Get the free Multistate Fixed/Adjustable Rate Note - 1 Year Treasury Index - Convertible (Form 35...

Show details

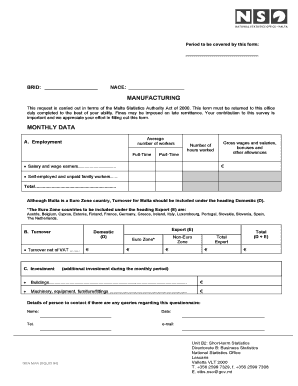

FIXED/ADJUSTABLE RATE NOTE (One-Year Treasury Index? Rate Caps? Fixed Rate Conversion Option) THIS NOTE PROVIDES FOR A CHANGE IN MY FIXED INTEREST RATE TO AN ADJUSTABLE INTEREST RATE. THIS NOTE LIMITS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign multistate fixedadjustable rate note

Edit your multistate fixedadjustable rate note form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multistate fixedadjustable rate note form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit multistate fixedadjustable rate note online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit multistate fixedadjustable rate note. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out multistate fixedadjustable rate note

How to fill out multistate fixedadjustable rate note:

01

Begin by carefully reviewing the document - Ensure you have a thorough understanding of the terms and conditions outlined in the multistate fixedadjustable rate note.

02

Fill in the borrower information - Input the borrower's name, address, contact details, and any other required personal information accurately.

03

Input the lender information - Provide the lender's name, address, and contact details. Double-check these details for accuracy.

04

Specify the loan details - Indicate the loan amount, interest rate, and terms of repayment as stated in the agreement between the borrower and lender.

05

Fill in the property information - Include the property address, legal description, and any other necessary details concerning the property being used as collateral for the loan.

06

Input adjustable-rate details - If applicable, provide the necessary information regarding the adjustment of the interest rate. This may include details on timing, adjustments periods, and rate caps.

07

Include any additional provisions - If there are any additional provisions or conditions specified in the multistate fixedadjustable rate note, make sure to include them accurately and completely.

08

Review and sign the document - Carefully read through the filled-out multistate fixedadjustable rate note, ensuring all information is correct. Sign the document where indicated and ensure all other required parties sign as well.

09

Keep a copy for your records - Make a copy of the filled-out multistate fixedadjustable rate note for your own records, as well as any additional copies required by the lender.

Who needs multistate fixedadjustable rate note:

01

Homebuyers - Individuals purchasing a property and requiring a loan may need to utilize a multistate fixedadjustable rate note to outline the terms of their mortgage.

02

Lenders - Financial institutions and lenders offering adjustable-rate mortgages may utilize a multistate fixedadjustable rate note to document the loan agreement and protect their interests.

03

Real estate professionals - Real estate agents and brokers who facilitate property transactions involving adjustable-rate mortgages may encounter the need for a multistate fixedadjustable rate note in their day-to-day business dealings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit multistate fixedadjustable rate note from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your multistate fixedadjustable rate note into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make edits in multistate fixedadjustable rate note without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your multistate fixedadjustable rate note, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I edit multistate fixedadjustable rate note on an Android device?

You can edit, sign, and distribute multistate fixedadjustable rate note on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is multistate fixedadjustable rate note?

A multistate fixedadjustable rate note is a type of loan document that combines features of both fixed and adjustable-rate mortgages. It allows borrowers to have an initial fixed interest rate for a certain period, after which the rate becomes adjustable based on market conditions.

Who is required to file multistate fixedadjustable rate note?

The filing of a multistate fixedadjustable rate note is typically done by lenders or financial institutions that offer this type of mortgage product to borrowers.

How to fill out multistate fixedadjustable rate note?

To fill out a multistate fixedadjustable rate note, you will typically need to provide information such as the borrower's personal details, loan terms, interest rates, and any additional provisions or conditions. It is important to carefully review and fill out the document in accordance with the applicable legal and regulatory requirements.

What is the purpose of multistate fixedadjustable rate note?

The purpose of a multistate fixedadjustable rate note is to provide borrowers with flexibility in their mortgage terms. It allows them to benefit from an initial fixed interest rate, which can provide stability and predictability, while also taking advantage of potential interest rate decreases in the future.

What information must be reported on multistate fixedadjustable rate note?

The specific information that must be reported on a multistate fixedadjustable rate note may vary depending on the jurisdiction and applicable regulations. However, commonly reported information includes the borrower's name, loan amount, interest rates, repayment terms, and any applicable fees or penalties.

Fill out your multistate fixedadjustable rate note online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multistate Fixedadjustable Rate Note is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.