Get the free ny 529 advisor guided forms

Show details

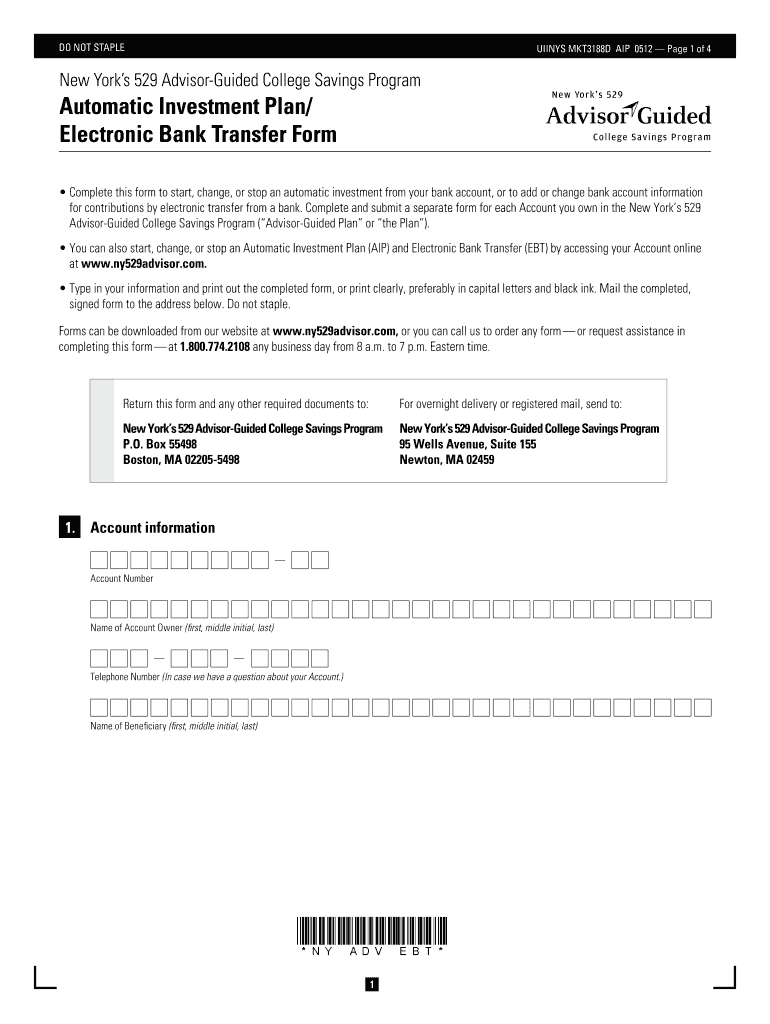

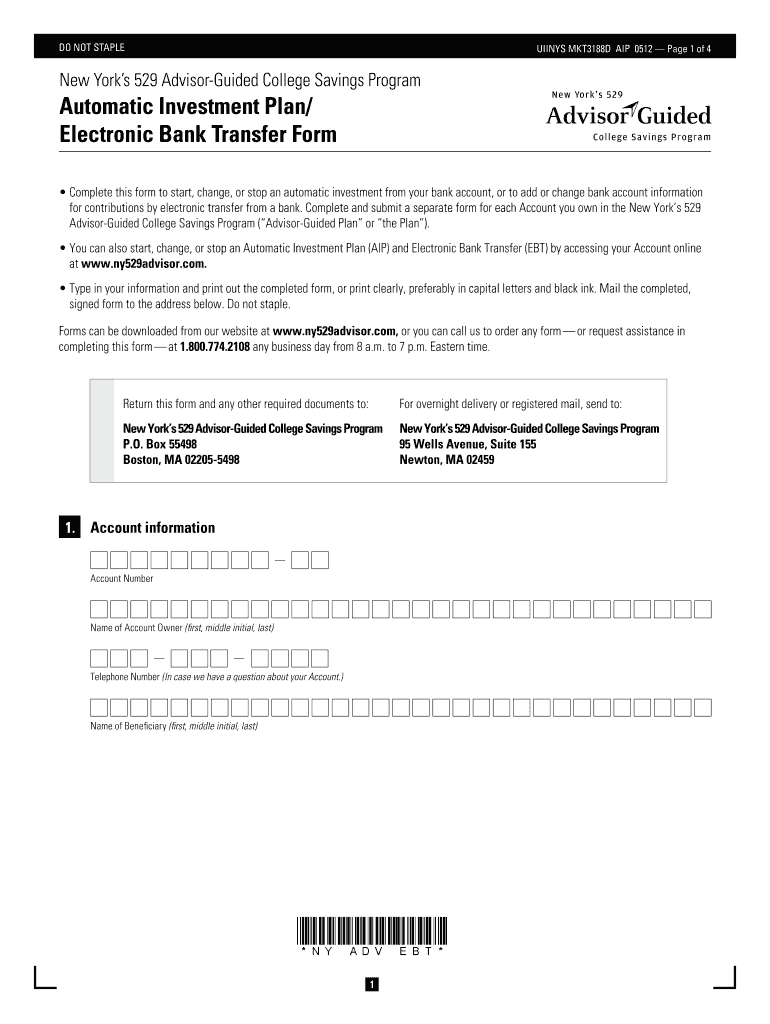

This form is used to initiate, modify, or cease automatic investments from a bank account to the New York's 529 Advisor-Guided College Savings Program. It allows users to manage bank account information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ny 529 advisor guided

Edit your ny 529 advisor guided form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ny 529 advisor guided form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ny 529 advisor guided online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ny 529 advisor guided. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ny 529 advisor guided

How to fill out New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form

01

Obtain the New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form from your advisor or the program's website.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Provide information about the bank account from which the funds will be withdrawn, including the bank name, account number, and routing number.

04

Indicate the amount of money you wish to invest and the frequency of the transfers (e.g., weekly, monthly).

05

Sign and date the form to authorize the automatic withdrawals.

06

Submit the completed form to your financial advisor or the designated program address.

Who needs New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form?

01

Individuals or families who are saving for a child's future college education expenses.

02

People who want to set up a systematic investment plan to contribute regularly to their 529 college savings account.

03

Advisors managing accounts for clients who wish to automate their investment contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is the biggest downside to a 529 plan?

529s count against you for federal aid “The greater the assets in the plan, the less aid is available from grants, loans and financial scholarships.” It's important to note, however, that the hit to financial aid depends on who owns the account.

Is a NY 529 plan worth it?

529s have the following advantages: Your earnings are tax-deferred. No federal taxes on qualified withdrawals* New York state taxpayers may qualify for more state-tax benefits**

What is the rating of the New York 529 plan?

Summary. New York's direct-sold 529 College Savings Program is a solid and affordable option for education savers. It earns a Morningstar Medalist Rating of Silver.

Where can I open a NY 529 plan?

