trust and Security Agreement and Amendment to Assignment of Leases and Rents, dated as of the Amendment Date, executed by Borrower and Lender.

Why do lenders prefer a deed of trust over a mortgage?

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deed of Trust Modification Agreement?

A Deed of Trust Modification Agreement is a legal document that alters the terms of an existing deed of trust, which secures a loan for real property. This agreement can modify aspects such as the interest rate, loan amount, or repayment terms to reflect changes in the borrower's circumstances.

Who is required to file Deed of Trust Modification Agreement?

The borrower and the lender are required to agree to the Deed of Trust Modification Agreement. Typically, it is the lender or their representative who files the agreement with the appropriate county or local authority to ensure that the modified terms are officially recorded.

How to fill out Deed of Trust Modification Agreement?

To fill out a Deed of Trust Modification Agreement, both parties must provide their identifying information, loan details, and specify the changes to the original deed of trust terms. It is advisable to include the legal description of the property and sign the document in the presence of a notary public.

What is the purpose of Deed of Trust Modification Agreement?

The purpose of the Deed of Trust Modification Agreement is to formally change the terms of an existing loan secured by a deed of trust, accommodating the borrower's needs or circumstances, and ensuring that the lender's security interests are maintained.

What information must be reported on Deed of Trust Modification Agreement?

The Deed of Trust Modification Agreement must include information such as the original loan amount, the names and addresses of parties involved, the legal description of the property, the specific modifications being made, and the signatures of both the borrower and lender, along with notarization.

Fill out your deed of trust modification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Trust Modification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.