Get the free Business Online Banking Application

Show details

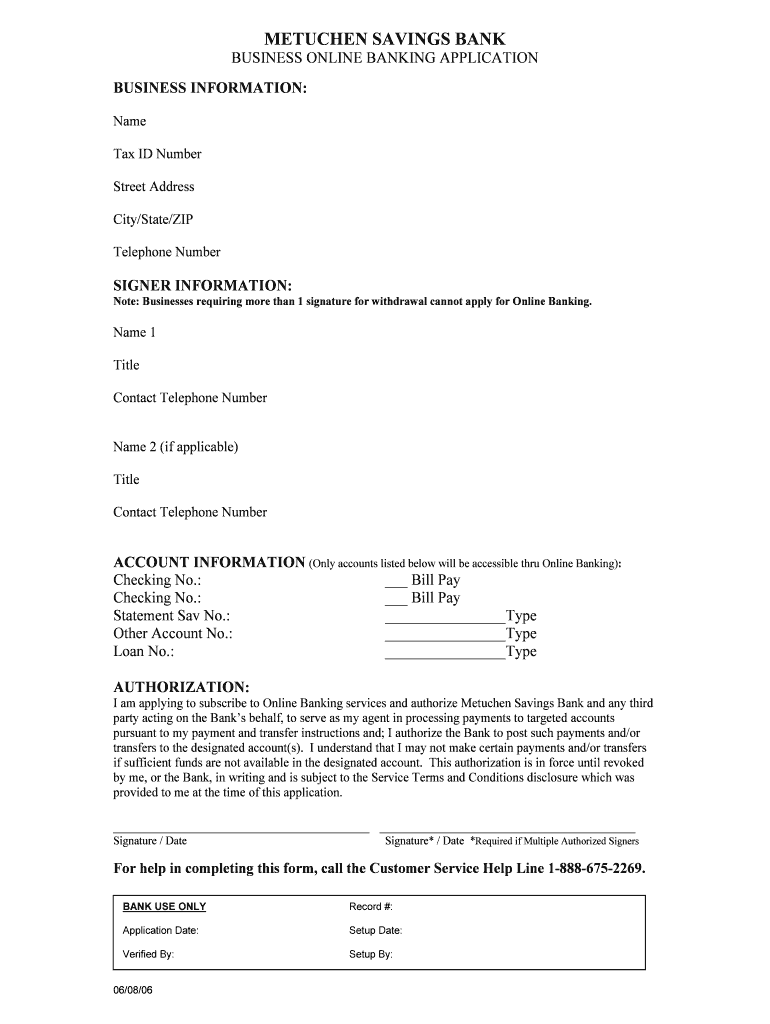

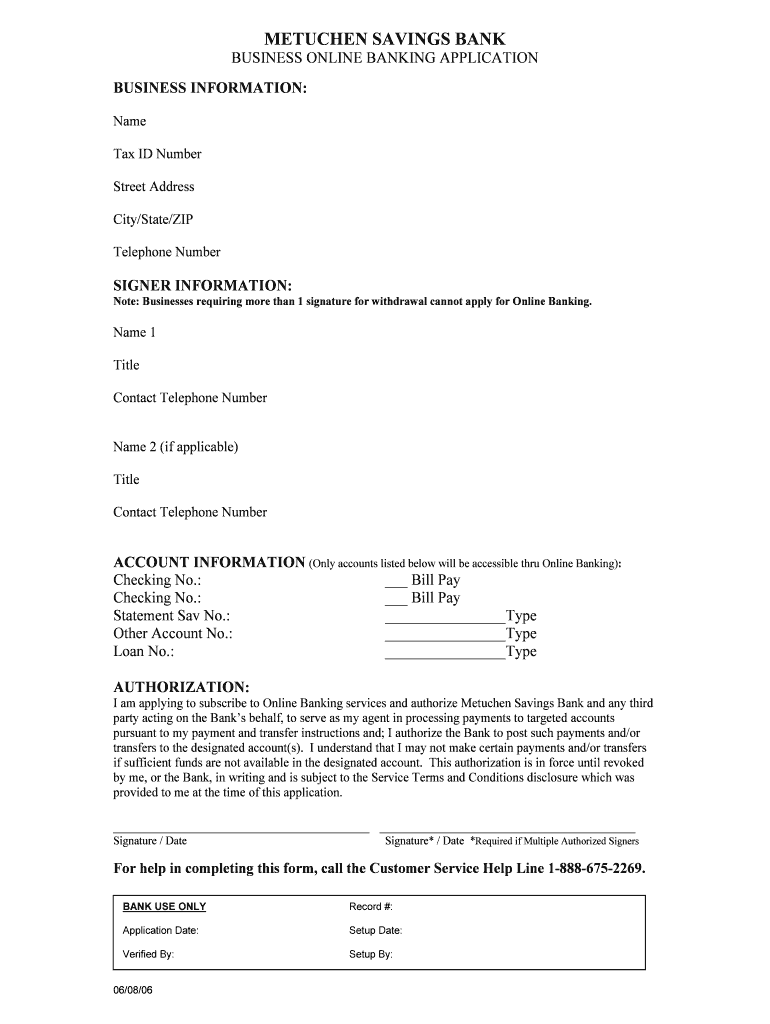

This document serves as an application for businesses to enroll in online banking services with Metuchen Savings Bank, outlining necessary business and signer information, account details, and authorization

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business online banking application

Edit your business online banking application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business online banking application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business online banking application online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business online banking application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business online banking application

How to fill out Business Online Banking Application

01

Visit your bank's website and navigate to the Business Online Banking section.

02

Download or access the Business Online Banking Application form.

03

Fill in your business information, including the business name, address, and type of business.

04

Provide the contact details of the business owner or authorized signer.

05

Enter the Tax Identification Number (TIN) or Employer Identification Number (EIN).

06

Choose the desired online banking services and features.

07

Review the terms and conditions associated with online banking.

08

Sign and date the application form.

09

Submit the completed application form to your bank via the specified method.

Who needs Business Online Banking Application?

01

Business owners looking to manage their finances online.

02

Companies that require convenient access to banking services.

03

Entrepreneurs who need to monitor transactions and account activities.

04

Organizations aiming for streamlined payment processes and invoicing.

Fill

form

: Try Risk Free

People Also Ask about

Which bank is best for business banking?

Westpac business bank account Westpac won the Canstar award for outstanding value with their business transaction account in 2024. With their Everyday Business Bank account customers can manage their income and outgoings and easily switch between their business and personal banking in the Westpac App.

What is the best online bank for small business?

Best business online banking: overview Bank/ ProviderTrustpilot scoreBest known for Tide 4.0² App-based business banking Wise Business 4.3³ Multi-currency accounts and international payments Starling Bank 4.3⁶ Fee-free everyday business banking Revolut Business 4.2⁹ Multi-currency accounts and international payments1 more row • Oct 28, 2024

Can you do Online Banking for a business account?

With Online Banking, you can set up and authorize other people to manage your online business banking accounts. You control and assign roles to users that define their ability to view and access accounts, make transactions, use Bill Pay and more.

