Get the free ADJUSTABLE RATE NOTE

Show details

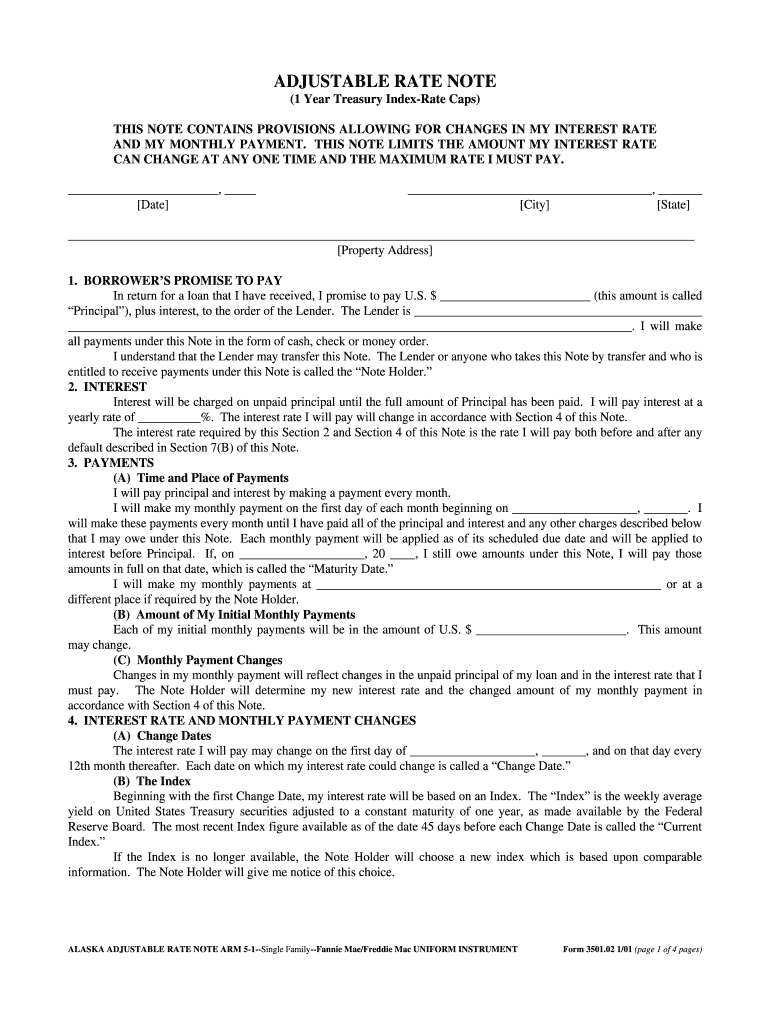

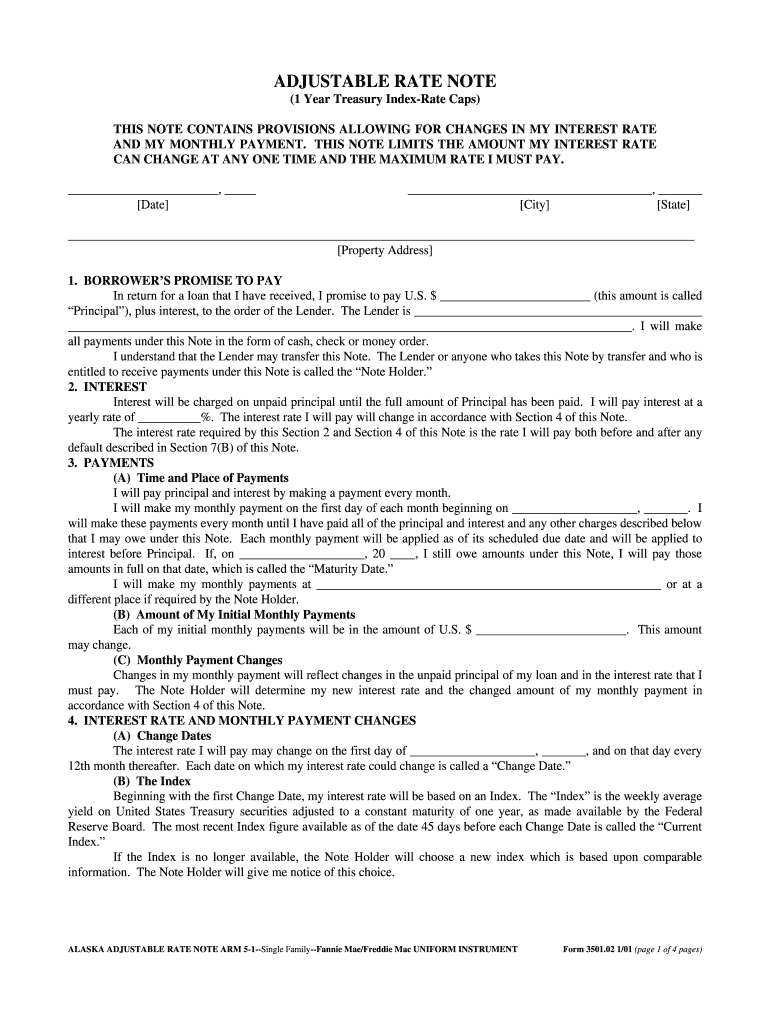

This document is a loan agreement outlining the borrower's promise to pay back a loan with an adjustable interest rate based on the 1 Year Treasury Index. It contains provisions for interest rate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign adjustable rate note

