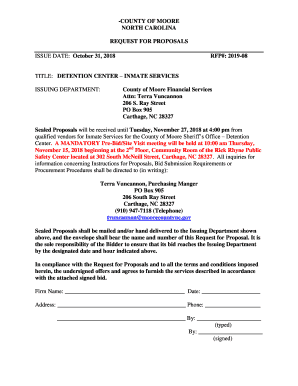

Get the free Financial Information Form

Show details

A form for borrowers and co-borrowers to provide their financial information, including personal details, employment, income, monthly expenses, and asset balances.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial information form

Edit your financial information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

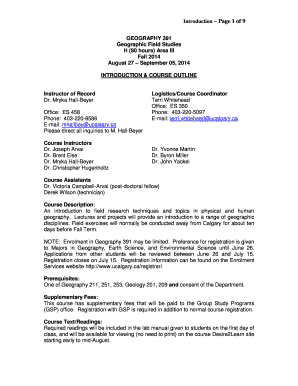

How to edit financial information form online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit financial information form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial information form

How to fill out Financial Information Form

01

Gather all necessary financial documents, such as income statements, bank statements, and tax returns.

02

Fill out the personal information section, including name, address, and contact details.

03

Provide details regarding your income sources, including salary, benefits, and any additional earnings.

04

List your expenses, including housing costs, utilities, transportation, and any debts.

05

Indicate your assets, such as savings accounts, investments, and property.

06

Review the form for accuracy and completeness before submission.

07

Submit the form by the designated deadline as instructed.

Who needs Financial Information Form?

01

Individuals applying for financial aid, scholarships, or loans.

02

Students seeking assistance for educational expenses.

03

Families needing help for housing or healthcare services.

04

Applicants for certain government programs or grants.

Fill

form

: Try Risk Free

People Also Ask about

What is form 433 f used for?

Form 433-F is used to obtain current financial information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability. Note: You may be able to establish an Online Payment Agreement on the IRS web site.

What is an example of a financial statement?

The income statement, balance sheet, and statement of cash flows are all required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

How do you write financial information?

How to write a financial statement Write an introduction. Detail expenses. Outline financial projections. Include individual financial statements. Determine the break-even point. Include a sensitivity analysis. Feature a ratio analysis. Include funding requests where necessary.

What is the form of financial statement?

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, revenues, and costs, as well as its cash flows from operating, investing, and financing activities.

How important is a financial statement in divorce?

As is often the case in divorce, one spouse may not have a complete knowledge of the marital financial situation. Before productive settlement discussions can occur, both parties must be on the same page and have full financial disclosure regarding all the property and debt they acquired during the marriage.

What are examples of financial information?

Important forms of financial data include assets, liabilities, equity, income, expenses, and cash flow. Assets are what the company owns, liabilities are what the company owes, and equity is what is left for the owners of the company after the value of the liabilities are subtracted from the value of the assets.

What is a financial statement form?

September 16, 2024. A financial statement in accounting is a written record that shows the monetary activities and performance of a company's financial position. 1. It details key information on what an organization owns and owes, as well as how much money it has made and spent.

What are main financial information?

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, revenues, and costs, as well as its cash flows from operating, investing, and financing activities.

What are 4 different types of financial information?

For-profit businesses use four primary types of financial statement: the balance sheet, the income statement, the statement of cash flow, and the statement of retained earnings.

Where do I get a financial statement?

Financial information can be found on the company's web page in Investor Relations where Securities and Exchange Commission (SEC) and other company reports are often kept. The SEC has financial filings electronically available beginning in 1993/1994 free on their website. See EDGAR: Company Filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Information Form?

The Financial Information Form is a document used to collect financial data from individuals or organizations for the purpose of analysis, verification, or compliance with regulations.

Who is required to file Financial Information Form?

Individuals or entities applying for loans, grants, or government assistance, as well as those meeting specific regulatory requirements, are typically required to file the Financial Information Form.

How to fill out Financial Information Form?

To fill out the Financial Information Form, gather all necessary financial documents, follow the instructions provided on the form, complete all sections accurately, and ensure that you provide your signature and date where required.

What is the purpose of Financial Information Form?

The purpose of the Financial Information Form is to assess the financial status of an applicant, determine eligibility for financial programs, and facilitate informed decision-making by lenders or funding organizations.

What information must be reported on Financial Information Form?

The Financial Information Form must report details such as income, expenses, assets, liabilities, and any relevant financial history or statements that reflect the financial condition of the individual or organization.

Fill out your financial information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.