Get the free Summer Skip-A-Payment

Show details

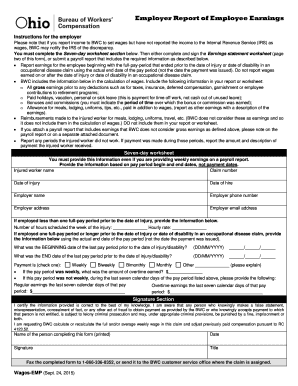

This document allows members of the United Bay Community Credit Union to skip a loan payment during the summer months of July and August, under specific conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign summer skip-a-payment

Edit your summer skip-a-payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your summer skip-a-payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit summer skip-a-payment online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit summer skip-a-payment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out summer skip-a-payment

How to fill out Summer Skip-A-Payment

01

Obtain the Summer Skip-A-Payment form from your lender's website or branch.

02

Fill in your personal information, including your name, account number, and contact details.

03

Indicate the preferred month(s) for skipping your payment.

04

Review the terms and conditions associated with the Summer Skip-A-Payment program.

05

Sign and date the form to confirm your consent and understanding.

06

Submit the completed form to your lender by the specified deadline.

Who needs Summer Skip-A-Payment?

01

Borrowers who experience financial hardship during the summer months.

02

Customers who want to use extra funds for travel, family activities, or vacations.

03

Members of credit unions or banks offering the Summer Skip-A-Payment program.

Fill

form

: Try Risk Free

People Also Ask about

Does skipping a payment hurt your credit?

No Credit Impact Skipping a payment through a holiday skip program like Skip a Pay won't affect your credit score. This is not the same as missing or being late on a payment, so there's no need to worry about your credit score taking a hit.

What is a holiday skip a payment?

This means the final payment date is extended by the amount of time you chose to defer the payment. How Does the Holiday Defer-a-Loan Payment Program Work? SCU Credit Union's Holiday Defer-a-Loan Payment Program allows qualifying borrowers to defer a loan payment during November, December, or January.

What is it called when you miss a payment?

Missed or late payments When a loan becomes delinquent, it can set off a chain of events that can negatively impact your financial future for years to come. Your interest rate can rise sharply, meaning you will be required to pay more for the loan moving forward.

Can I skip a 1 month credit card payment?

Understand the Consequences of a Missed Credit Card Payment Higher interest rates: Missing payments may trigger an interest rate increase. Banks can charge you with a different interest rate, known as the penalty interest rate. Damage to credit score: Missed credit card payments negatively impact your credit score.

Can you block a monthly payment?

Go Directly to Your Bank to Revoke Authorization According to the Consumer Financial Protection Bureau, you should start this process by sending a letter to your bank and subscription company that revokes your payments. Alternatively, you can give your bank a stop payment order.

Is it possible to skip a payment?

Skip-a-pay, or skip my payment, means your lender has authorized you to skip a loan payment. Skip-a-pay doesn't get you off the hook entirely – you're still liable for the outstanding balance to your lender – but it can allow you some breathing room when your finances are tight.

Can I skip a monthly payment?

While skipping a payment allows you to take a break from paying down the loan balance, interest still accrues and is tacked on to the end of the loan term. You'll ultimately be paying more in overall interest over the life of the loan if you choose to skip a payment.

How do I ask to skip a payment?

If your lender already has a payment deferment option in your loan agreement, you only need to choose “skip a payment” in your payment coupon book or apply to skip a payment on the lender's website. If your lender doesn't explicitly mention deferment in the agreement, first call them to understand your options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Summer Skip-A-Payment?

Summer Skip-A-Payment is a financial program that allows borrowers to temporarily pause their loan payments during the summer months.

Who is required to file Summer Skip-A-Payment?

Typically, any borrower who has an eligible loan and wishes to participate in the program must file for a Summer Skip-A-Payment.

How to fill out Summer Skip-A-Payment?

To fill out a Summer Skip-A-Payment, borrowers should complete the application form provided by their lender and submit it according to the lender's instructions.

What is the purpose of Summer Skip-A-Payment?

The purpose of Summer Skip-A-Payment is to provide financial relief to borrowers by allowing them to temporarily defer their loan payments during the summer, often when expenses may be higher.

What information must be reported on Summer Skip-A-Payment?

The information that must be reported typically includes the borrower's account details, the specific loan being deferred, and the requested timeframe for skipping payments.

Fill out your summer skip-a-payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Summer Skip-A-Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.