Enroll and Contribute to the Program To see the acceptable forms of contributions or to enroll, visit NY's 529 College Savings Program website or call the Program toll-free at 877-NYSAVES (877-697-2837).

What is the best 529 plan for NY residents?

New York 529 plan performance 529 PlanOverall 5-Cap Rating New York's College Savings Program – Direct Plan 5/5 New York's Advisor-Guided College Savings Plan 4/5 Mar 18, 2024

What are the tax advantages of the NY 529 plan?

Tax Advantages of the Program For example, tuition, fees, room and board, books, supplies, and equipment required for enrollment or attendance at any eligible post-secondary school in the world. You can receive a New York State income tax deduction of up to $5,000 ($10,000 for married couples filing jointly).

Which state has the best performing 529 plan?

Top-rated 529 plans in 2025 Oregon College Savings Plan. Ohio's 529 Plan CollegeAdvantage. UNIQUE College Investing Plan (New Hampshire) ScholarShare 529 (California) Pennsylvania 529 Investment Plan. my529 (Utah) New York's 529 College Savings Program. Alaska 529.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form?

The Automatic Investment Plan/Electronic Bank Transfer Form is a document that allows participants in New York's 529 Advisor-Guided College Savings Program to set up recurring contributions to their account through electronic bank transfers.

Who is required to file New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form?

Individuals who want to establish an automatic investment plan for their New York 529 college savings account are required to file this form.

How to fill out New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form?

To fill out the form, participants must provide personal information such as account details, bank information for the transfer, the amount to be contributed, and the frequency of the contributions.

What is the purpose of New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form?

The purpose of the form is to facilitate and automate the process of making regular contributions to a college savings account, helping families to save consistently and efficiently for future educational expenses.

What information must be reported on New York's 529 Advisor-Guided College Savings Program Automatic Investment Plan/Electronic Bank Transfer Form?

The form must report account holder information, bank account details, the amount of automatic transfer, and the schedule for the recurring investment.

Fill out your ny 529 advisor guided online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ny 529 Advisor Guided is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.