Which online bank is best for business?

Best online business bank accounts American Express® Business Checking. : Best customer support. Axos Bank. Bluevine Business Checking. Brex Business Account. Chase Business Complete Banking® First Internet Bank Business Money Market Savings. Found Small Business Banking. Grasshopper Innovator Business Checking Account.

How do I create an Online Banking app?

8 major stages to create a mobile banking app Step 1: conduct research. Step 2: build a prototype. Step 3: provide the security. Step 4: design the UI/UX. Step 5: choose a tech stack. Step 6: develop the app. Step 7: release and maintain. Step 8: improve and update.

Which bank account is best for online business?

A single business checking account may suffice for smaller operations or LLCs with no employees. Otherwise, your company will want multiple business accounts that each serve different purposes — payroll, operating expenses and business taxes, for example.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Online Banking Application?

The Business Online Banking Application is a digital platform that allows businesses to manage their banking transactions online, including account management, fund transfers, bill payments, and access to account statements.

Who is required to file Business Online Banking Application?

Typically, businesses that wish to utilize online banking services to manage their accounts must file the Business Online Banking Application. This includes companies of various sizes that require efficient banking solutions.

How to fill out Business Online Banking Application?

To fill out the Business Online Banking Application, follow these steps: 1. Obtain the application form from your bank's website or branch. 2. Provide necessary business information such as business name, address, and tax identification number. 3. List authorized users and their roles. 4. Sign and date the form, and submit it through the bank's specified channels.

What is the purpose of Business Online Banking Application?

The purpose of the Business Online Banking Application is to facilitate secure online management of business banking accounts, enhance operational efficiency, and provide convenience in handling financial transactions.

What information must be reported on Business Online Banking Application?

The information that must be reported on the Business Online Banking Application typically includes the business's legal name, address, contact information, tax identification number, bank account details, and a list of authorized users who will access the online banking services.

Fill out your business online banking application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Online Banking Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.