Get the free Capaha Bank Credit Report Direct Dispute

Show details

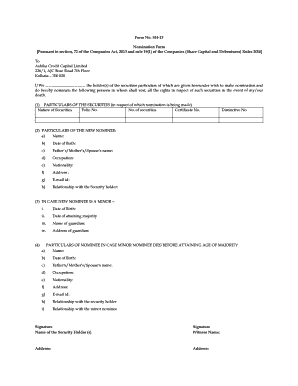

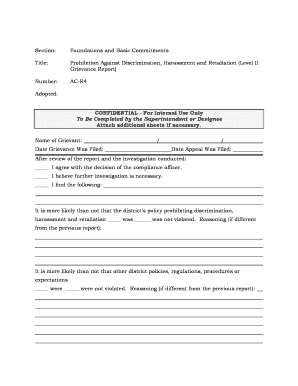

This form is used to dispute information on a credit report with Capaha Bank, including the ability to provide personal information and details regarding the dispute.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign capaha bank credit report

Edit your capaha bank credit report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your capaha bank credit report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing capaha bank credit report online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit capaha bank credit report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out capaha bank credit report

How to fill out Capaha Bank Credit Report Direct Dispute

01

Gather necessary documents: Collect your personal identification and any related financial documents.

02

Obtain your credit report: Request a copy of your credit report from Capaha Bank.

03

Identify discrepancies: Review your report for any errors or unauthorized accounts.

04

Visit Capaha Bank's website: Access the Direct Dispute section for credit reports.

05

Fill out the dispute form: Complete all required fields accurately, noting the specific errors.

06

Attach supporting documents: Include any evidence you have to support your dispute.

07

Review your submission: Ensure all information is correct before submitting.

08

Submit the form: Send the completed form and documents to Capaha Bank via the provided method.

09

Keep a copy: Retain records of your submission for your reference.

Who needs Capaha Bank Credit Report Direct Dispute?

01

Individuals who have identified errors in their credit report from Capaha Bank.

02

People who want to dispute unauthorized accounts or inaccurate financial information.

03

Anyone looking to improve their credit score by correcting discrepancies.

Fill

form

: Try Risk Free

People Also Ask about

How to dispute transactions on your credit report?

The credit bureaus also accept disputes online or by phone: Experian (888) 397-3742. Transunion (800) 916-8800. Equifax (866) 349-5191.

How to dispute collections and win?

You can submit your dispute online or by mail, but either way, it should include: Copies of supporting documents proving the error. A clear explanation of why the debt isn't yours. Your contact information and report details. Copies of any communication with the collector.

What is a direct credit dispute?

(ii) The direct dispute is substantially the same as a dispute previously submitted by or on behalf of the consumer, either directly to the furnisher or through a consumer reporting agency, with respect to which the furnisher has already satisfied the applicable requirements of the Act or this section; provided,

How to remove disputes from credit reports?

Call the phone number on the report. The file number or report ID will get you to a human so they can pull up the account in dispute. Tell them you no longer dispute the account and agree with the balance and prior paying history, furthermore need the dispute wording removed as it is preventing mortgage loan approval.

What should I say to dispute on my credit report?

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

What do you say in a credit dispute?

The letter should say you're disputing errors and should include: your complete name and address; each bit of inaccurate information that you want fixed, and why; and copies (not originals) of documents that support your request. Many businesses want disputes sent to a particular address.

What is the best reason to dispute a credit report?

Common reasons for filing a credit dispute Inaccurate information: This could include wrong balances, incorrect payment history, account status, or credit limit. It could also be due to a creditor accidentally entering the wrong information.

What do you say when filing a dispute?

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Capaha Bank Credit Report Direct Dispute?

Capaha Bank Credit Report Direct Dispute is a formal process through which consumers can challenge or dispute inaccurate information found in their credit reports that are held by Capaha Bank.

Who is required to file Capaha Bank Credit Report Direct Dispute?

Any consumer who identifies inaccuracies in their credit report provided by Capaha Bank has the right to file a Capaha Bank Credit Report Direct Dispute.

How to fill out Capaha Bank Credit Report Direct Dispute?

To fill out the Capaha Bank Credit Report Direct Dispute, consumers should provide their personal information, including name and address, details of the disputed information, and any supporting documents that verify their claims.

What is the purpose of Capaha Bank Credit Report Direct Dispute?

The purpose of the Capaha Bank Credit Report Direct Dispute is to ensure that consumers can rectify inaccuracies in their credit reports, which can affect their credit scores and borrowing capability.

What information must be reported on Capaha Bank Credit Report Direct Dispute?

The information reported on Capaha Bank Credit Report Direct Dispute must include the consumer's identifying details, the nature of the dispute, the specific inaccuracies in the report, and any relevant documentation that supports the claim.

Fill out your capaha bank credit report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Capaha Bank Credit Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.