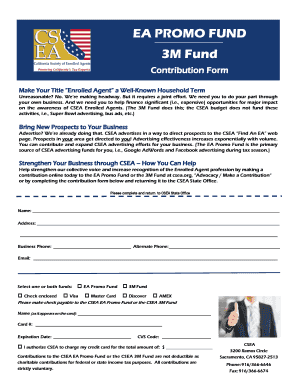

Get the free Deed of Trust Modification Agreement

Show details

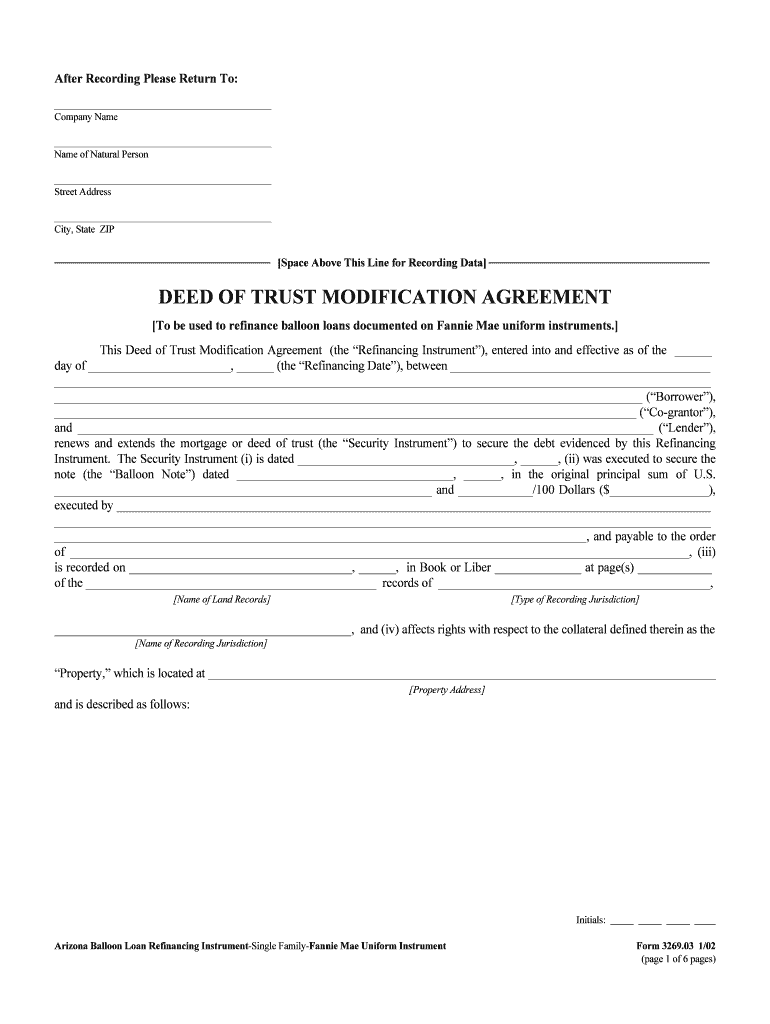

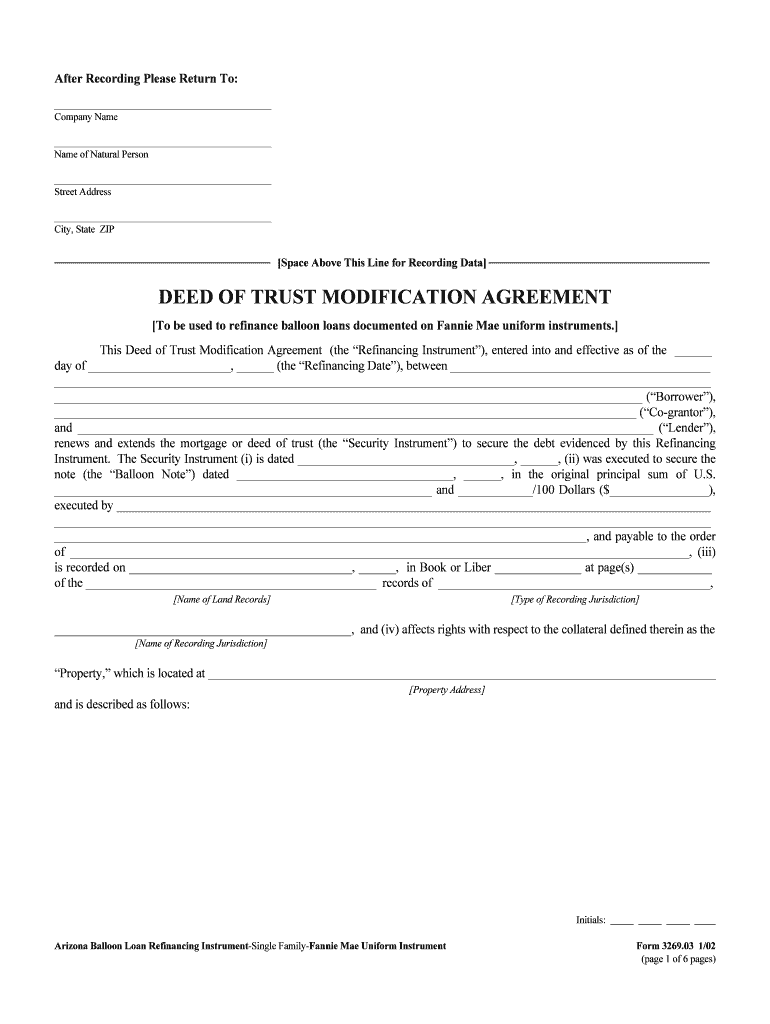

This document serves as a Deed of Trust Modification Agreement used to refinance balloon loans documented on Fannie Mae uniform instruments, extending and renewing the mortgage or deed of trust to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of trust modification

Edit your deed of trust modification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of trust modification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deed of trust modification online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit deed of trust modification. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of trust modification

How to fill out Deed of Trust Modification Agreement

01

Obtain the Deed of Trust Modification Agreement template or form from a reliable source.

02

Read through the existing Deed of Trust to understand the terms that need modification.

03

Fill in the names and contact information of all parties involved in the agreement.

04

Specify the original loan amount and any adjustments to the terms that are being modified.

05

Clearly state the new terms and conditions agreed upon by all parties.

06

Include the effective date of the modifications.

07

Make sure both parties review the agreement thoroughly before signing.

08

Sign the agreement in the presence of a notary public if required.

09

Distribute copies of the signed agreement to all parties involved.

Who needs Deed of Trust Modification Agreement?

01

Homeowners seeking to modify the terms of their existing mortgage.

02

Lenders wanting to legally document changes made to the original Deed of Trust.

03

Parties involved in real estate transactions that require updated loan terms.

Fill

form

: Try Risk Free

People Also Ask about

What is a modification agreement for a deed of trust?

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make

What is the purpose of a trust deed?

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure. Late payments should be avoided to prevent escalation and property loss.

What is a deed of trust in English?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Why a lender may prefer to have a deed of trust instead of a mortgage?

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure. Late payments should be avoided to prevent escalation and property loss.

What is the disadvantage of a deed of trust?

