Get the free Chase Health Savings Account (HSA)

Show details

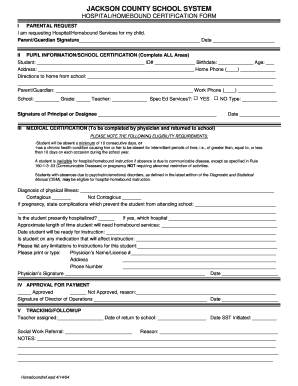

This form is used to gather necessary information for the initiation of a Health Savings Account (HSA) for employees of the company, including company contributions and contact details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign chase health savings account

Edit your chase health savings account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your chase health savings account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit chase health savings account online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit chase health savings account. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out chase health savings account

How to fill out Chase Health Savings Account (HSA)

01

Obtain the Chase Health Savings Account (HSA) application form from the Chase website or a local branch.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details regarding your employment, including your employer's name and address.

04

Specify the type of health insurance plan you have that qualifies for an HSA.

05

Review the terms and conditions of the HSA, ensuring you understand the fees and benefits.

06

Sign the application form to certify the information provided is accurate.

07

Submit the completed application form to Chase via online application, mail, or in-person at a branch.

Who needs Chase Health Savings Account (HSA)?

01

Individuals with high-deductible health insurance plans who want to save for medical expenses.

02

People looking to reduce their taxable income while saving for healthcare costs.

03

Employees with access to an HSA through their employer's health benefits package.

04

Anyone interested in accumulating tax-free savings for medical expenses in retirement.

Fill

form

: Try Risk Free

People Also Ask about

What is the best bank for HSA?

Fidelity is the best choice if you're shopping on your own for a health savings account (HSA) because it has no fees or minimum balance requirements, offers a vast array of investment choices, and has a stellar interest rate on deposits.

What is the best bank for an HSA account?

Fidelity is the best choice if you're shopping on your own for a health savings account (HSA) because it has no fees or minimum balance requirements, offers a vast array of investment choices, and has a stellar interest rate on deposits.

What types of savings accounts are offered at Chase bank?

Chase offers two main savings account options: the Chase Savings account and the Chase Premier Savings account. The premier account pays a slightly higher yield if you're eligible for the relationship interest rate.

Does Chase have HSA?

A Chase Health Savings Account (HSA) is an easy way to save for healthcare expenses. If you ever worry about paying medical bills, an HSA can definitely help you. An HSA is not just a savings account.

How do I access my HSA account?

The HSA Central Mobile App gives you complete access to your account, with the same functionality as the Consumer Portal. Take a photo of your receipt for tax-purposes. Make HSA transactions and view account activity. View and manage your contributions. View and manage your HSA investments.

Can I put my HSA in my bank account?

Quickly and easily access funds with the HSA Bank Health Benefits Debit Card used at point of sale, or have funds directly deposited to a bank account through online distribution.

What is the difference between HSA and health savings account?

Both accounts let you make pre-tax contributions and grow tax-free earnings. But only an HSA lets you take tax-free distributions for qualified medical expenses. After age 65 you can use your health savings account for any expense, you'll simply pay ordinary income taxes — just like a 401(k).

Does Chase bank offer HSA accounts?

The Chase HSA is a special tax-advantaged account that is used with a high-deductible health plan "HDHP," and allows you and your family members to pay for various qualified medical expenses (PDF) — from co-payments at your doctor's office to pharmacy bills, dental care, vision care, and more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Chase Health Savings Account (HSA)?

A Chase Health Savings Account (HSA) is a tax-advantaged savings account designed to help individuals save for qualified medical expenses. It is typically paired with a high-deductible health plan, allowing account holders to contribute pre-tax income, which can grow tax-free and be withdrawn tax-free when used for eligible healthcare costs.

Who is required to file Chase Health Savings Account (HSA)?

Individuals who contribute to a Chase Health Savings Account (HSA) and those who utilize the funds for medical expenses may need to file IRS Form 8889 with their federal income tax return. This applies to anyone who established an HSA during the tax year or made contributions to an HSA.

How to fill out Chase Health Savings Account (HSA)?

To fill out a Chase Health Savings Account (HSA), individuals must first ensure they are eligible and have a high-deductible health plan. Then, open an HSA through Chase, where you can choose how much to contribute. Contributions can be made via payroll deduction or manual deposit. To fill out related IRS forms, report contributions, earnings, and distributions accurately to track tax benefits.

What is the purpose of Chase Health Savings Account (HSA)?

The primary purpose of a Chase Health Savings Account (HSA) is to provide individuals with a means to save money for future medical expenses in a tax-advantaged way. It encourages saving for healthcare costs and allows account holders to manage and budget for their medical expenditures effectively.

What information must be reported on Chase Health Savings Account (HSA)?

Information that must be reported on Chase Health Savings Account (HSA) includes total contributions made during the year, any distributions taken for qualified medical expenses, and the balance at the end of the tax year. This is typically reported on IRS Form 8889, which includes details about contributions and distributions.

Fill out your chase health savings account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Chase Health Savings Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.