Edit your adjustable rate note form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your adjustable rate note form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit adjustable rate note online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit adjustable rate note. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out adjustable rate note

How to fill out ADJUSTABLE RATE NOTE

01

Start by entering the date at the top of the document.

02

Write the full name and address of the borrower.

03

Include the loan amount in numbers and words.

04

Specify the interest rate and how it will adjust over time.

05

Detail the adjustment intervals and the index used for adjustments.

06

Fill in the terms of the loan, including maturity date and payment schedule.

07

Include any applicable fees and prepayment penalties.

08

Have the borrower review the document thoroughly.

09

Sign and date the note in the designated areas.

Who needs ADJUSTABLE RATE NOTE?

01

Individuals purchasing a home with a mortgage.

02

Refinancers looking for potentially lower initial payments.

03

Borrowers expecting to sell or refinance before adjustments occur.

04

Investors seeking flexibility in their loan payments.

Fill

form

: Try Risk Free

People Also Ask about

Why would a home buyer choose an adjustable-rate mortgage?

Why would a home buyer choose an adjustable rate mortgage? If you plan on staying in the home short-term, you can benefit from a 5-year ARM rate or 10-year ARM rate. In both cases, the rate would be lower than a fixed-rate loan. To qualify, you need an excellent credit history and larger down payment.

What is the main downside of an adjustable-rate mortgage?

Monthly payments might increase: The biggest disadvantage (and biggest risk) of an ARM is the likelihood of your rate going up. If rates have risen since you took out the loan, your payments will increase when the loan resets.

What is an adjustable rate note?

With an adjustable-rate mortgage, the initial teaser rate is generally only for the first few years, and then it begins to adjust periodically. Once the rate begins to adjust, the changes to your interest rate (and payments) are based on the market, not your personal financial situation.

Do you need 20% down for an ARM?

Down payments for ARMs are usually the same as fixed-rate loans, but loan types allow for lower down payments (FHA or VA loans). In most cases, expect a minimum of 5% down, though 20% is preferred because private mortgage insurance (PMI) is often required on loans with less than a 20% down payment.

What is an example of an adjustable rate?

For example, during the first five years in a 5/6m ARM your rate stays the same. After that, the rate may adjust every six months (the 6m in the 5/6m example) until the loan is paid off. This period between rate changes is called the adjustment period.

What are the benefits of an ARM?

Overall, financing your home with an adjustable-rate mortgage (ARM) can provide you with the benefit of lower payments and more flexibility. It can be great for home buyers with less money for a down payment, regardless of how long they plan to stay in the home.

What is the most common adjustable-rate mortgage?

Let's look at an example: The most common adjustable-rate mortgage is a 5/1 ARM.

Why would anyone get an adjustable-rate mortgage?

Adjustable-rate mortgages can be advantageous in certain situations. Here are a few examples: You don't plan to stay in the home for a long time. If you know you're going to sell a home within five to 10 years, you can opt for an ARM, taking advantage of its lower rate and payments, then sell before the rate adjusts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ADJUSTABLE RATE NOTE?

An Adjustable Rate Note is a type of loan agreement where the interest rate on the loan can change periodically based on changes in a corresponding financial index, potentially affecting monthly payment amounts.

Who is required to file ADJUSTABLE RATE NOTE?

Generally, borrowers who enter into an Adjustable Rate Mortgage (ARM) or similar financial instrument must complete and file the Adjustable Rate Note as part of the loan documentation.

How to fill out ADJUSTABLE RATE NOTE?

To fill out an Adjustable Rate Note, borrowers need to provide personal information, loan amount, interest rate details, payment schedule, and any applicable index references or margin specifications.

What is the purpose of ADJUSTABLE RATE NOTE?

The purpose of the Adjustable Rate Note is to outline the terms and conditions of an adjustable-rate loan, including how the interest rate adjustments will be made and the implications for the borrower.

What information must be reported on ADJUSTABLE RATE NOTE?

The Adjustable Rate Note must report information such as the principal loan amount, interest rate, payment schedule, information about the index that affects rate adjustments, and rights and obligations of both the borrower and lender.

Fill out your adjustable rate note online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Adjustable Rate Note is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.