Being on the mortgage note makes you the party obligated to pay the mortgage. Signing the mortgage creates your agreement to allow the lender to use the real estate as. collateral for the debt. Being on the deed makes you an owner of the property, whether that property does or does not have a mortgage against it.

What is a deed of trust in simple terms?

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Why use a deed of trust instead of a mortgage?

Under a deed of trust, the property can be sold if the borrower is in default without going through a costly, lengthy legal procedure. The process is known as a nonjudicial foreclosure. The deed of trust allows the trustee to maintain the controlling interest in the property until the debt is paid in full.

What is an amended deed of trust?

Amendment to Deed of Trust means that certain Amendment to the Deed of Trust and Security Agreement and Amendment to Assignment of Leases and Rents, dated as of the Amendment Date, executed by Borrower and Lender.

Why do lenders prefer a deed of trust over a mortgage?

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deed of Trust Modification Agreement?

A Deed of Trust Modification Agreement is a legal document that alters the terms of an existing deed of trust, which typically involves changes to interest rates, loan amounts, maturity dates, or other significant provisions.

Who is required to file Deed of Trust Modification Agreement?

The parties involved in the original deed of trust, usually the borrower and the lender, are required to file the Deed of Trust Modification Agreement to officially document the changes.

How to fill out Deed of Trust Modification Agreement?

To fill out a Deed of Trust Modification Agreement, one must provide the original deed information, state the modified terms, include the signatures of all parties involved, and ensure it is notarized before submission.

What is the purpose of Deed of Trust Modification Agreement?

The purpose of a Deed of Trust Modification Agreement is to legally document changes to the terms of the existing deed of trust in order to reflect new agreements between the borrower and lender.

What information must be reported on Deed of Trust Modification Agreement?

The Deed of Trust Modification Agreement must report information such as the original loan amount, new modified terms, borrower and lender details, property description, and signatures of all parties involved.

Fill out your deed of trust modification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Trust Modification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.